The much-discussed trade tariffs that US president-elect Donald Trump is expected to introduce next year could actually be beneficial for trade, while Brexit might leave the UK in a better position than countries in the European Union.

These are the views of Rathbones’ David Coombs and Columbia Threadneedle’s Peter Hewitt, respectively.

Multi-asset manager Coombs, who runs the Rathbone Strategic Growth Portfolio, recently told Trustnet that the UK has already entered a recession. He also thinks Trump's election victory means it is more likely there will be pressure for the Russia-Ukraine war to come to an end, for Israel to ratchet back conflict in the Middle East and for the European Union to both spend more on defence and to look into its regulatory relationships with the US.

“My job is to look at the at the financial, rather than the personal implications,” he said.

“So far, the playbook is classic Trump: threaten, threaten, threaten, get to the table, back down a little bit. That's the world we're in right now and it's pretty positive for equities, in a weird sort of way.”

Trump’s negotiation tactic is supportive of US economy and stocks because Europe, Canada and Asia need to do something themselves to counteract that, the manager explained – not necessarily tit-for-tat tariffs, but new ways to make their economies more attractive to outside investment.

“Trump is going to be a traditional, small-state conservative. Everything points towards him trying to contract the public and promote the private sector, which is a very strong tailwind for equities,” Coombs said. “Weirdly, it could be good for trade.”

Despite his “bull-in-a-china-shop” manners, Trump raises some important issues that otherwise wouldn't have been addressed – for example, China has been selling subsidised products into Western markets, which isn’t allowed in the European Union under the WTO’s fair competition measures.

If these differences are addressed, it could be good for Western equities, the manager argued. But, ultimately, it could also encourage China to increase stimulus into the domestic economy and that could be a positive upside risk in 2025.

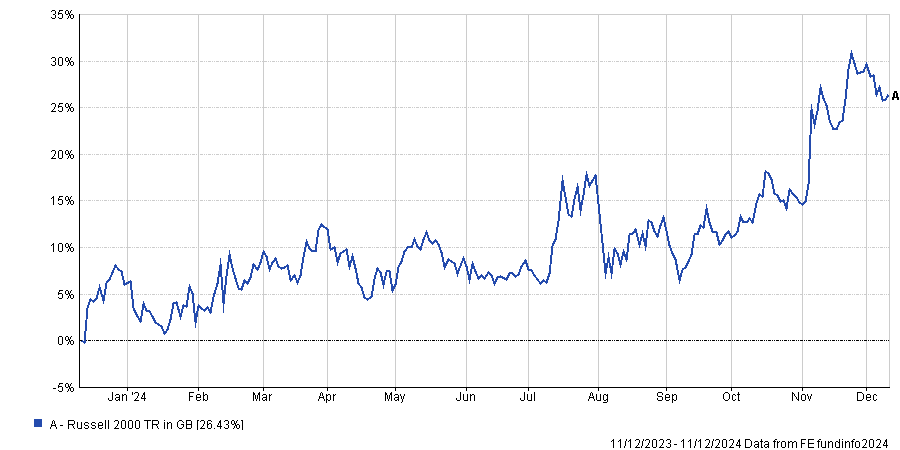

For these reasons, Coomb’s portfolios now have a greater tactical position in US small-caps, achieved via a Russell 2000 ETF, and the manager has also been “gently” adding to his China exposure, “just in case the country surprised us with mega-bazooka stimulus pack packages next year”. In particular, he increased his weightings in American-Hong-Kong based insurance company AIA and technology and videogames company Tencent, both of which he has held for a long time.

Performance of index over 1yr

Source: FE Analytics

Meanwhile, CT Global Managed Portfolio Trust manager Hewitt doesn’t think the UK is in a recession or that it will be soon.

Despite conceding to a general doom-and-gloom atmosphere and a Budget that was “anti-growth”, the UK market is still at “a very significant discount” in terms of its price-to-earnings (P/E) ratio against other comparable markets and “certainly against America”. Also, UK wages are growing in real terms, which means consumer spending is still reasonable.

“If costs go up, it will be interesting whether company profits do as well, but in terms of the overall economy, it's still performing reasonably well. Remember there's a lot more public spending happening, which does filter through to private companies eventually,” Hewitt said.

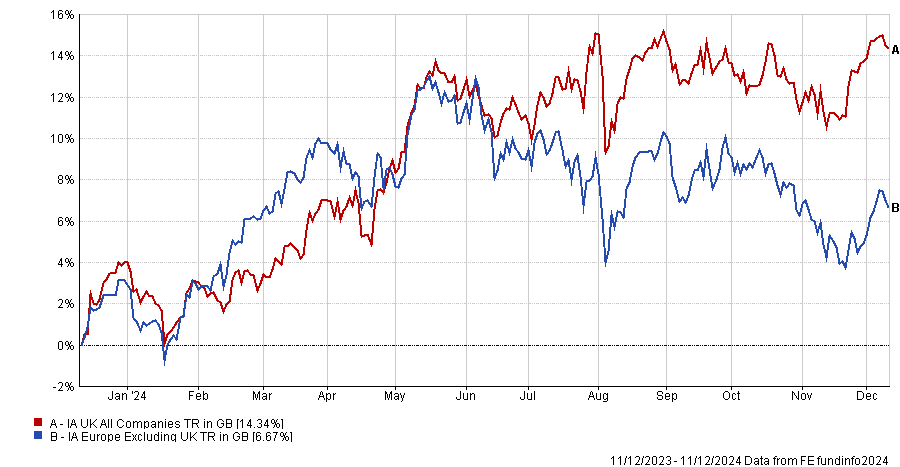

“I still think there's a strong story in the UK. It’s not great for growth, but the long-term case isn’t impacted and the UK should close the gap even with other European markets, which is quite marked, in the next two to three years.”

To that end, the manager believes Brexit could play out more positively that some might anticipate.

Performance of sectors over 1yr

Source: FE Analytics

The European Union is going to be hit with massive tariffs by Trump, but the UK isn't in the union anymore.

“Maybe, with Trump in mind, Brexit was a good move. I don't pass judgment on that. My job is to analyse what we have got,” the manager said.

“But it could be that there is a 25% tariff on an EU company and a 10% tariff on a UK company, which is still not good but better than its competitor in Europe. Who knows.”

Speculations aside, Hewitt recommended to always be driven by fundamentals, stressing that the cheapness of the UK – both relative to its competitors and its own history.

The way the manager plays this is through mid- and small-caps, anticipating “strong performance” from investment companies that specialise in that area.

As to when that could materialise, he had no better forecast than “at some point”.