Funds managed by the likes of abrdn, Rathbones and Artemis are being backed the journalists in Trustnet’s editorial team for 2025, with the question of how to approach the US stock market being the biggest issue.

US equities had another strong year in 2024, thanks to the artificial intelligence (AI) revolution, the US exceptionalism narrative and Donald Trump’s second presidential win. However, there are questions about if recent US winners will continue their run into 2025 and, if not, how the market rally will broaden out into other areas.

Below, the Trustnet editorial team explain how they are approaching this dilemma and the funds they think will outperform over the coming 12 months.

Head of editorial Gary Jackson: abrdn Global Smaller Companies

Thinking about where to invest in 2025, I find myself focusing on global small-caps for a few reasons. Historically, small-cap companies have shown the potential for higher growth compared to their larger counterparts, particularly during periods of economic recovery. With global economies stabilising and the direction of interest rates likely to remain favourable, smaller companies could stand to benefit.

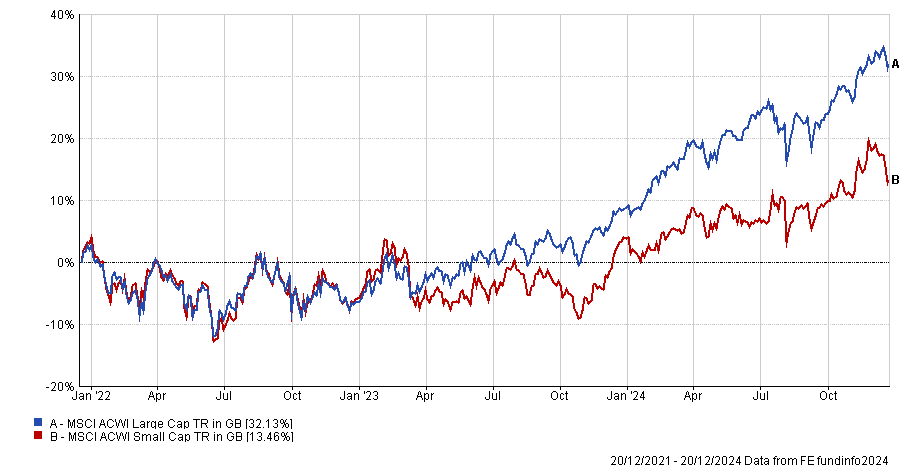

Additionally, small-caps are currently trading at attractive valuations relative to large-caps following their recent underperformance (see chart below), presenting a reasonable entry point for those willing to accept their higher volatility in exchange for long-term growth potential.

Performance of global large-caps vs small-caps over 3yrs

Source: FE Analytics

My preferred fund in this space is abrdn Global Smaller Companies. It offers a well-researched, diversified approach to small-caps, focusing on businesses with strong fundamentals and growth prospects. By targeting quality companies, the fund mitigates some of the risks inherent in small-cap investing, which adds a layer of confidence to this choice.

Manager Kirsty Desson said: “We’re looking for those rare companies that, we think, have what it takes to be a potential large-cap leader of tomorrow, resulting in a high conviction portfolio of around 50 stocks.”

Its global reach adds another layer of appeal, providing exposure to regions where small businesses may have unique advantages, such as local market expertise or favourable economic conditions. Around half the portfolio is in the US, where small-caps are among the expected beneficiaries of president-elect Donald Trump’s policies, but also offers exposure to Japan, the UK, Australia, Germany and other countries.

While small-caps are not without their challenges – they tend to be more sensitive to market fluctuations and economic downturns – this is precisely why I’m approaching this decision with balance. I see this as a calculated step to diversify my portfolio, which has plenty of exposure to large-caps, and position it for potential upside in a less crowded segment of the market.

Editor Jonathan Jones: Rathbone Global Opportunities

This year has been one of surprising prosperity for investors despite myriad reasons for markets to collapse. Although there is still trepidation heading into 2025, I am taking the glass-half-full approach and picking something that should do well if the good times keep on rolling.

I already own Rathbone Global Opportunities in my ISA and am picking it here. The fund is managed by Alpha Manager James Thomson and is predominantly invested in the US (71.4% of the portfolio).

