Despite the fact most active equity managers are lagging behind the index in 2024, a handful of funds are on track to beat the stock market for the sixth consecutive year, Trustnet research has found.

In a study last week, we revealed that just 31% of the 1,350 active funds in 10 core equity sectors are ahead of their peer group’s most common benchmark this year. This is the worst result in at least five years and significantly worse than 2019, when 63% of active funds managed to outperform the market.

The sectors we examined were IA Asia Pacific Excluding Japan, IA Europe Excluding UK, IA Global, IA Global Emerging Markets, IA Global Equity Income, IA Japan, IA North America, IA UK All Companies, IA UK Equity Income and IA UK Smaller Companies.

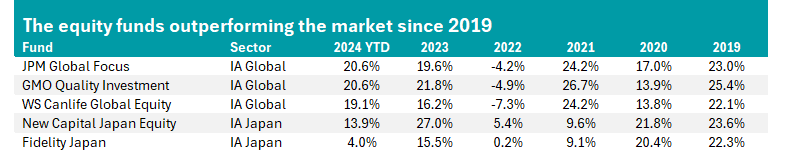

However, we also found that there are five active funds within these sectors that are not only outperforming the market in 2024 but also did so in each of the previous five full calendar years. They can be seen in the table below, with their total return in each year.

Source: FE Analytics. Total return in sterling to 15 Nov 2024

The table is ranked by the fund’s 2024 returns and at the top is the £6.3bn JPM Global Focus fund, which is managed by Timothy Woodhouse, Helge Skibeli and James Cook. Both Woodhouse and Skibeli hold FE fundinfo Alpha Manager status.

The team uses a bottom-up stock selection process to build an “aggressively managed” and high-conviction portfolio of stocks that it believes to be attractively valued while showing significant profit growth or earnings recovery potential.

It can invest across the market-cap spectrum but currently has close to 70% of assets in mega-caps, with Microsoft, Nvidia, Amazon, Meta and Mastercard being the largest holdings. Its largest overweights are to emerging markets, the US and retail stocks.

GMO Quality Investment is close behind. This £3.6bn fund is run by Tom Hancock, Ty Cobb and Anthony Hene, who look for companies with ‘high quality’ characteristics that could allow them to outgrow the competition over the long run.

Analysts on the FE Investments team, which has the fund on its Approved List, said: “Since 2019, stock selection has been particularly strong within information technology and healthcare, which is particularly positive given these sectors are the fund’s largest overweights.

“The team’s ability to pick more defensive names within these sectors also allows it to be defensive when the market sells off. This was seen following the 2020 Covid sell-off and the August 2024 tech sell-off, where the fund protected well compared to the market.”

The £621m WS Canlife Global Equity fund is managed by Mike Willans and Bimal Patel, who use a blend of top-down macro views and bottom-up stock selection when building the portfolio. It is not biased towards any particular investment style, although the managers have a preference for “misunderstood investments that have underperformed the market or sector”.

All three of the above funds reside in the IA Global sector, but the remaining two consistent outperformers are in the IA Japan peer group. Japanese equities have rallied in recent years as investors warm to wide-reaching improvements in corporate governance, although they suffered a sharp crash earlier this year in the unwinding of the yen carry trade.

Michele Malingamba’s £52m New Capital Japan Equity fund has a growth tilt, with a focus on large-caps. It has a quarter of its portfolio in industrials and 18% each in information technology and financials, with top holdings being Tokio Marine, Hitachi, Sumitomo Mitsui Financial Group, Mitsui OSK Lines and Tokyu Corp.

In his latest update, Malingamba said there are three issues that he is watching closely: politics (agendas of Japan’s new premier Shigeru Ishiba and US president-elect Donald Trump); geopolitics (the Ukraine/Russia and Israel/Hamas conflicts); and monetary policy (central banks’ willingness to continue to be less restrictive).

The final fund that is outperforming the market in 2024 as well as during the past five full calendar years is Min Zeng’s £456m Fidelity Japan fund. It also has around one-quarter of its portfolio in industrials, with financials and information technology being the next biggest allocations.

It’s important to note that Zeng has only managed the fund since December 2022, having taken over from Ronald Slattery when he retired after 23 years at Fidelity. Zeng has a value approach to investing and 13 years of investment experience.

These are the only five active funds from the 10 core equity sectors to have outperformed in all six periods covered by this research. If the bar is lowered to specify outperformance in 2024 to date and four of the past five full calendar years, then another 67 funds make the cut.

Among these are well-known names such as Artemis Income, Rathbone Global Opportunities, BlackRock European Dynamic, Royal London Sustainable Leaders Trust, Jupiter Asian Income, Schroder Global Equity, BNY Mellon UK Income and WS Blue Whale Growth.