Investors in Fundsmith Equity have received their annual shareholder letter this morning, in which veteran manager Terry Smith invited them to disregard his poor short-term performance, analysed his top and bottom stocks and those bought and sold, and discussed artificial intelligence (AI) and semiconductors.

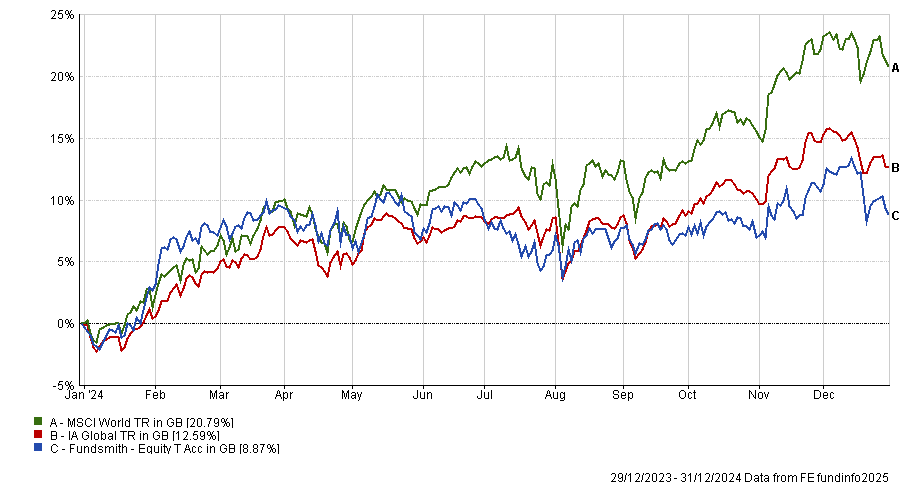

Fundsmith Equity returned 8.9% in 2024 against 20.8% of the MSCI World Index, as the chart below shows, also remaining well below the index over the past five and three years.

But Smith suggested investors should focus on his longer-term achievements instead, namely the 2.7% per annum more than the index delivered since inception and the higher Sortino ratio of 0.87 versus 0.60, meaning that investors in the fund enjoyed less downside volatility than those invested in the index.

Performance of fund against sector and index over 1yr

Source: FE Analytics

For his underperformance, the manager blamed market concentration of the largest tech names – not just in the US, but globally.

“Outperforming the market or even making a positive return is not something you should expect from our fund in every year or reporting period, and outperforming the market was more than usually challenging once again in 2024,” he said.

“Our fund owns some but not all of these [mega-cap] stocks, and it was difficult to perform even in line with the index unless you owned them at least in line with their index weighting.”

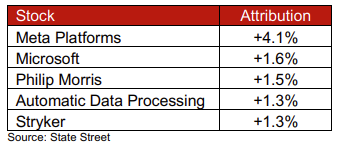

Of the tech giants, Smith defended his sometimes contested positions in Meta and Microsoft, which were respectively at their fourth and ninth appearance in the list of annual top contributors.

Fundsmith Equity’s top 2024 performers

Source: State Street

“Meta’s performance makes me wonder whether I should have a fund which invests solely in the one stock in our portfolio each year for which we have received the most critical comments,” he said.

“Microsoft attracted strident criticism when we started buying at about $25 a share in 2011. The 2023 year-end price was $376 and $422 in 2024.”

Of the remaining Magnificent Seven, Smith sold Apple, which he had begun purchasing two years ago, convinced that the growth in service revenues was an indicator that Apple had achieved a functioning ‘ecosystem’ or had tied its users to the products.

“We correctly foresaw a number of reporting periods ahead when sales growth would be lacklustre and so bought a small stake hoping to add to it as the poor sales performance came to pass,” he said.

“We were right about the sales performance but wrong about the share price which rose strongly, placing the shares on a rating about 50% higher than the S&P 500. We were not going to buy more stock against that background and it was occupying a place in our portfolio and so we sold our stake.”

There was no mention of Alphabet, first bought in 2022.

The portfolio also lost Diageo, which the manager had owned since inception and has now sold due to “problems with its new management, shown by a lack of information about its Latin American business” and because the drinks sector is likely to suffer from the spread of weight-loss drugs, which inhibit alcohol consumption.

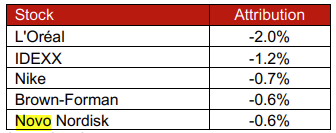

Despite this concern, the underperforming Jack Daniel’s distiller Brown-Forman (-0.6%) was retained to “keep a foothold in what has long been a sector with good business characteristics”.

“It is a company which survived prohibition, so we hope there is literally something in the DNA to help with these adverse circumstances,” Smith said.

Nike, another underperformer (-0.7%) with management problems, stayed on the “good news” that there has been a change of operating officer this year.

“We see many commentators musing about the reasons why the US economy is so successful. Perhaps one reason is a quicker finger on the trigger when top executives do not deliver,” Smith said.

Food company McCormick was the third and final leaver.

Of his top underperformers, L’Oreal (-2%) and US pet healthcare provider IDEXX (-1.2%), the Fundsmith Equity manager said they are fundamentally good businesses affected by external shocks (a struggling economy in China for the former and a slackening in the pace of vet visits after the scramble to adopt pets during the pandemic for the latter). Smith said he intends to “smile through the pain of underperformance”.

He is also awaiting a “return to form” for Novo Nordisk, a surprise underperformer (-0.6%). Mot only did its share price fall 10% but it also finished the year on a price-to-earnings ratio half that of its nearest competitor: Eli Lilly.

Smith said: “In investment it is always better to travel hopefully than to arrive, and there is certainly an arms race going on amongst drug companies to develop competitor drugs. We originally bought Novo because of its radical approach to drug discovery and would not rule out further developments.”

Fundsmith Equity’s top 2024 underperformers

Source: State Street

On the flip side, Smith initiated buying Swedish industrial company Atlas Copco and chipmaker Texas Instruments, which has “a long history of investing well ahead of upswings in demand and producing handsome returns from it”.

It is also a beneficiary of the onshoring of semiconductor manufacturing and the manager preferred it to market darling Nvidia, which he understands as a capital goods company – a bad investment in an economic downturn.

“If you think the performance of consumer companies is a worry in a downturn wait until you see what happens to their suppliers, especially the suppliers of capital equipment like factory machinery,” he said.

“Nvidia supplies capital goods — its latest generation GPU server sells for about $3m each — and a significant downturn in demand from its clients who do service consumers would be interesting to watch from a safe distance.”