Niall O’Connor, an alternative multi-asset fund manager, joined RM Funds this month from Brooks MacDonald, bringing his Defensive Capital fund with him.

The rebranded SVS RM Defensive Capital fund is all-weather strategy focusing on alternative investments that are not correlated to equities and bonds, with the aim of giving investors an element of capital protection.

About half the portfolio is held in investment trusts, including Georgia Capital, Riverstone Energy and Yellow Cake, which invests in uranium. O’Connor said he is looking for investments that “dance to a different tune or have idiosyncratic behaviour”.

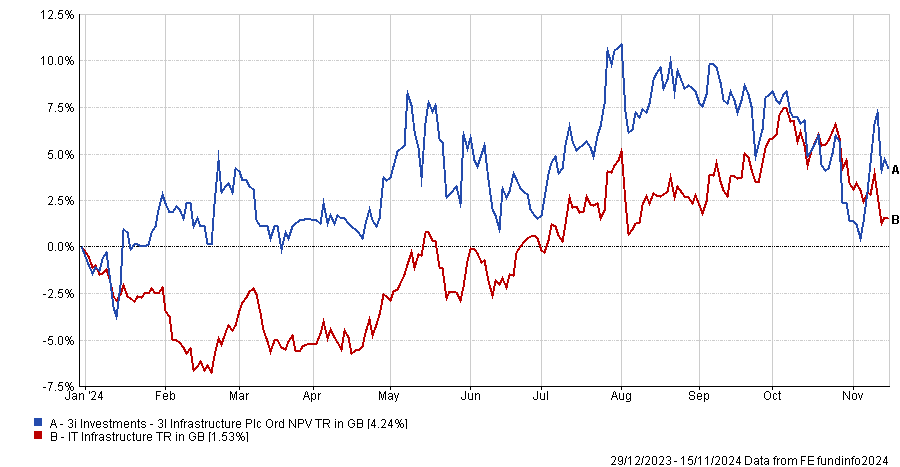

Most recently, O’Connor invested in 3i Infrastructure because it sold off substantially ahead of the Budget on fears that capital gains taxes would be hiked steeply. “It looked silly cheap,” he said.

Performance of trust vs sector year-to-date

Source: FE Analytics

Below, O’Connor highlights five out-of-favour investment trusts which he believes offer good value and which he holds in the SVS RM Defensive Capital fund.

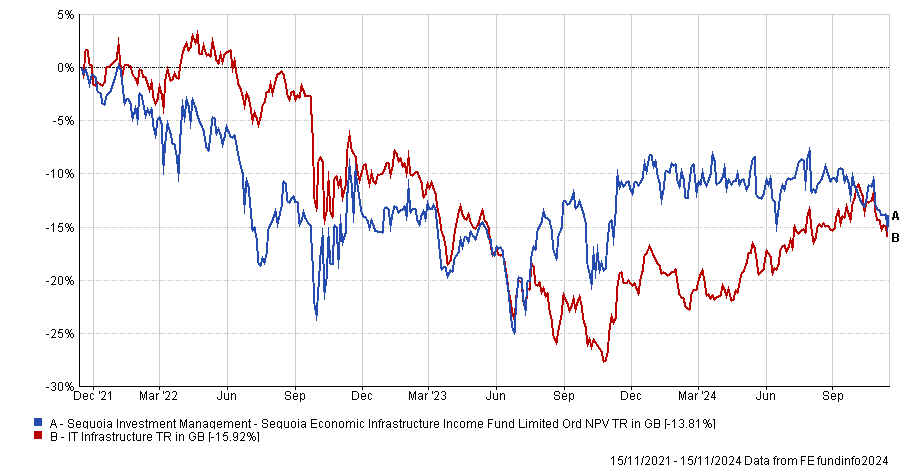

Sequoia Economic Infrastructure

Sequoia Economic Infrastructure lends to non-investment-grade infrastructure projects.

Infrastructure loans are usually low risk, O’Connor argued. Infrastructure projects deliver consistent revenue, assets such as bridges or airports will continue to be used so have longevity and, in the event of a default, something like an airport still has value.

Nonetheless, Sequoia had four problem loans: a hotel in Glasgow, Bulb Energy in the UK, a potash company and a school in the US. “That blotted its copy book because it had a really good run until that point,” O’Connor observed.

Performance of trust vs sector over 3yrs

Source: FE Analytics

Now the trust has a clean book and merits a fresh look, he said. It is trading at a 21% discount. Its new loans are delivering an average yield of 10% and the loan yield on the trust’s share price is almost 12%.

