The Allianz Strategic Bond fund has undergone a complete overhaul in the past few months after its manager Mike Riddell left and Allianz restructured its fixed income teams.

Historically, the firm had three fixed income teams: a macro unconstrained team under Riddell, who joined Fidelity in August; the global markets team, which was brought over to Allianz from Rogge Global Partners in 2011; and the European team based in Paris.

All three have been merged under portfolio managers Ranjiv Mann, Luke Copley, Filippo Novembri and chief investment officer Julian Le Beron. The four of them are now in charge of the Allianz Strategic Bond portfolio, among other strategies.

The move spooked investors when it was announced in May, with experts suggesting to sell positions. In its heyday in 2021, the fund amassed close to £3bn of assets under management; today, it’s down to £276.5m. But Le Beron is confident he can turn the fund around.

Fund’s assets under management over 3yrs

Source: FE Analytics

The new investment process is “very much top-down and fundamentally driven”, as Le Beron described it – a key difference from Riddell’s valuation-based approach.

The starting point is an assessment of the major markets, looking at the underlying country fundamentals. The second step is overlaying the valuation component, for both local rates and forex, to look for misalignments between fundamentals and market valuations. Finally, there is a qualitative assessment, where the judgment and experience of the portfolio managers comes into play.

“In the final step, we look at cyclical factors, monetary policy, expectations versus our views,” Mann explained. “We also take potential political risk into account, which has started to become more of an important factor in developed markets as well, not just emerging markets, as it used to be.”

If the managers disagree on any point, Le Beron has the final decision as CIO.

“I do have to override, when needed to, every once in a while. The last time that that happened was while assessing conviction strategies,” he said.

“This summer, bond yields were rising and we had to have conviction to stay long duration. There were obviously reasons why the data was getting a bit stronger, the consumer was bit more resilient, the US economy seemed sustainable. I steered the team to stick to our long duration bias, which then worked well into the fourth quarter, when we saw that huge reversal in price action.”

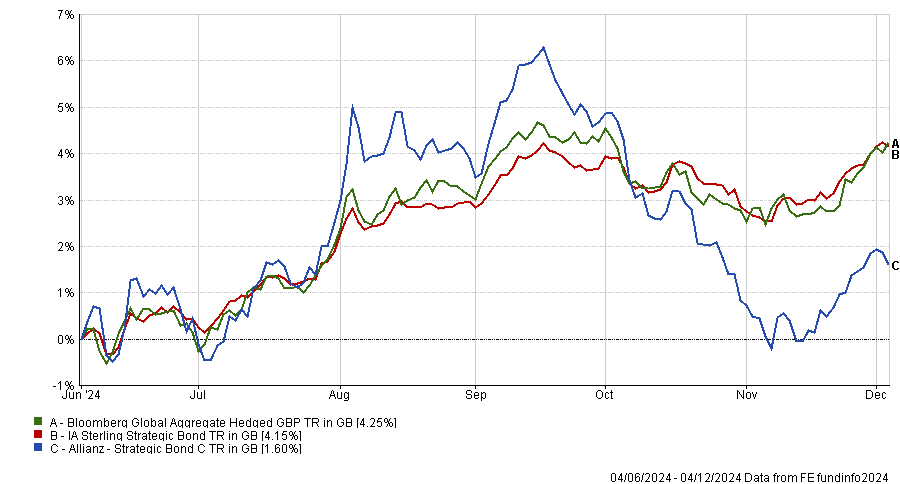

Performance of fund against sector and index over 6 months

Source: FE Analytics

As the previous example testifies, the fund is “more agile and nimble” than Riddell’s legacy team, which could hold onto positions for quite a long time.

Another difference is that it uses a lot more relative value and curve strategies, rather than just outright duration.

“By relative value, I mean that when we buy one bond market, we sell another, so that overall, it remains duration neutral. At the moment, for example, gilts have underperformed and we have started to buy them. At the same time, we have been selling European bonds. This is a good example of cross-market signals,” Le Beron said.

“As for curve strategies, that’s another way of building portfolios in fixed income. At the moment, we like curve steepness, so we overweight bonds, in the five-year sector and sell 30-year bonds, for example.”

Gilts look particularly attractive, Mann explained, because the UK is still priced for a very shallow rate-cutting cycle, while the underlying disinflation process still remains in place.

“The Bank of England is remaining more cautious and more conservative versus other central banks. Against that, valuations for gilts versus other G10 markets certainly look more attractive, both just on an outright basis but also on a relative value basis – specifically versus German Bunds,” he said.

“Also, following the UK election, some of the risk premium that was attached to owning UK assets has also diminished. That, in aggregate, presents a relatively constructive backdrop for gilts.”

The resulting portfolio, compared to Riddell’s, is one where the amount of gilts has doubled. The team has also reduced headline duration, added to curve risk and taken profits from inflation-linked bonds.

“There's been quite a lot going on, not just in this portfolio but also across the whole suite of global market portfolios,” Le Beron concluded.