Share prices have shot up during the past two years while earnings have moved sideways, meaning future earnings growth is already priced in. Valuations are a long way from fair, therefore returns going forward are likely to disappoint, said Freddie Lait, managing partner at Latitude Investment Management.

This is especially the case for “the Magnificent Seven and a few friends” such as Novo Nordisk, ASML, Thermo Fisher Scientific and Costco, which are “similarly expensive, large and well-owned,” he said, “and that is where we see a lot of risk”.

However, Lait has found several other large, well-established businesses that are growing their earnings and have a better probability of achieving attractive risk-adjusted returns. They include Tesco, Autozone, Interactive Brokers, Ryanair, Shell, Visa, McKesson, JPMorgan and Bank of America.

He thinks these companies “will grow at least as fast as the Magnificent Seven, if not faster, at half the valuation, if not less than half”.

Lait still owns Alphabet in his Latitude Global equity fund and Latitude Horizon multi-asset strategy but he has sold Apple, Microsoft, Meta, ASML and Novo Nordisk.

“They are very well understood, very good businesses and it's not so much that I in any way know they're going to crash or that they're going to suddenly offer really shocking returns,” he said.

“Our game is all about playing probabilities and I think the probability is you can make better, stronger returns while running less risk by investing away from these popular stocks today. It's not a call on them not working. It's a call on being able to do better elsewhere.”

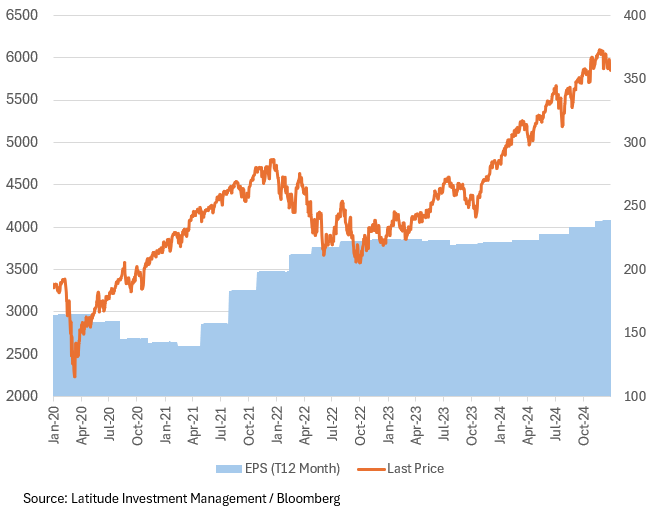

The largest US companies appear to be a risky bet because valuations have run up without the earnings growth to support them. Back in October 2022, the S&P 500 was trading at its long-term fair value, with an average price-to-earnings (P/E) ratio just over 17x. Since then, earnings have risen by about 7%, Lait said.

By contrast, the S&P 500 has risen 66.8% in US dollar terms from 1 October 2022 to 13 January 2025. Gains are even higher (74.3%) from the trough of 12 October 2022 to the peak of 6 December 2024.

Earnings per share versus price for the S&P 500

Therefore, earnings would need to rise by some 60% while valuations drifted sideways for US equities to get back to fair value, he concluded.

Lait expects his portfolio to outperform if it re-rates from an average P/E ratio of 15x to 17-19x – or if the wider market corrects from 26x to 22x. “If the two happen together, we're going to have a really good time. But I just think over time, the probability is that a portfolio like ours will substantially outperform the market,” he said.

Below, he outlines his investment thesis for Tesco, Autozone and Interactive Brokers.

