Simple things are easier to keep track of and more manageable – this universal truth also applies to investment portfolios.

Not only that: DIY investors might not have the time, drive or money to curate and maintain a long list of investments, in which case simple portfolios can be not a choice, but a necessity.

If investing in just two funds, it is crucial to make them as different as possible to provide diversification benefits and one way to do this could be to choose different styles of investing, such as a growth and a value fund, which are likely to perform strongly at different times.

For example, growth stocks have historically performed well when interest rates are below 4%, whilst value stocks tend to outperform when interest rates are higher, said Victoria Hasler, head of fund research at Hargreaves Lansdown. Market sentiment can also impact the growth/value trade depending on how optimistic investors are feeling at any given point in time.

Below, we asked experts to highlight fund pairings that would work well as a minimalist, two-fund portfolio based on the growth/value divide.

Rathbone Global Opportunities and Artemis Global Income

For the growth element, Hasler chose the Rathbone Global Opportunities fund managed by James Thomson, whom she described as “one of only a few global fund managers to show they can pick great companies and perform better than the broad global stock market over the long term”.

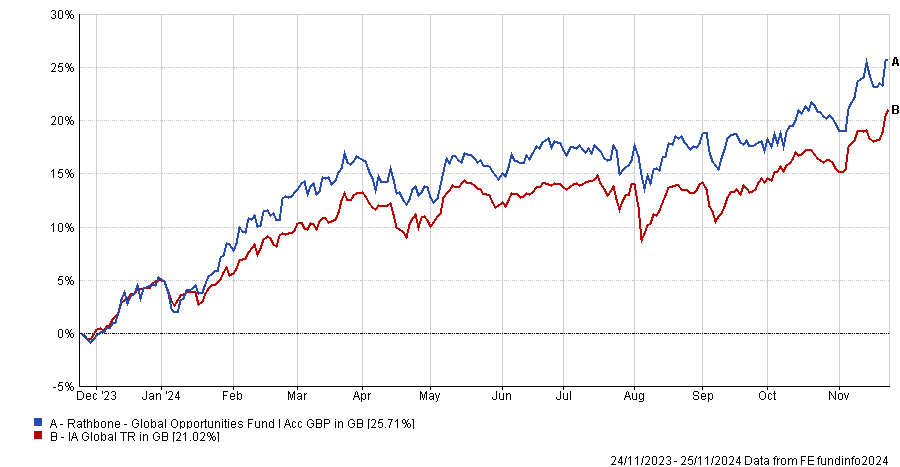

Performance of fund against sector and index over 1yr

Source: FE Analytics

Thomson looks for easy-to-understand businesses that can grow to dominate their industry and defend themselves from competition, as well as companies with superb potential that might be overlooked by other investors.

“Thomson mainly focuses on innovative companies with high-growth potential that tend to do better when markets are rising. But he also invests in some companies that could grow their earnings at a steadier rate, which could hold up better when markets wobble, and avoids those that are overly complicated,” Hasler said.

“He likes companies where a positive catalyst, such as a change in management, will eventually get noticed by other investors and boost their share prices.”

The value choice was Artemis Global Income, whose managers Jacob de Tusch-Lec and James Davidson invest in companies aiming to pay big dividends, those with moderate but growing dividends and unloved companies with recovery potential.

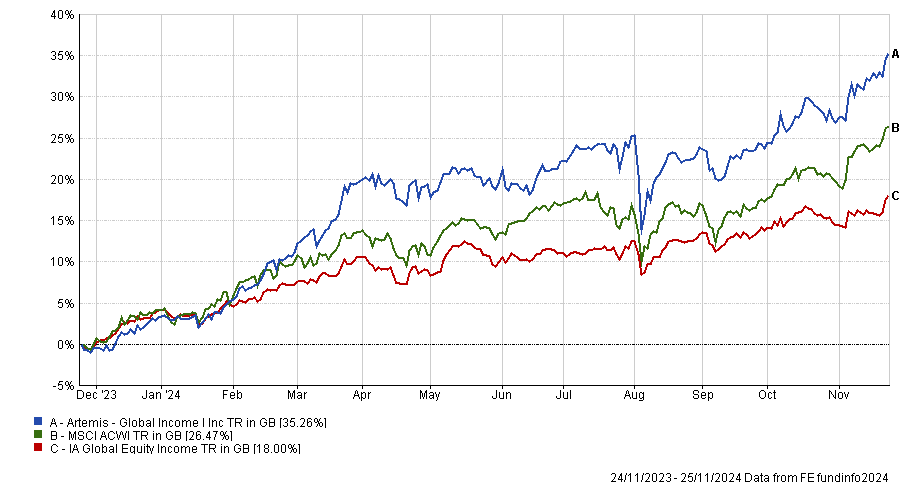

Performance of fund against sector and index over 1yr

Source: FE Analytics

“The market moves we have seen this year on the back of various elections and other political and geopolitical events are exactly the sort of time when value investors can often find bargains,” Hasler noted.

“The fund offers plenty of diversification and no single company or sector makes up too much of the fund. The income provided by the fund may also provide some ballast when value investing is out of favour.”

