Global dividend strategies are a well-established group. There are around 50 global dividend funds with at least €100m assets under management each, managing a total of €75bn.

However, over the past five years or so, the median yield of these funds has taken a notable tumble. The question investors should be asking is: where has all the yield gone?

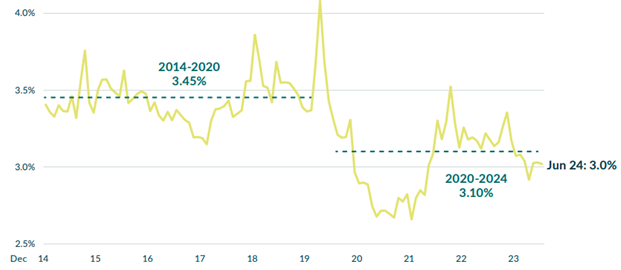

Median dividend yield of global dividend funds from 2014 to June 2024

Source: Van Lanschot Kempen

This drop was for a long time attributed to falling yields across financial markets, but this explanation no longer holds water as rates have increased recent years.

Dividend strategies have historically tilted towards larger-caps, as dividend payments are a characteristic of larger, more mature companies. In our view, there has been a structural shift in the investment style of many dividend funds which explains their lower yields today.

A number of factors are driving this trend.

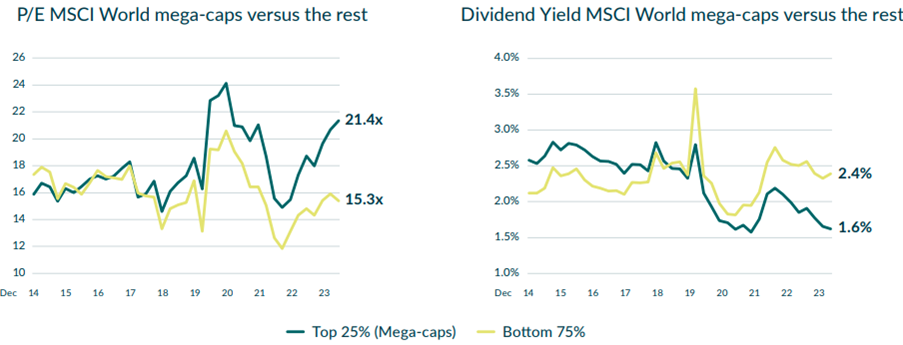

First, valuations of the largest companies have increased. As a result, yields of this cohort are lower and valuations are less attractive. Currently, mega-caps trade at a significant valuation premium to the rest of the market and offer the lowest yield, whereas in the past they offered a higher yield at a comparable valuation.

Dividend yield of the largest companies has declined as valuation has increased

Source: Van Lanschot Kempen

Second, there has been a shift in the type of companies in which dividend funds invest. Following the strong performance of growth companies and the fact that more of those companies have started to pay a dividend, focus has shifted from investing in companies with a high current dividend yield to companies with high expected dividend growth.

A clear point of evidence of this shift is that over 70% of global dividend funds currently have exposure to the Magnificent Seven. Yet none of these mega-cap companies has a dividend yield above 1% at the time of writing.

The bias towards larger companies in dividend strategies used to be accompanied by a tilt towards value. Dividend is a fundamental factor and when valuations rise the dividend yield inevitably goes down. Over time, by sticking to large-caps, the investment style of dividend funds has moved away from value-investing towards a more blended portfolio.

With that, the exposure offered by global dividend funds looks more like that of the MSCI World and thus offers less of the diversification benefits you would usually expect when investing in dividend equities.

As equity markets reach extreme levels of market concentration, diversification becomes even more important. Valuations are currently more attractive and yields are higher, outside the well-known large-cap names. We see opportunities in mid-cap stocks, emerging markets players and companies in non-traditional dividend industries.

In countries like Japan and South Korea, for example, improvements in corporate governance and capital allocation are unlocking significant value. In euroland and the UK, there are solid companies with attractive valuations.

On a sector basis, Asian tech stocks, selective consumer companies, and the media and entertainment industry look particularly interesting right now given that valuations and yield have become more attractive.

Diversifying the underlying drivers of a portfolio makes it more robust. By looking at a broader range of opportunities, it is possible to achieve an attractive yield while maintaining a similar dividend cover ratio and even reaching higher mid-term earnings growth expectations.

As large-caps have continued to rally, some investors may understandably worry about missing out on returns. However, history shows that in the long run, the largest stocks tend to underperform versus the rest of the market. Even the largest stocks turn out to be sensitive to gravity eventually.

Trends in concentration also tend to change direction. The track record of mega-caps when they are trading at lofty valuations is poor – remember the Nifty Fifty or the tech bubble.

Obviously, it is hard to pinpoint if and when a lasting rotation will happen. That makes it even more important to seek diversification strategies when markets are extremely concentrated. When it comes to hunting dividend yield, investors should consider looking for opportunities off the beaten track.

Joris Franssen is head of the dividend and value team at Van Lanschot Kempen. The views expressed above should not be taken as investment advice.