Less than one-third of active equity funds have beaten their passive rivals in 2024, AJ Bell research has found, owing to surging Magnificent Seven stocks, concentration risk and managers’ inability to match high index weightings to this year’s winners.

AJ Bell’s Manager versus Machine report looks at active funds in seven key equity sectors, comparing their performance to the average passive fund rather than a benchmark to reflect the real-world choice that investors have between active and passive funds.

The latest edition of the report shows that just 31% of active funds have outperformed their tracker rival in 2024 to the end of November. The picture doesn’t get much better over the long term either, with the research finding that only 33% of active funds are beating passives over the past decade.

Laith Khalaf, head of investment analysis at AJ Bell, said: “Make no mistake, passive funds are eating the lunch of active managers and the continued strong performance of index trackers will do nothing to staunch this trend.

“Whether you look at the short term or zoom out and take a wider perspective, the picture remains dismal for active managers, and it’s the influential IA Global and North America sectors where a lot of the damage is being done.”

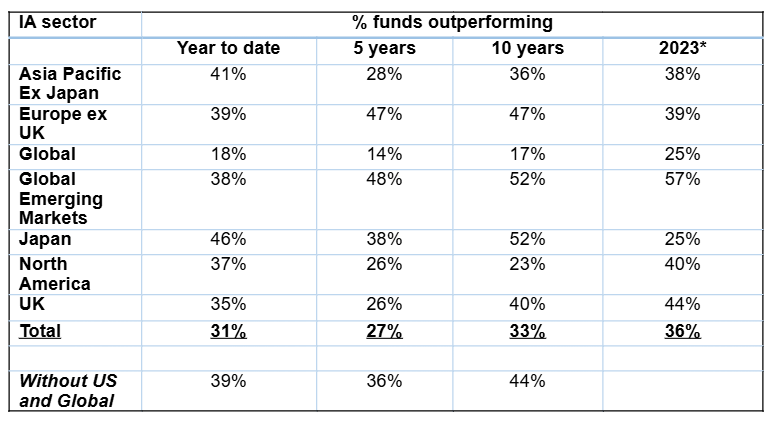

Percentage of active funds outperforming the average passive alternative

Source: AJ Bell, Morningstar. To 30 Nov 2024

The above table illustrates Khalaf’s point that the IA Global and North America sectors are among those with the most pronounced underperformance as only 18% of global equity and 37% of North American equity funds have beaten their passive peers this year.

Of course, this is down to the US exceptionalism narrative and the Magnificent Seven, which have dominated market leadership for a number of years now. The Magnificent Seven are Nvidia, Alphabet, Tesla, Microsoft, Amazon, Meta Platforms and Apple – stocks that are benefitting from the artificial intelligence (AI) revolution.

AJ Bell’s analysts noted that to match the exposure of an S&P 500 tracker to the Magnificent Seven at the start of 2024, an active manager running a US fund would have had to dedicate 28% of their portfolio to these stocks, with 7% in each of Apple and Microsoft.

Thanks to their continued strong performance and growing market cap, this grew to a 33% stake in the Magnificent Seven – with more than 6% positions in Apple, Microsoft and Nvidia – by the end of November.

“These are punchy positions for an active manager to adopt, unless their own fundamental research leads them to precisely the same conclusion as the market. Not only would this seem too much of a coincidence by half, it would undermine the rationale for active management at its root,” AJ Bell’s Manager versus Machine report said.

“Any active US manager who did happen to invest in all of the Magnificent Seven stocks in equal proportion to their weight in the index would find themselves underperforming the market, and their passive peers, on that portion of their portfolio once charges have been deducted.

“That would put a huge burden on the remaining two-thirds of their portfolio to deliver outperformance, while also prompting fund investors to consider disinvesting and putting a third of the proceeds into a tracker fund, with the remaining two thirds in a ‘proper’ active fund to achieve a similar, cheaper alternative.”

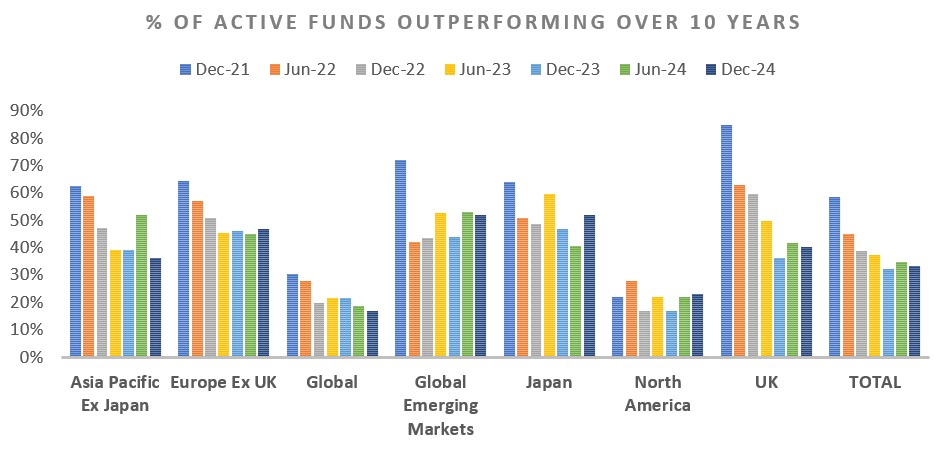

Previous Manager versus Machine results

Source: AJ Bell, Morningstar

The strong returns from the S&P 500, driven by its mega-cap tech names, has also caused positioning dilemmas for global equity managers as the US stock market now makes up around 70% of global benchmark indices such as the MSCI World.

A decade ago, the average active global equity fund had 46% in the US, compared with 57% in an index tracker. However, the average passive fund now has 69% in the US and active funds are still behind, with a 59% weighting.

“Given the extreme performance differential between the US and other regions, being underweight the S&P 500 goes a long way to explaining why so few active managers have outperformed the passive machines in the global sector,” AJ Bell said.

“Consequently, it seems pretty inevitable that until there is a reversal of the dominant performance of the US stock market and the big tech stocks within it, this report will continue to paint a bleak picture of the fortunes of active managers in the global and US sectors.”