Doric Nimrod Air Three

O’Connor holds the aircraft leasing trusts Doric Nimrod Air Two and Three.

Doric Nimrod Air Two is almost closed. It has sold all its aircraft to Emirates and is waiting to receive cash, which it expects to return to shareholders in January 2025.

Doric Nimrod Air Three still owns several A380 aircraft but after its fixed-length leases expire in a year or two, O’Connor expects Emirates to buy the planes outright.

Both trusts have had a turbulent few years and the investment case now is very different to O’Connor’s original thesis.

Before Covid, many airports were slot-constrained so the best way for airlines to cater to rising passenger numbers was to use bigger planes. The A380 is the largest plane ever made and its lease rates are higher than other aircraft, judging by the percentage of the plane’s value. O’Connor was also attracted to the trusts because Emirates is such a high-quality counterparty.

However, when the Covid pandemic struck, “the last thing you needed was big aircraft. Just about every A380 was parked up in a desert somewhere”, he recalled. Another problem with A380 aircraft is they require more fuel and more maintenance than other planes because they have four engines rather than the standard two.

Emirates has been buying planes from Doric Nimrod Air Two for $40-50m each, which is a massive discount from their initial value of $270m, but the trusts have still made money from their leases.

Despite the pandemic, O’Connor has not lost any money on these investments and he added to his positions when valuations were lower.

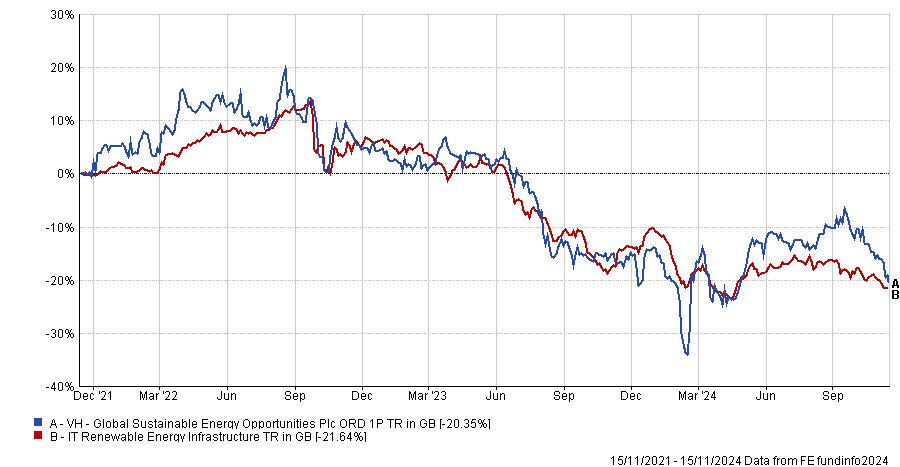

VH Global Sustainable Energy Opportunities

VH Global invests in projects such as Australian solar power, Iberian solar, Brazilian hydro and a US oil storage terminal near the Mexican border that is providing low sulphur oil to Mexico to make its energy system cleaner.

The trust is on a 38% discount. O’Connor thinks the discount is so large because VH Global has been tainted by association from issues at other renewable energy trusts. “The baby has been thrown out with the bathwater,” he said.

Aquila Energy Efficiency never managed to reach critical mass, he said. Meanwhile, ThomasLloyd Energy Impact, which invested in solar energy plants in India, had to abandon a project that almost went bankrupt and has been wound down.

Furthermore, investors who prefer larger trusts might choose SDCL Energy Efficiency instead, whose market capitalisation of £597m dwarfs VH Global’s £268m, he said.

Performance of trust vs sector over 3yrs

Source: FE Analytics

All of these factors leave VH Global looking like a bargain. Even though many of its projects are pre-operational, its dividend is already covered and it is yielding 7.4%, O’Connor said. One more of its projects become operational, it could generate even more income.

Trusts in wind-up

O’Connor has allocated 30% of his investment trust exposure – or 15% of his fund’s assets – to companies that are winding up or being acquired, which deliver a predictable and stable return stream. “It’s nice because you know what the returns will be,” he said.

Blackstone Loan Financing is trading on a 30% discount and anticipates it will take six years to wind up the trust. That equates to returns of 5% per annum and there’s a 15% dividend on top, O’Connor said. If the company manages to wind up sooner, annualised returns could be much higher.

GCP Asset Backed Income is also winding up, with a more aggressive timescale of two years or sooner. It is on a discount of 8-10% and the cash returns to shareholders will be front-end loaded, O’Connor said.