Seven investment trusts will soon hold general meetings so shareholders can vote on resolutions from Saba Capital Management to replace their boards. Saba has proposed two directors for each trust who, if elected, would consider replacing the incumbent managers with Saba and changing the trusts’ investment strategies. They would also look at mergers and liquidity events, including tender offers and share buybacks.

The trusts being targeted are Baillie Gifford US Growth, CQS Natural Resources Growth & Income, Edinburgh Worldwide, European Smaller Companies, Henderson Opportunities, Herald and Keystone Positive Change.

Boaz Weinstein, Saba’s chief investment officer, said: “Our plan is simple: with a reconstituted board, we intend to provide shareholders with long-overdue liquidity options alongside the opportunity for greater long-term returns under a new investment strategy and manager.”

Saba has accused the trusts’ boards of failing to hold management accountable for poor performance and ignoring wide discounts. “While there are multiple levers to narrow these persistent discounts, inaction has been the consistent course of current leadership,” Weinstein said.

The boards have responded that Saba’s criticisms are unfounded and have urged shareholders to vote against them.

Performance track records

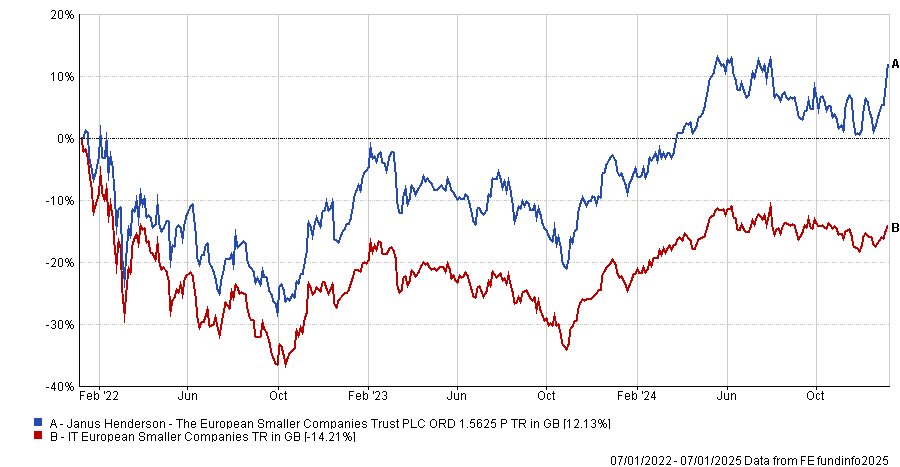

Performance has not been as bad as Saba is portraying, several boards have argued. Some of the trusts have delivered strong returns; for instance, European Smaller Companies is the best performer in the four-strong IT European Smaller Companies sector and is the only member of the quartet with a positive three-year return.

Performance of trust vs sector over 3yrs

Source: FE Analytics

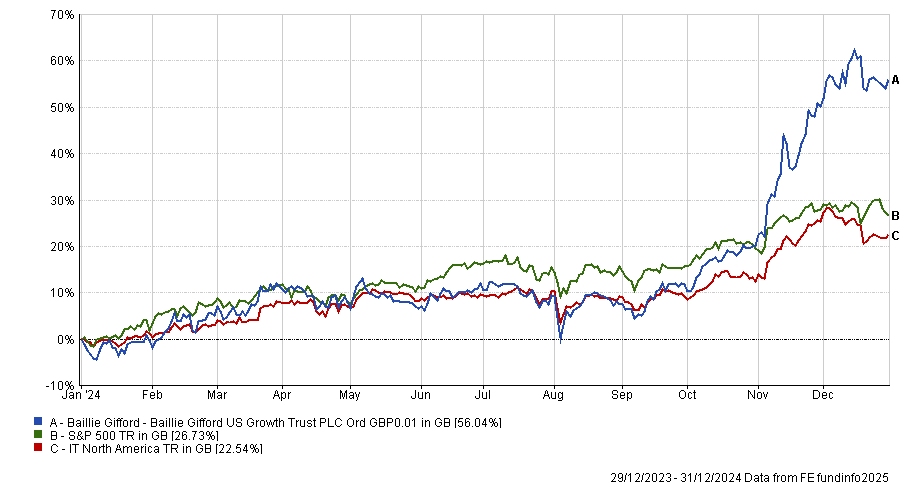

Baillie Gifford US Growth and Edinburgh Worldwide surged in 2024 with share price returns of 56% and 24%, respectively, marking an impressive recovery after a difficult few years for Baillie Gifford’s growth style of investing. Baillie Gifford US Growth was last year’s fifth-best performing trust across all sectors.

