Income funds remain a crucial component of many investors' portfolios, particularly for those approaching retirement and looking for a steady source of income. However, income funds are not exclusive to older investors. Indeed, following a year of interest rate cuts, the outlook for income-focused strategies may be brightening.

Below, Trustnet asked fund selectors for their income fund suggestions for 2025.

Blackrock UK Income

In the home market, Jason Hollands, managing director at Evelyn Partners, saw potential in the £603m Blackrock UK Income fund as “the UK has long been a standout market for income seekers”.

Managed by Adam Avigdori and David Goldman, the portfolio targets companies with the potential to grow their dividends rather than businesses with high but stagnant yields. Hollands explained that this has led to attractive capital growth and performance compared to its competitors.

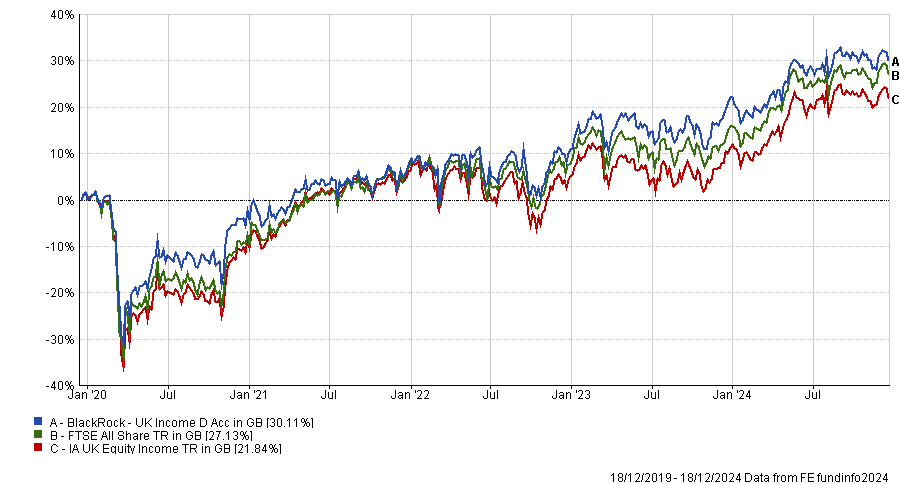

Indeed, the strategy has posted a top quartile return of 30.1% in the IA UK Equity Income sector over five years, along with a yield of 3.64%

Performance of the fund vs the sector and benchmark over 5yrs

Source: FE Analytics

Hollands added that the portfolio benefits from Avigdori and Goldman's extensive experience and willingness to shift holdings “depending on the market environment and valuations”.

As a result, Hollands concluded that while the fund may lag in stronger markets, it held up better on the downside. For example, over the past five years, the portfolio was in the top quartile for volatility, maximum drawdown and downside risk.

M&G Global Dividend

For investors interested in the global market, Charlie McCann, investment analyst at Square Mile, pointed to the £2.2bn M&G Global Dividend fund.

McCann said: “We believe the fund is well placed to meet the changing demands of markets in 2025.”

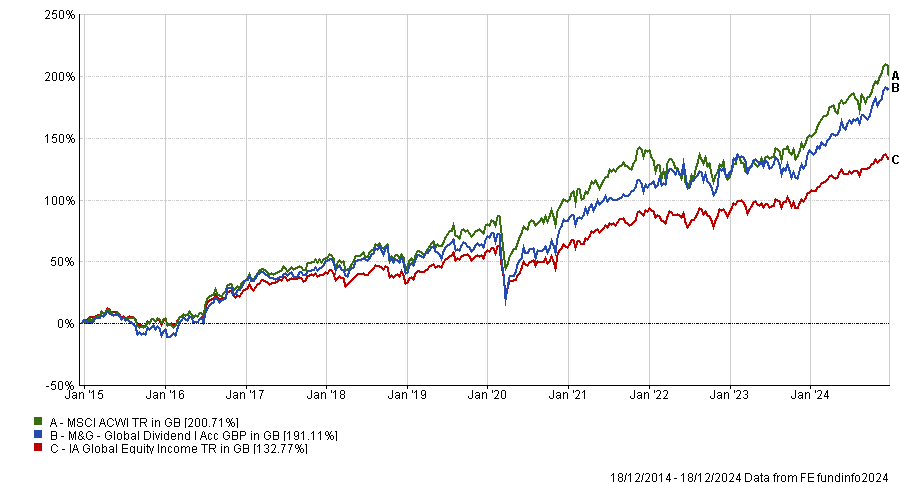

With a dividend yield of 2.35%, the fund has been one of the 10 best-performing portfolios in the IA Global Equity Income sector over one, three, five and 10 years.

Performance of the fund vs the sector and benchmark over 10yrs

Source: FE Analytics

McCann explained that it had successfully grown the dividend over time, having achieved “more than 7% compound annual growth since its inception” and looks poised to continue growing in 2025.

Moreover, McCann said the fund benefits from a sensible investment process. The fund invests primarily in a core bucket of high-dividend stocks, supplemented by higher growth names and more cyclical parts of the market.

