The Baillie Gifford US Growth trust’s board is urging shareholders to vote against activist investor Saba Capital Management’s proposals to make “substantial, self-serving and destructive changes” to the company.

Saba has amassed a 25.2% stake in the trust and has requested that it convene a general meeting to allow shareholders to vote on a range of resolutions, including replacing the board with Saba’s nominees, changing the trust’s investment mandate and replacing Baillie Gifford’s managers with Saba’s.

The general meeting will take place in Baillie Gifford’s Edinburgh offices on 3 February but shareholders need to take action before noon on 30 January – potentially earlier if they are voting through platforms.

Tom Burnet, non-executive chair of the trust, said: “We urge all shareholders to make their voices heard and to vote against Saba's self-serving and destructive proposals.

“Since IPO in March 2018, the company has delivered exactly what it promised: an investment trust through which its shareholders can access and benefit from some of the most exciting growth opportunities in both public and private US companies in a low-cost structure that can be held for the long term.”

Private companies in which the trust invests include SpaceX, Databricks and Stripe.

The trust’s investment performance has been much stronger than Saba has indicated, the board argued in a stock exchange announcement this morning. “Save for the three-year period that Saba focused on in its statement, the company has materially outperformed all of Saba's publicly available funds over recognised measurement periods,” it stated.

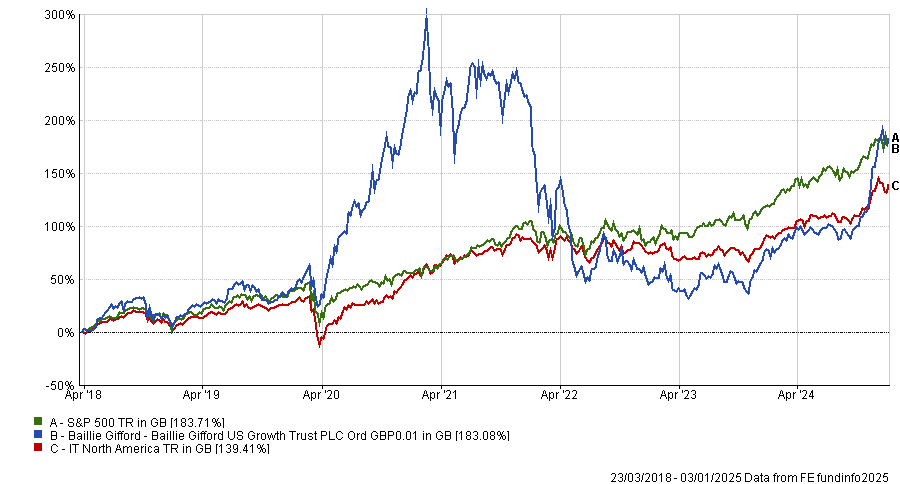

Since March 2018, the trust’s net asset value (NAV) has risen by 183.9%, equating to an annualised return of 16.7%, which is in line with the S&P 500 index’s return of 16.9%.

Performance of trust vs benchmark and sector since inception

Source: FE Analytics

Over the past five years, the trust’s performance resides amongst the top 6% of all UK-listed investment companies and the top 14% of all US equity open-ended funds and exchange-traded funds globally, according to the board.

Furthermore, over the 12 months to 31 December 2024, the trust’s NAV total return was 33.4%, ahead of the S&P 500’s 27.3%.

“With a supportive business environment in the US, the company's shorter-term performance is recovering strongly following the challenging market environment post-pandemic that impacted growth equity investors, and the outlook is positive, both at a macro and a portfolio level,” the board said.

The trust’s costs are the second lowest of the seven investment companies in the AIC North America sector (the lowest does not invest in private companies). “The ongoing charges of Saba's publicly available funds are materially higher (c.2x or more) than the company's,” the board pointed out.

Saba is also targeting two other trusts managed by Baillie Gifford (Edinburgh Worldwide and Keystone Positive Change), as well as two from Janus Henderson Investors (European Smaller Companies and Henderson Opportunities), alongside CQS Natural Resources Growth & Income and Herald.