RIT Capital Partners has a dynamic new chief executive at the helm who is on a mission to narrow its 29% discount, improve communication with shareholders and tell the trust’s story.

Maggie Fanari joined J. Rothschild Capital Management, which manages RIT Cap (as the trust is colloquially known) in March 2024 from the Ontario Teachers Pension Plan, where she was global group head of high conviction equities.

From day one, shareholders were vocal about the need to improve transparency, so she revamped the website, improved disclosures within the trust’s results, hired Cadarn Capital to bolster investor relations and brought in a head of communications, Zinka McHale.

She also made a couple of senior investment hires: Mike Dannenbaum from Alliance Bernstein as head of public equities and Frank Ducomble from Morgan Stanley to run capital markets and implementation.

Negative sentiment surrounding private investments and fees are also reasons for RIT Cap’s entrenched discount, but Fanari believes these headwinds could become tailwinds, as she explains below.

Please summarise RIT Capital Partners’ investment strategy

We want to generate equity-like returns with less risk than equity markets. We focus on wealth accumulation and aim to create a portfolio that's well diversified, so no one investment, theme or style will overshadow all the returns.

About 32% of the portfolio is in private assets, 24% is in uncorrelated strategies, mostly liquid credit, and the remainder is in quoted equities, split between direct investments and third-party managers.

Of the three pillars, quoted is the one we've been leaning into recently. We’ve been able to get close to 20% returns from listed equities this year and last year.

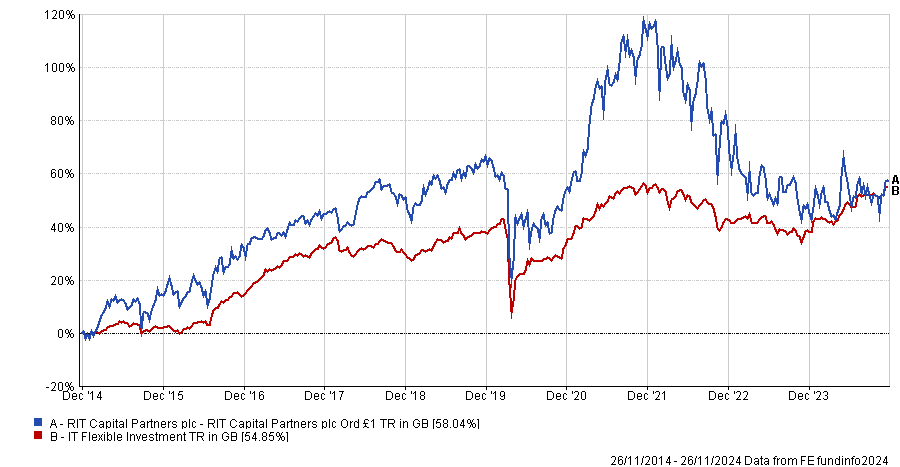

Performance of trust vs sector over 10yrs

Source: FE Analytics

What measures are you taking to address the 29% discount?

Obviously, where the discount is today is incredibly frustrating. It is top of mind for us as a management team.

We were making some inroads into the discount after we reported our interim results but then there were concerns over capital gains tax ahead of the Budget and we saw our trading volumes more than triple. Now the Budget has been announced, hopefully this issue has cleared.

Our fees have been a headwind that has recently alleviated itself. We also need to tell our story and improve transparency and communication, with more investor education around our private portfolio. We are buying back shares and continuing to push on investment performance.

How have the changes to cost disclosure rules impacted RIT Cap?

Our operating costs – what it takes to run the business – are not an additional cost that we charge our shareholders, that's all deducted from our net asset value (NAV).

Under the prior cost disclosure regime, RIT Cap’s costs were almost 5%. Now our ongoing charges figure (OCF) is 77 basis points. When we printed our new cost disclosures, we were immediately reinstated on Fidelity's platform.

In 2020 and 2021 we had two very strong years. We were generating 20% NAV returns, so we were paying carry fees and incentive fees to our third-party managers. Under the previous accounting rules, we had to amortise those costs over five years. In 2023 we actually paid very little in fees but our charges appeared high because we had to amortise the costs from prior years.

There has been some negative sentiment towards trusts that hold private assets; how has that impacted RIT Cap?

We saw very strong returns from private markets until there was a step change in interest rates. On the back of those strong returns and organic growth, the percentage of private assets within our portfolio peaked at 42%.

That has been a headwind in the past couple of years, when investors were concerned around venture, growth and valuations.

We are trying to reduce our privates allocation because we've seen exciting opportunities in the public space. Private assets are currently 32% and our chairman has said they should be anywhere from 25% to a third.

Our privates portfolio has generated a 15% annualised return over the past 10 years. It is well diversified by manager, vintage, sector and geography. We didn't pile into these private investments in 2020 and 2021; about 70% of our portfolio was invested pre-2020.

Our managers include Thrive Capital, which recently invested in OpenAI; Iconiq Capital, which manages money for Silicon Valley's elite; and Peter Thiel’s Founders’ Fund, so they’re the best of the best.

We invested alongside Greenoaks Capital Partners in Coupang, which is effectively the Amazon of South Korea, in 2018-19 and we’ve made seven times our money.

Are there any themes in the public equity portfolio?

Late last year, we identified small- and mid-cap stocks as an interesting theme. They were trading at 20-to-30-year lows.

We added to our China exposure early this year because it looked fundamentally cheap. It's a market where we've got deep networks, good external managers and the ability to make high-conviction investments.

Healthcare is a long-term theme based on changing demographics, but you need the right partners. Our ability to invest alongside some of the premier healthcare managers gives us a lot of conviction and there's going to be a ton of growth.

We see a tremendous amount of potential in Japan and we think we're in the early to mid-innings of corporate governance reforms, which will take time to filter through. Opportunities are company-specific and idiosyncratic, dependent on our managers’ ability to unlock value.

Digital transformation is another theme. We made a tactical decision in 2020-21 to look at digital transformation through our privates portfolio and we didn't want to double up on that exposure in our public portfolio because then you just end up with one giant growth factor. We’ve relaxed that distinction since then, but we still don’t want to swamp the portfolio with a massive growth bias. We invested in Amazon off its lows – that's been a great story – and we also own Microsoft.

What’s your highest conviction investment?

Since we invested in Talen Energy in the middle of last year, it's up 150%. It was just coming out of Chapter 11 and it wasn't the easiest stock to get hold of, but we were creative with the trading desk and managed to get an allocation because we saw a lot of upside.

Three catalysts have appeared over the past 12 months or so. It sold a database to Amazon Web Services and that unlocked $1.5bn to $2bn of value. It sold another asset in Texas for well above analysts’ estimates. Then it got upgraded to a Nasdaq listing, which opened up the shareholder base.

Talen specialises in nuclear power. There is a lot of euphoria around that space today and we like the management team.

Talen is an example of our ability to deliver something investors might not see or don't have access to. That's our heritage.

What do you enjoy doing outside of investing?

I enjoy working out, going to restaurants, travelling and visiting museums.