Nutshell Growth and Lightman European

FundCalibre managing director Darius McDermott picked Nutshell Growth first, a high-conviction global growth portfolio with a disciplined valuation approach led by Mark Ellis, who brings “a unique perspective from his prior career as a successful trader”.

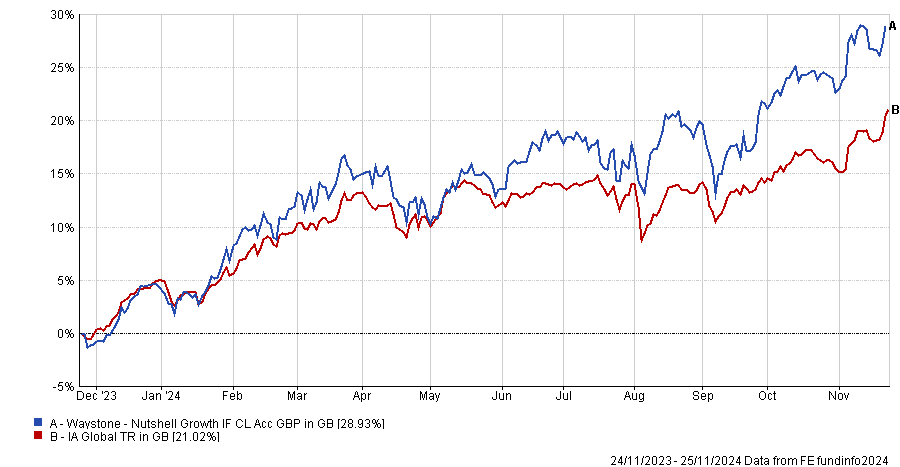

Performance of fund against sector and index over 1yr

Source: FE Analytics

McDermott is a fan of the fund’s emphasis on quantitative analysis and its disciplined, unemotional strategy that avoids attachment to specific companies or management teams.

“The team challenges traditional stock-picking methods by suggesting that analyst reports often suffer from biases and short shelf life,” he said.

“It thrives on nimbleness, using new information to reposition swiftly – an ability rooted in Ellis’s trading expertise. We’re impressed by its agility and see it as a compelling core option for growth exposure.”

McDermott paired it with the WS Lightman European fund, a standout option delivering top-quartile performance over three and five-year periods.

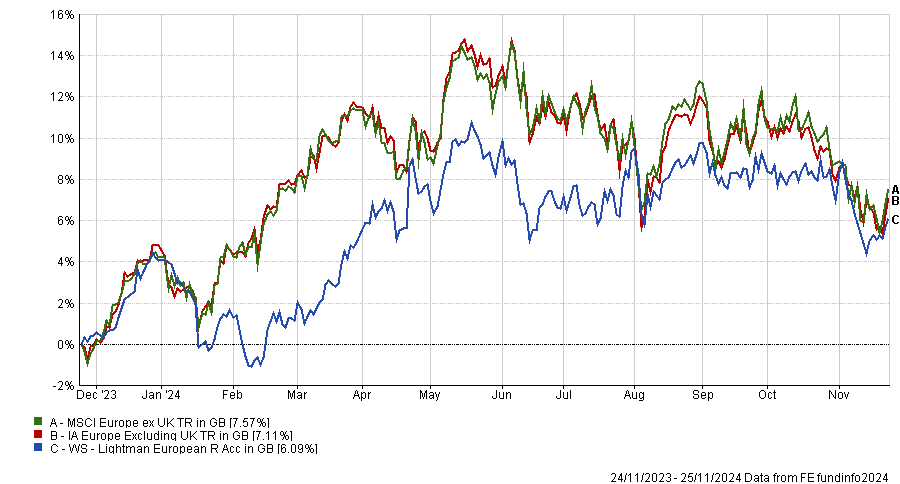

Performance of fund against sector and index over 1yr

Source: FE Analytics

Manager Rob Burnett focuses on stocks with low price-to-book and price-to-earnings ratios, combined with high cash flow yields, which he believes are the best characteristics over the long term for European shares.

“In the past, finding value meant compromising on balance sheets but that is not necessary today,” McDermott stressed.

“As one of the few remaining true European value funds, Lightman stands out as a cornerstone for value exposure.”

