Several global equity strategies focusing on environmental, social and governance (ESG) factors posted strong absolute returns last year but failed to keep up with global benchmarks. The same was true for active managers in general. The average fund in the IA Global sector returned a respectable 12.6% in 2024 yet this was nowhere near the MSCI All Country World Index’s 19.6% or the MSCI World’s 20.8%.

It can be difficult to make sweeping statements about ESG strategies because funds and firms take different approaches, said Dominic Rowles, lead ESG analyst at Hargreaves Lansdown.

But broadly speaking, ESG funds tend to have a bias towards growth companies, mid-caps and sectors such as technology, whilst being underweight value, large-caps and areas such as tobacco, mining, oil and gas.

These tilts were a tailwind for global ESG funds but a headwind for UK strategies last year due to the different dynamics of each market, he said. On a global basis, tech stocks and growth outperformed whereas in the UK, value strategies fared better.

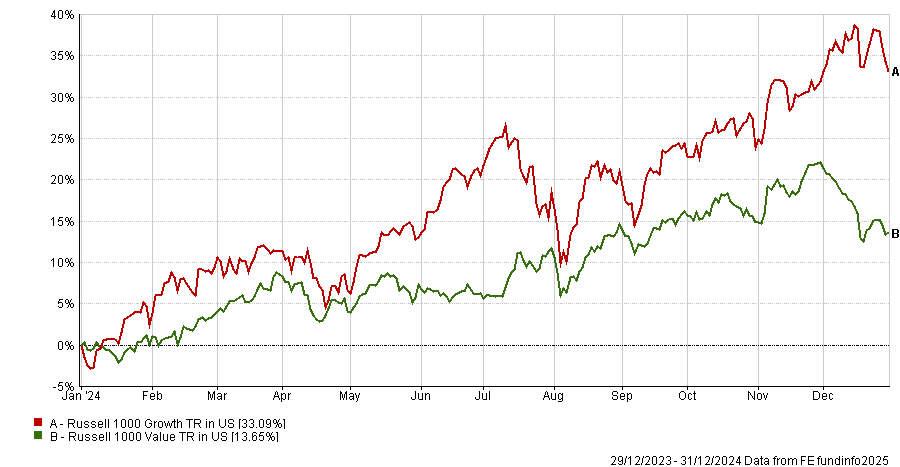

Performance of US large-cap growth and value stocks in 2024

Source: FE Analytics

Tobacco, which is a larger part of the UK than the global market and features in about 70% of UK equity income funds, rose 41.1% last year (using the FTSE All Share Tobacco index). This hurt funds that exclude tobacco.

To illustrate the disparity between dynamics in the UK and globally, the L&G Future World ESG Tilted and Optimised Developed Index returned 21.3% last year, helped by its tilts towards growth stocks, versus 19.3% for the FTSE All World index. The opposite was the case in the UK, where the Legal & General Future World Tilted and Optimised UK Index rose 7.15% last year, versus 9.5% for the FTSE All Share.

Global equity funds tend to have a decent allocation to technology but there are nuances, Rowles said. Tesla and Amazon divide opinion due to concerns about governance and workers’ rights, respectively.

For Columbia Threadneedle Investments’ (CTI) £1.3bn CT Responsible Global Equity fund, technology was the greatest contributor to returns. It beat the IA Global sector by more than a percentage point due to having over 5% of its portfolio apiece in Microsoft, Nvidia and Apple as of 30 November 2024.

Jamie Jenkins, CTI’s head of global ESG equities, said 2024 was “a challenging year for index relative returns, partly due to high-flying names that are not in our acceptable universe (e.g. Amazon, Meta Platforms and Tesla) and partly due to some unfavourable stock picking (DexCom, Vestas and zero weight Broadcom).”

Darius McDermott, managing director of FundCalibre, described CT Responsible Global Equity as “a core global equity fund with a formidable track record in stock picking and an independent responsible investing team”.

“With top holdings such as Apple, Mastercard and Nvidia, its strategy has deftly avoided many of the pitfalls of recent years, enabling it to maintain stable performance over the past 12 months,” he said.

For the £1.9bn Janus Henderson Global Sustainable Equity fund, ‘enablers’ such as semiconductors, electrical infrastructure and electronic component providers fit within its social themes. It has several holdings with exposure to electrification, including Schneider Electric, Prysmian and NVent, and artificial intelligence, such as Nvidia.

These holdings performed well last year, as did a range of stocks in other sectors, such as US property and auto insurer Progressive and US rail technology company Wabtec, said Hamish Chamberlayne, head of global sustainable equities.

“Nvidia was the standout performer in the portfolio. While most headlines focused on Nvidia’s hypergrowth and share price gains, we were equally impressed by the efficiency gains displayed by its newest GPUs. We view Nvidia as enabling enormous leaps in computing power for much lower energy than would otherwise have been consumed,” he explained.

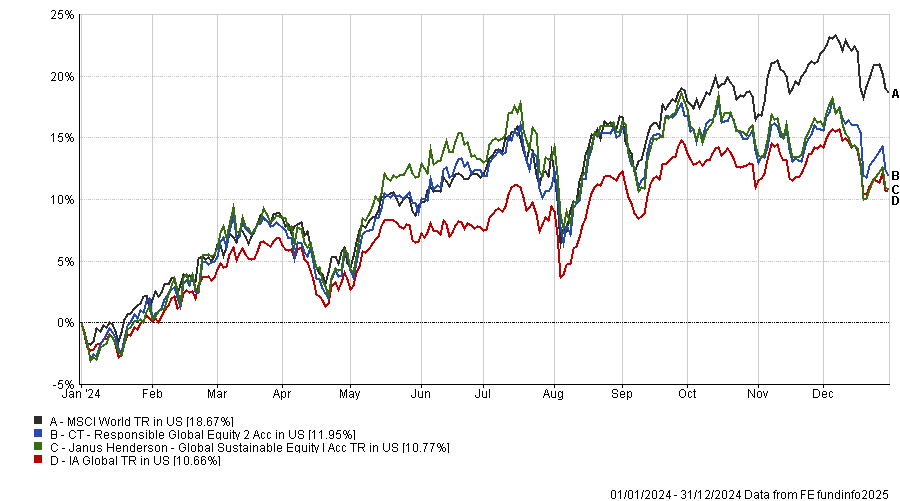

Performance of funds vs sector and benchmark last year

Source: FE Analytics

Besides tech, banks also surged in 2024 after being out of favour for many years, said Mike Fox, head of equities at Royal London Asset Management. “A change in the interest rate environment, the end of a multi-year realignment of regulation, and operational improvements within banks generally, have led to strong outperformance.”

Fox’s UK-focussed Royal London Sustainable Leaders Trust holds Standard Chartered and HSBC within its top 10.

This trend counted against funds that were underweight financials, such as CT Responsible Global Equity, said Jenkins. “Financials and in particular US banks, where we have been underweight, performed particularly well in the run-up to the US election. Some of these are unacceptable and for most of them a clear cut sustainability case is not easy to construct,” he noted.