Performance of trust vs sector and benchmark in 2024

Source: FE Analytics

James Budden, head of global marketing at Baillie Gifford, said: “Saba cherry-picked data when our style of investing was out of favour to portray a narrative of poor performance and wide discounts. We recognise the past few years have been tough for the companies we invest in; however, performance has notably improved throughout 2024. This outperformance has been reflected in tighter discounts.”

For long-term shareholders in US Growth and Edinburgh Worldwide, whose patience is finally being rewarded, this seems the wrong time to “rock the boat” and change investment manager, he added.

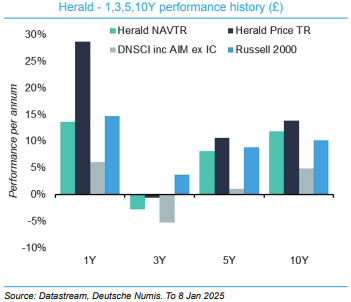

Herald has also suffered a torrid three years but performed strongly over 10 years, as the chart below shows.

Herald’s performance history

Herald’s chairman Andrew Joy said: “Since the first day of dealings (21 February 1994) the company has delivered a 27x NAV total return. Since Saba started investing in 2009, it has materially underperformed Herald. Since that date Herald has delivered a NAV total return of over 865%.”

Its long-term track record has been “absolutely incredible”, agreed Peter Hewitt, who holds Herald in his CT Global Managed Portfolio Trust.

He does not think the trust should be judged too harshly for the past three years when the small companies in which it invests were out of favour and many investment trusts underperformed due to a torrent of headwinds such as higher rates and confusing cost disclosure rules. “Almost every company I look at has got a poor three-year record,” he said.

Furthermore, it would be a shame if Herald were to disappear – which could happen if Saba’s plans to offer all shareholders a 100% cash exit at 99% of the trust’s NAV come to fruition. “No other listed company does what it does. It’s unique,” he said.

Herald’s investment team possesses deep expertise in small tech and media companies – “an unresearched segment of the equity market which has great potential, focused on discovering tomorrow’s winners”, he said.

Hewitt also holds Henderson Opportunities, whose focus on AIM stocks, small- and mid-caps has counted against it in recent years. “If we had a period where mid- and small-cap stocks started performing again, then Henderson Opportunities would do well,” he said.

James Carthew, head of investment companies at QuotedData, said Saba seems to be targeting trusts facing cyclical performance challenges, such as CQS Natural Resources. “History suggests that when Chinese demand for commodities picks up, this fund will perform extremely well and Saba’s plans would mean that ordinary shareholders miss out on that.”

Discounts narrowing

As for the discounts, Baillie Gifford US Growth and Edinburgh Worldwide are currently trading at a slight premium after strong NAV and share price performance last year.

Weinstein said he considers the discounts narrowing “to be a direct result of Saba building our total stake in these trusts to £1.5bn”.

For Saba to take all the credit for the discount narrowing is “wishful thinking”, Budden responded. In the run-up to Saba’s attack, it bought shares in US Growth at a tight discount, which did indeed bring in the discount further, but there were other buyers. Strong investment performance (the NAV rose 34% last year) also had a part to play in improving sentiment and demand, he explained.

Liquidity events

Henderson Opportunities has stolen a march on Saba’s plans to consider liquidity events by offering shareholders the option to exit at NAV or roll over their investment into an open-ended fund with a similar mandate.

Carthew said these plans are “perfectly sensible”. “It is only a shame that rollover is into an open-ended fund but it is very unlikely that any investment trust would want to run the risk of Saba rolling its stake onto their register and stirring up more trouble – one more example of its unhelpful presence in our sector,” he added.

Keystone Positive Change announced its intention to wind down in September 2024. Shareholders can choose between an uncapped cash exit or rolling into Baillie Gifford’s £1.8bn open-ended Positive Change fund.

Elsewhere, liquidity events could be problematic for trusts holding small-caps and private companies, Carthew said: “Herald being the obvious example as it is a big fund with a huge tail of small illiquid positions that trade by appointment that could take years to sell off and you would likely move the market against you in many of these, particularly once the market spots you as a forced seller.”

Boards taking action to address discounts and performance

Saba’s insinuation that the boards have been asleep at the wheel is unfair, Budden said.

Edinburgh Worldwide’s board instigated sweeping changes late last year, appointing Luke Ward and Svetlana Viteva as co-managers alongside Douglas Brodie, reducing the number of holdings and raising the market cap ceiling. The board also committed to return up to £130m to shareholders this year.

Keystone Positive Change’s board had already proposed a merger with its open-ended sister fund prior to Saba’s attack, Carthew pointed out. “We don’t see how it can really accuse the board of inaction given the steps that it has taken.”

Additionally, the board of CQS Natural Resources Growth & Income offers investors an annual continuation vote and is currently conducting a review. Options on the table include a full cash exit at NAV, merging with another trust and increasing the dividend.