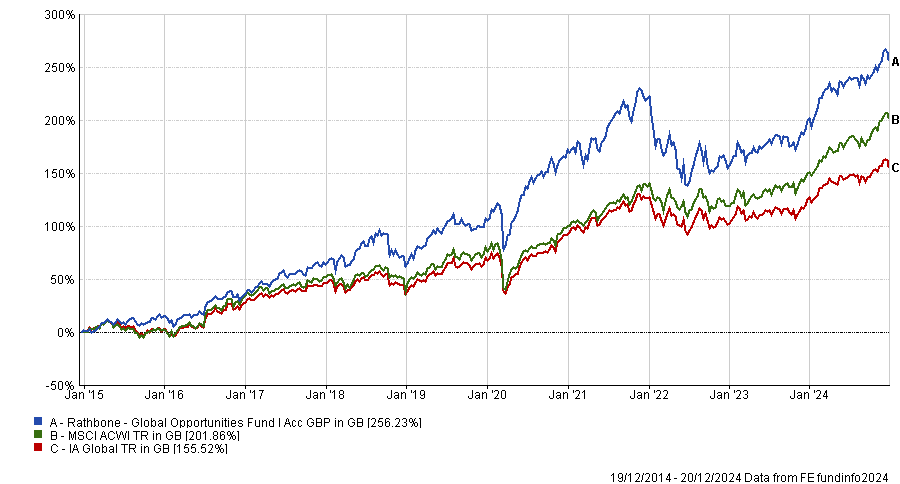

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

With Donald Trump becoming president in 2025, things could be on the up in the US. The president-elect has promised huge fiscal spending during his tenure and markets performed well during his first term. Indeed, the S&P 500 made a total return of 21.1% in 2017 (in US dollars).

This fund owns some big tech names such as Nvidia and Microsoft that have thrived over the past 18 months but also owns defensive holdings, giving it a more balanced performance trajectory. Although returns are below par over three years due to its lack of Magnificent Seven positions, next year could be a big one for some of its less heralded companies.

News editor Emma Wallis: Brown Advisory Global Leaders

I’ve waded my way through a multitude of fund managers’ outlooks this year and the consensus forecast is that 2025 should be a good year for equities, albeit nowhere near as good as 2024, so I’m going with an equity fund.

US equities are richly valued and while some managers argue there are good reasons for that, such as strong earnings growth, others warn that the slightest disappointment or earnings miss could be severely punished when stocks are priced for perfection.

I am still undecided about whether the US will continue outperforming all other regions or if cheaper areas are a safer bet. So I’ve decided to delegate geographic decisions to the experts by choosing Brown Advisory Global Leaders, managed by Mick Dillon and Bertie Thomson.

I don’t know how much longer the current late-stage bull market will last and if next year will be volatile – quite possibly with Donald Trump at the helm of the US. But wherever markets and economies are headed, the companies within Brown Advisory Global Leaders, which are solving problems for their customers and taking market share, are well placed to weather any storms.

If markets do sell off, Dillon and Thomson will be taking advantage and buying more shares in great companies at cheaper prices. They have to. Their investment process includes a drawdown rule whereby if a stock falls 20%, they have to buy more or get out. Staying still is not an option.

Whilst Dillon and Thomson aim to buy stocks when they are cheap, their portfolio is nonetheless quite richly valued and that does concern me. In a real world scenario I would pair this fund with a value manager and a small-cap specialist.

However, I can sleep soundly at night knowing that Dillon and Thomson will do their utmost to perform because they could not be better incentivised. “Bertie and I have only two investments,” Dillon told me earlier this year. “We are partners and shareholders at Brown Advisory and we invest in Brown Advisory Global Leaders and that’s it. We’re all in. I'm a big believer in people who eat their own cooking.”

Senior reporter Matteo Anelli: Premier Miton US Opportunities

I am often the annoying anti-consensus person in the room and that shows when I’m picking investments too, although probably (hopefully) looking beyond the Magnificent Seven isn’t anti-consensus anymore.

My pick is Premier Miton US Opportunities, an unconstrained fund concentrated on 40 multi-cap companies that have demonstrated their strength across market cycles. It is a very flexible fund that can target more defensive or cyclical businesses depending on the market environment and, most importantly, isn’t invested in the same US companies that everyone already owns.