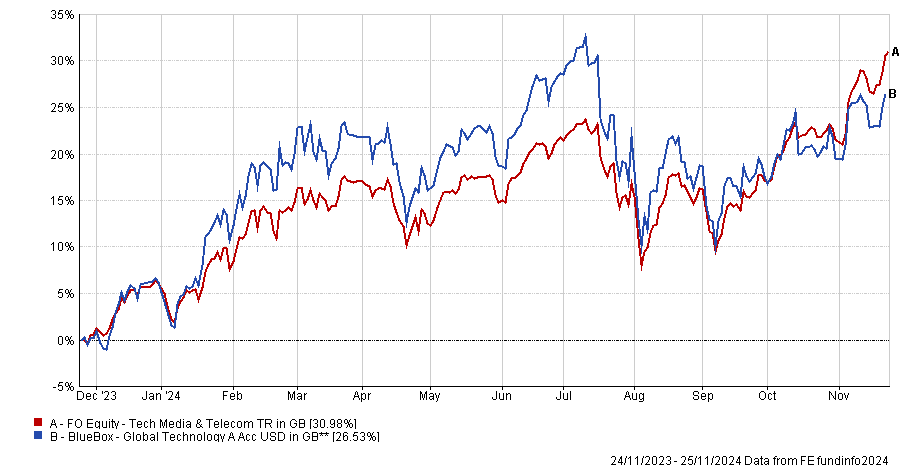

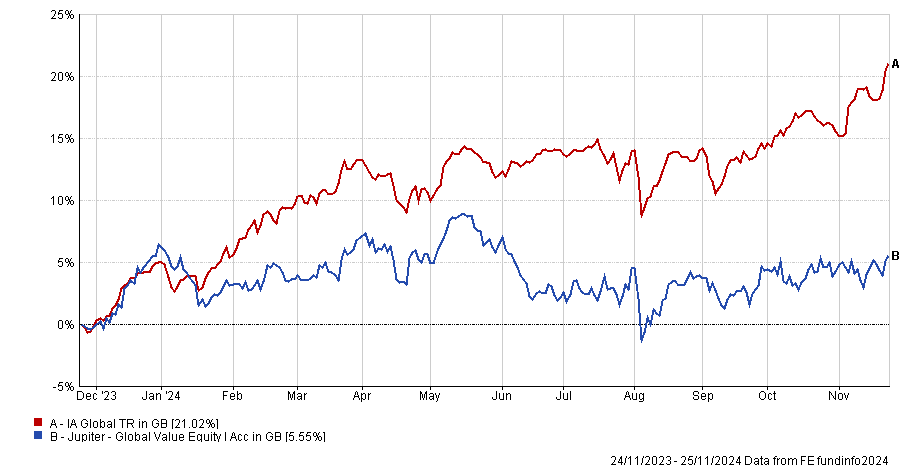

Bluebox Global Technology and Jupiter Global Value Equity

David Lewis, an investment manager in Jupiter’s Merlin independent funds team, began with Bluebox Global Technology, a growth fund that plays into the long-term theme of technology becoming increasingly important in modern life.

Performance of fund against sector and index over 1yr

Source: FE Analytics

“The Jupiter Merlin team took some time to unearth the right strategy in the technology space, wanting to select a manager who was not simply a tech believer, but whose process was based on traditional fundamental research and company cash flows. We found that in William De Gale,” Lewis said.

De Gale’s strategy aims to take advantage of the theme of technology adoption by investing in companies that are the building blocks of that growth, often chip and hardware designers and manufacturers.

“On top of this, Bluebox only invests in established cash generative companies, thus avoiding the high valuations, unproven business models and lack of profitability found elsewhere in the technology space.”

When it comes to the value side of the equation, Lewis opted for Brian McCormick’s Jupiter Global Value Equity fund.

Performance of fund against sector and index over 1yr

Source: FE Analytics

He liked McCormick’s uncompromising approach to governance when unearthing “an attractive mix” of both quality and value companies down the market-cap scale.

“We have been impressed by his ability to select winning stocks, avoid major losers and by his depth of thought, demonstrated by his thoughtful portfolio construction, which is grounded in academic research,” Lewis concluded.

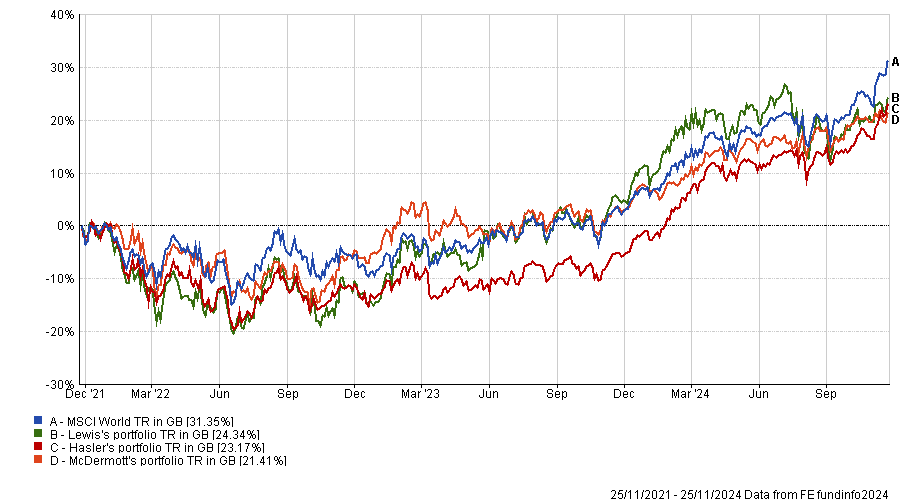

Performance of 50/50 growth and value portfolios against index over 3yrs

Source: FE Analytics

This article is part of a series on two-fund portfolios. Previously, we covered the core/satellite, multi-asset and equity/bond approaches.