He explained that the allocation to each of these buckets shifted overtime in response to the current market backdrop, which allowed the fund to perform well during the market rally in the first half of 2024, while also beating the benchmark when the market broadened.

NextEnergy Solar

In the investment trust space, James Carthew, head of investment companies at QuotedData, was bullish on renewable energy and found the £373m NextEnergy Solar trust compelling.

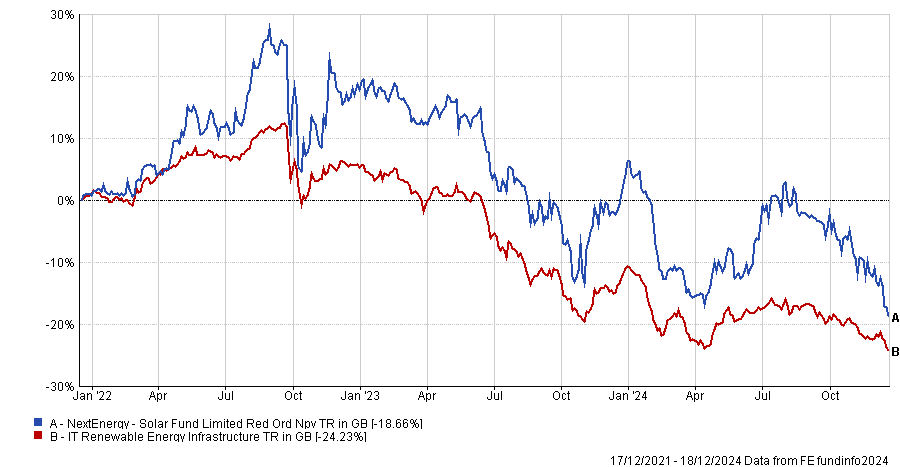

Over three years the portfolio ranked in the second quartile of the IT Renewable Energy sector, although the tough backdrop for renewables – caused by higher interest rates – means the trust down by 18.7% in this period.

Performance of the trust vs the sector over 3yrs

Source: FE Analytics

However, Carthew concluded the portfolio was due for a turnaround. The trust operates at a 32% price discount compared to its net asset value (NAV), with a "whopping dividend yield" of 13.06%, which would be covered by 1.1x to 1.3x cash earnings.

Furthermore, Carthew explained that the company started a capital recycling plan in 2023, which has helped fund share buybacks and narrow the discount, which will provide the opportunity for a broad variety of new investments moving forward.

Guinness Asian Equity Income

Finally, Alex Watts, fund analyst at interactive investor, suggested the £266m Guinness Asian Equity Income fund for investors who exposure to the Asian market.

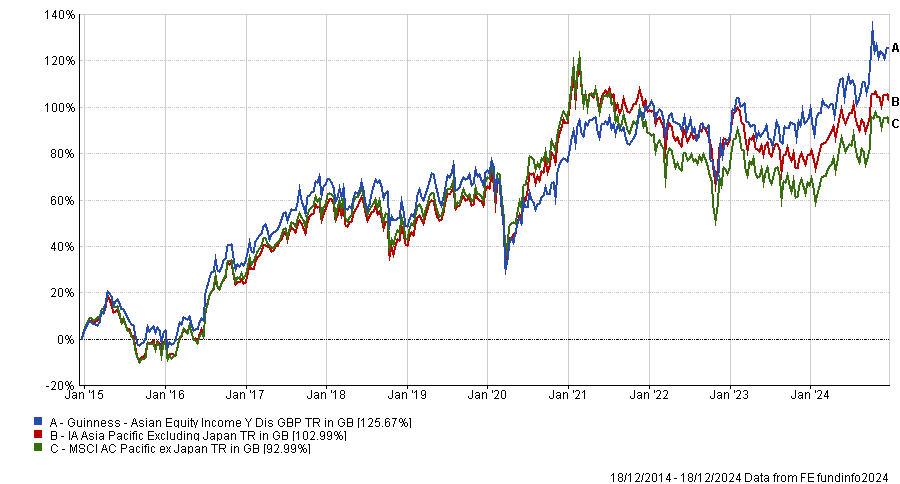

This fund has generally outperformed its sector, with a top quartile performance of 125.7% over the past 10 years. While it did slide into the second quartile over five years, it rallied and returned to the first quartile over three.

Watts added that with a 3.8% yield, it was one of the highest-yielding portfolios in its sector.

Performance of the fund vs the sector and benchmark over 10yrs

Source: FE Analytics

Watts said: “Towards the end of 2024, the region benefitted from early signs of a recovery of its largest market, China, as share prices reacted positively to a range of stimulus measures.”

Watts explained that the fund's 38.4% weight to China has positioned it well to play on this recovery if it continues. However, it is otherwise well diversified with an equally weighted approach, preventing overexposure to any company.

Moreover, Watts argued that with most of the portfolio’s revenue based on the “economies and trade of the Asia Pacific region”, it was an attractive diversifier particularly for those wanted to move away from the concentrated US market.