Markets have performed strongly over the past two years largely thanks to the stratospheric rise of the ‘Magnificent Seven’ stocks in the US. But to capture these gains long-term investors would have had to stomach some severe losses in 2022.

As such, some with a cautious mindset may have chosen to eschew these popular technology stocks in favour of more defensive positions.

For those looking to protect their wealth and grow it more slowly, rather than putting their eggs solely into the stock market, Paul Angell, head of investment research at AJ Bell, has highlighted funds that he believes should be on cautious investors’ watchlists in 2025.

First up is the £1.2bn TwentyFour Corporate Bond fund, managed by Chris Bowie, Gordon Shannon, Graeme Anderson and Diana Chiu. It is a risk-aware sterling corporate bond fund with analysts focusing on multi-sector bonds, investment-grade bonds and asset-backed securities. Angell said the team has “impressive expertise” in these areas.

“The managers of this fund target superior risk-adjusted returns versus peers, and the fund is therefore often cautiously positioned within its peer group,” he added.

“Whilst the shape of the portfolio in recent years has tended to include an underweight to interest rate risk, offset by an overweight to credit risk, the fund has actually been underweight both interest rate and credit risk of late, given the managers’ caution around the tight level of credit spreads.”

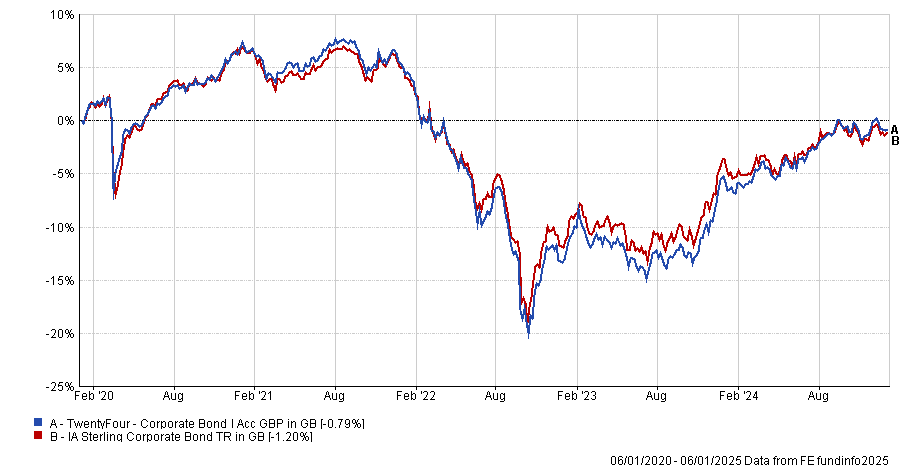

Over five years the fund has made a small loss of 0.8%, better than average in the IA Sterling Corporate Bond sector, and over the past 12 months it has risen to the top quartile of its peer group with a return of 6.2%.

Performance of fund vs sector over 5yrs

Source: FE Analytics

At present, the fund is expected to yield around 5.7% in 2025, something it should be able to do “providing no major pull-backs in credit spreads”. This is “still attractive thanks to the now higher risk-free rate in the UK”, said Angell, who added that there is “further potential for capital returns should interest rate expectations in the UK fall”.

Another option for the risk-averse is Personal Assets Trust, a defensive multi-asset investment company run by FE fundinfo Alpha Manager Sebastian Lyon, who puts an emphasis on capital preservation.

“The manager tends to invest in traditional asset classes (equities, government bonds and gold), and is reactive to market opportunities with his weightings to these core asset classes,” said Angell.

However, this does not sacrifice returns during the good times. Indeed, during the bull runs in 2023 and 2024, the trust was an above-average performer in the IT Flexible Investment sector.

