Semiconductor stocks are becoming less cyclical because their end-clients have changed and are now mega-cap tech companies rather than individuals. This transformation is not yet fully baked into valuations, according to Stephen Yiu, manager of the WS Blue Whale Growth fund, who thinks share prices will continue to climb.

Semiconductor stocks possess “underestimated potential for alpha”, the FE fundinfo Alpha Manager said, with valuations that “should be trading higher than before over the medium term”.

Share prices will be determined by new dynamics going forward, primarily ‘silicon sovereignty’, which he described as the biggest theme out there.

Currently, over 90% of high-end semiconductors are produced in Taiwan by the Taiwan Semiconductor Manufacturing Company (TSMC), which is controlling the supply of the chips needed for producing the latest technologies. To reclaim their silicon sovereignty, Western governments have decided to re-shore their semiconductor capabilities – a “reversal of a historical decision due to the geopolitical uncertainties in Asia Pacific” which started with the US Chips Act in 2022.

Fast-forward to today, over $400bn has been committed to building new foundries in Germany, France, Ireland, Malaysia, many US states, South Korea and Japan – all of which will need tons of mission-critical equipment at a pace that “has never happened before in history”.

According to Yiu, this new growth, which will be more supply-driven than demand-driven, is going to provide enough tailwind to offset the headwind that the end market is facing and is the first reason why semiconductor stocks should re-rate higher.

His second point, which is linked to artificial intelligence (AI), is that the quality of the industry’s client base has improved. In 2019, about 50% to 60% of TSMC’s business was in the end market (smartphones) and just 30% in larger applications such as data centres and servers; today, that number has flipped.

The customer base has changed from consumers, who were spending on discretionary technology, to enterprises investing in AI – a stickier client than retail consumers, who are a dependant on the economic cycle.

Before 2022, Nvidia’s revenue was mostly determined by crypto miners and gamers who wanted to accelerate their computers. Today, thanks to AI, Nvidia’s customers are Apple, Microsoft, Amazon, Google and Meta – the biggest companies in the world with a lot of cash on their balance sheets.

“The quality and sustainability of the revenue stream is evolving as we speak. This should make demand for semiconductors less cyclical in the future", Yiu said.

“We see all these changing dynamics as an opportunity. But if you look at valuations, the semiconductor companies are trading at similar levels as before, so the market has still not recognized the direction of travel.”

Despite these developments, the manager said the semiconductor industry will always retain a certain degree of cyclicality.

However, that's not necessarily a hurdle, with some managers trying to take advantage of that, including Julian Bishop, co-manager of Allianz’ Brunner investment trust, who bought ASML 18 months ago, when there was a big downturn in demand for its products.

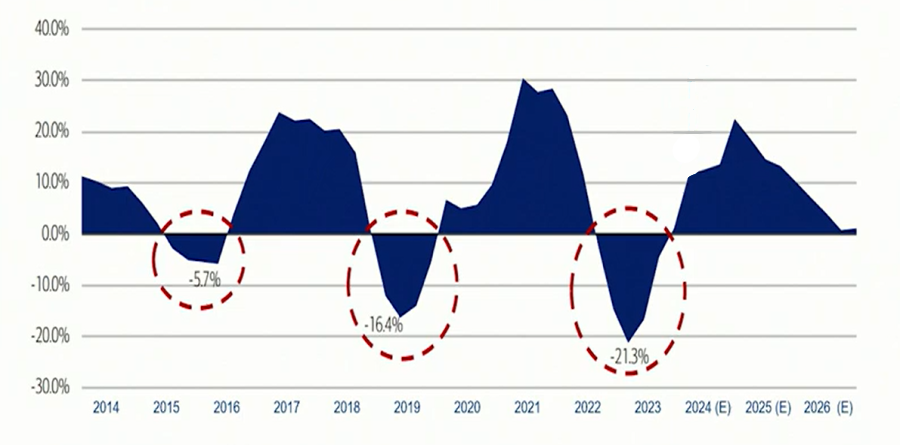

Demand for semiconductors is currently in the foothills of the next upcycle, which could last through the middle of 2026, as the chart below shows.

Historical and estimated semiconductor demand

Source: BofA Global Research, Allianz. Data as at 12/2023.

“There's a shortage, prices go up and everyone over-bills. Demand overshoots and you get this big hangover, as customers stop ordering and microchips sales suddenly fall a great deal. That’s why historically, we have always had big downturns in the short term,” Bishop explained.

“Today, there's still a downturn,” he admitted. “But we are expecting demand to come back and there's great structural growth as well. These down cycles are an opportunity to pick up things at a good price.”