Tesco

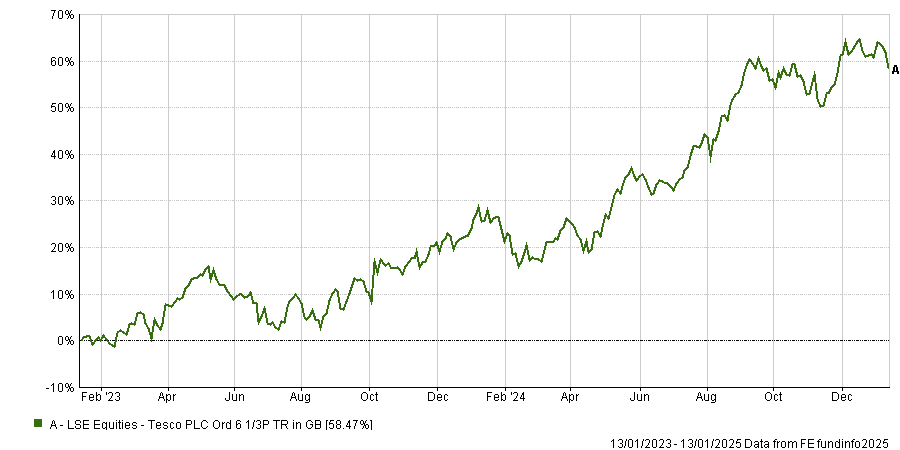

Tesco is the Latitude Global fund’s largest holding. It is trading on 14x earnings and Lait expects it to deliver an annualised total return of 15-20% for the next five years. The supermarket pays a 4% dividend and is buying back shares.

Tesco has been growing its market share consistently for two and a half years due to its superior customer service offering, savvy management and low prices (Tesco price matches Aldi). Given that its cost base is fixed, every incremental customer improves Tesco’s profit margins, he explained.

Performance of stock over 2yrs

Source: FE Analytics

It is a “very defensive business, inflation protected over time” and is backed by property assets, he said. Furthermore, if a recession does occur, Tesco is likely to gain market share from upmarket supermarkets as well as people eating in instead of ordering takeaways or eating out.

Autozone

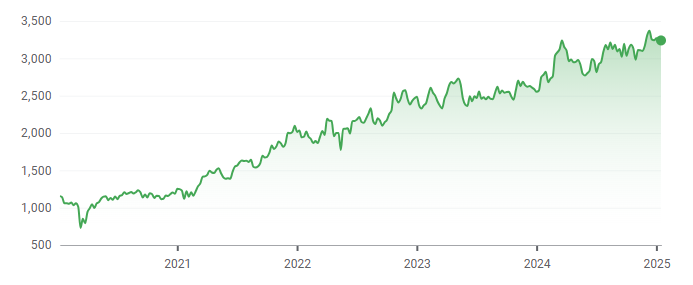

Autozone, the US car parts retailer, has generated 20% compound annual returns since Lait first invested in 2009 and it still only trades on 20x earnings, which he believes is inexpensive given the company’s growth prospects.

Performance of stock over 5yrs

Source: Google Finance, data to 14 Jan 2025 in US dollars

People tend to spend 4-5% more each year on fixing up their cars so Autozone benefits from underlying market growth. Its increasing sales to garages and expansion into Latin America are additional growth drivers.

“If your car breaks, you just spend the money on the brake pads or the windscreen wipers or whatever's gone wrong with it. So Autozone is highly defensive. It's inflation protected. It's got the highest return on capital out of every US retailer we've looked at,” Lait said.

Interactive Brokers

Interactive Brokers was up 125% last year and is trading on 26x earnings. “It's probably our most expensive share. We have trimmed some but given the rate of growth, it's still one of our largest holdings,” Lait said.

Performance of stock over 1yr

Source: Google Finance, data to 14 Jan 2025 in US dollars

Interactive Brokers initially served professional day traders and other individuals but the technology was so advanced that it began selling to hedge funds and financial advisors about 10 years ago. Financial advisors can white label the platform so their own clients can use it to trade.

“The best thing about the platform is it's totally free and then it has the most honest interest paid on cash,” Lait continued. Interactive Brokers pays clients 50 basis points less than the federal funds rate on cash reserves.

“Trading is cheaper than anyone else in the marketplace and margin loans are half the price. On the flip side, it makes the widest margins out of anyone in the space, because the whole business is so automated and so technologically advanced that even though it charges the lowest prices, it makes the most money.”