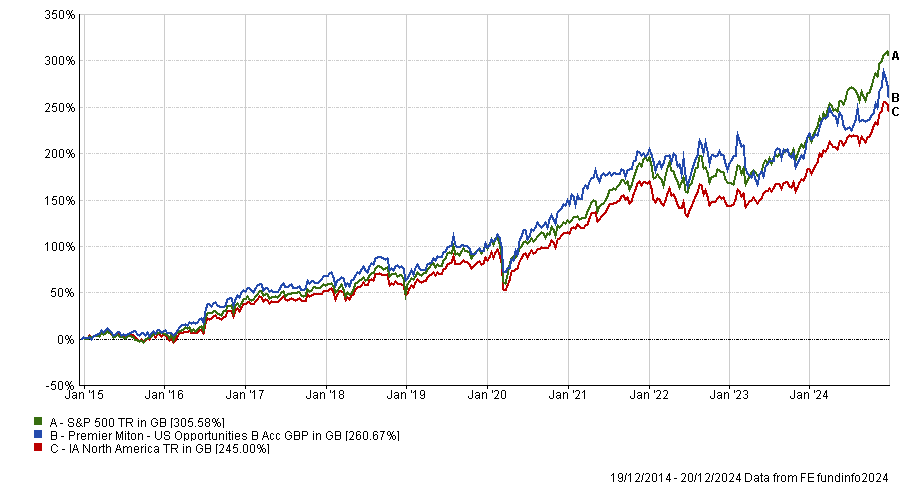

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

Experts are now expecting returns to move away from the US mega-caps into the lower capitalisation companies, which might also benefit from new domestically-focused policies in the US. The fund doesn’t include any of the Magnificent Seven, so has underperformed its peers and market in recent years, but I’d hope this would turn around if and when market leadership in the US shifts.

Reporter Patrick Sanders: Artemis Global Income

As the latest addition to the Trustnet team, I went back and forth on the ‘safe choice’ of picking an index tracker, banking on another year of spectacular US performance. But ultimately, I thought I would go with a fund that stuck out to me over my opening months on the team – Artemis Global Income.

This fund appeals to me for a few reasons. Firstly, after talking with managers Jacob de Tusch-Lec and James Davidson I have a good understanding of their approach to equity income investing. The managers have an interesting and well-diversified stock-picking strategy.

While there is a major US allocation, the high-conviction portfolio also has exposure to Europe, Japan and has even recently pivoted more towards China. Since I’m picking a single fund rather than building a full portfolio, this broad exposure appeals to me and might serve me well if the market broadens out next year as some investors have suggested.

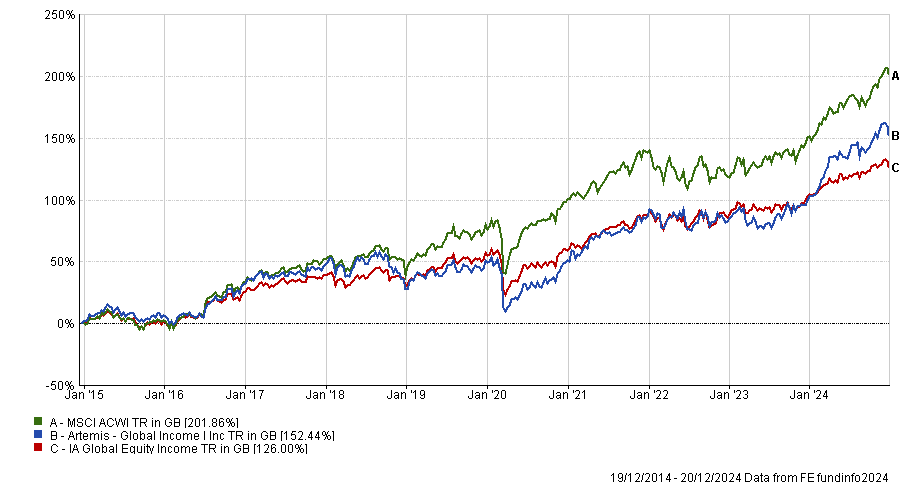

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

De Tusch-Lec and Davidson’s approach has also worked recently and put the fund in the top quartile of the IA Global Equity Income sector over the one, three and five years. With a 4.21% dividend yield placing it within the top five yielding funds in the sector, it matches all the criteria I would look for in equity income.