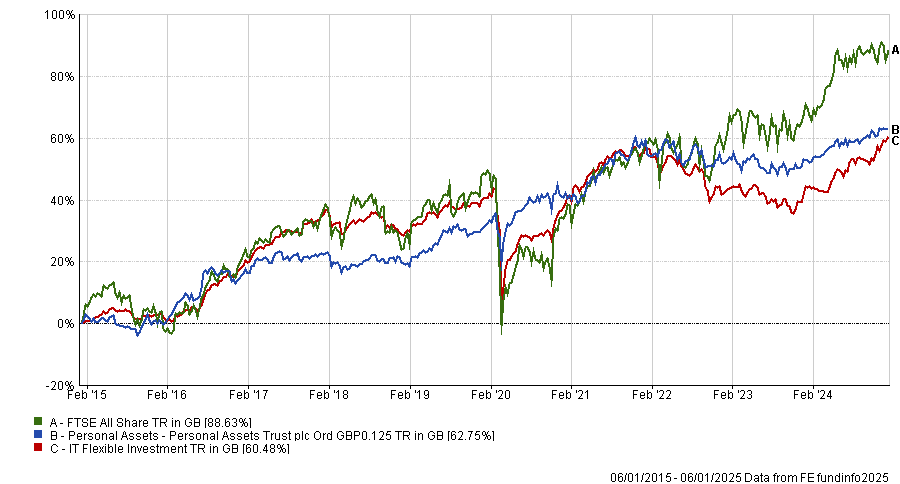

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

The only year the trust failed to beat its average peer over the past decade was 2017, showing its consistency in a range of market environments.

“Despite being invested in major, liquid asset classes, the trust still takes on market risk, and there is therefore no guarantee the trust will protect capital over any period. That said, the trust’s long-term performance has been good, delivering a solid return profile with significantly less volatility than wider markets,” said Angell.

The trust thrived in 2022 and 2020 when markets were choppy and is known for “holding up when riskier assets, such as equities and credit, sell off”.

Income investors

Another option for investors who do not want to become reliant on volatile US growth stocks could be to look for income producers. These funds are typically used by those in retirement who are looking to earn a living from their pension, so tend to be more defensive.

Aegon High Yield Bond is on the higher end of the risk spectrum in the bond space but is worthy of inclusion, according to Angell.

Managed by Thomas Hansen and Mark Benbow, the fund is entirely index agnostic as they believe “passively investing in a high yield index is nonsensical given indices are weighted to the most indebted businesses,” he said.

“Given this index agnostic approach, Aegon’s global team of credit analysts are therefore crucial to the success of the fund, as they help generate the individual bond ideas that populate the portfolio.”

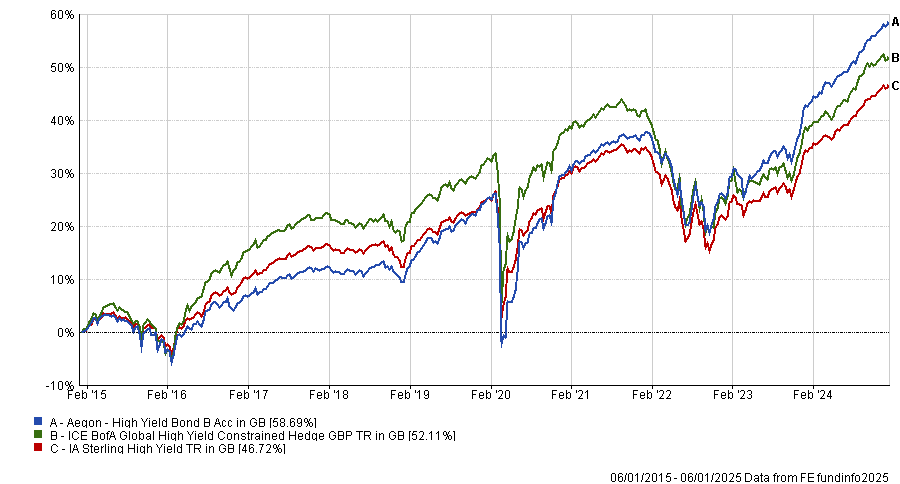

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

The fund has been a top-quartile performer in the IA Sterling High Yield sector over one, three five and 10 years, making 58.7% over the past decade, good enough for third place in the 22-strong peer group.

Turning to equities, another option is Alpha Manager Henry Dixon’s Man Income fund, which invests in UK stocks across the market capitalisation spectrum.

“The team seek out undervalued and unloved companies through identifying two types of stocks – those trading below their replacement cost and those where the market appears to be undervaluing profit streams,” said Angell.

All stocks held must have a yield in line with the market, with the manager having a preference for those that have the potential for dividend growth (exceeding twice the market average). The fund can also hold a small weight in bonds (maximum 20%).

“This is a very actively managed UK equity fund, which can diverge significantly from the index and have high levels of turnover. These factors often result in both the fund’s volatility and transaction costs being elevated,” said Angell.

It has been the best performing IA UK Equity Income fund over the past decade, up 127.9%, and sits in the top quartile of the peer group over one, three and five years as well.