Consistently outperforming competitors can be challenging for even the most exceptional funds as concentrated global markets have made outperformance much more difficult.

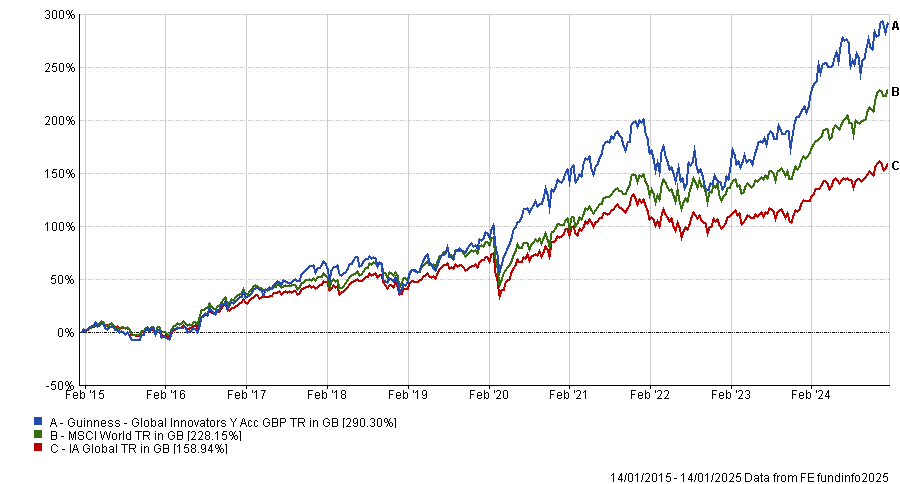

Despite this, the Guinness Global Innovators fund has achieved top-quartile returns over the past one, three, five and 10 years. Co-managed by Ian Mortimer and Matthew Page, the fund was up by 290.3% over the past decade, the fifth-best performance in the IA Global sector.

Performance of the fund vs the sector and MSCI World over 10yrs

Source: FE Analytics

For Mortimer, there was no “secret sauce” to the strategy's success. He argued that “growth is actually quite unpredictable” and it was extremely difficult for any investor to spot the next big trend.

Instead of chasing “flash in the pan” stocks or trends, Mortimer explained that outperformance was the result of selecting stocks with “baseline growth potential” and reliable characteristics. Below, he identifies some of these reliable stocks, including the stocks he has held through “thick and thin”.

Meta

Mortimer and Page currently own six of the Magnificent Seven in their portfolio, but Mortimer identified Meta as a particular favourite.

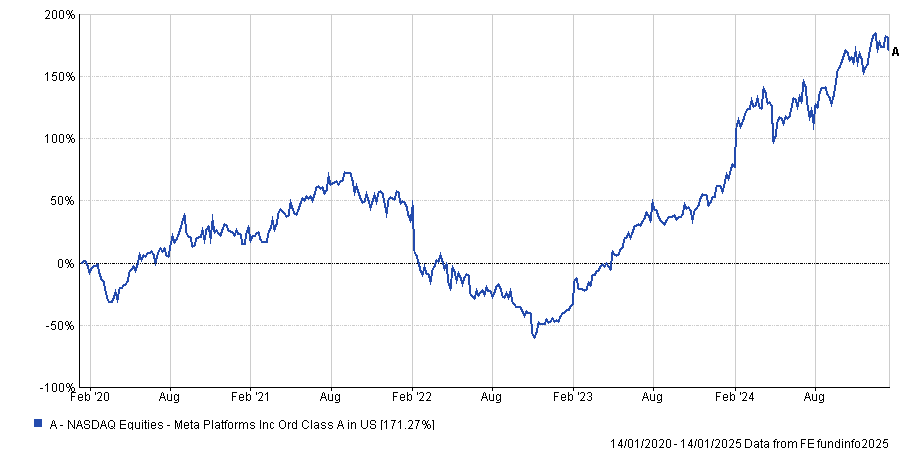

In the past five years, it has been one of the top-performing tech stocks, with share price up by 171%.

Share price performance of Meta over 5yrs

Source: FE Analytics

However, Mortimer explained that in recent years Meta has “been through a lot in terms of market expectations”. For example, in 2022, Meta’s share price slid to $99, down from $336 at the start of the year.

Mortimer explained this was because of fears that it was overspending on the Metaverse, as well as concerns about its user retention. He said that, because of these worries, Meta fell to a forward price-to-earnings ratio of 9x in 2022.

However, Mortimer had remained confident in the value of Meta despite this underperformance. Instead of removing it from the portfolio entirely, the team chose to rebalance it, believing it would turn around. As a result, the fund benefitted from Meta's "year of efficiency" in 2023, when its share price, margins and growth all experienced a resurgence. Indeed, in 2023, the portfolio was up by 32.1%, compared to a sector average of 12.7%.

He added: "We have owned Meta for several years, through thick and thin".

Moreover, with significant exposure to the artificial intelligence (AI) megatrend last year, Mortimer believed that Meta was poised for further long-term growth.

London Stock Exchange Group

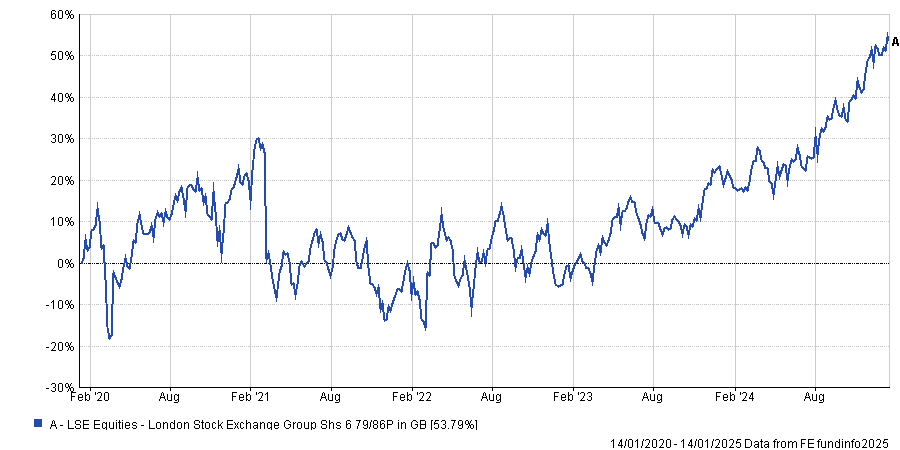

Mortimer also pointed towards the London Stock Exchange Group (LSEG). It’s share price has climbed by 53.8% in the past five years.

Share price performance of London Stock Exchange over 5yrs

Source: FE Analytics

Despite being listed in the UK, Mortimer explained that LSEG was an international business deriving revenues from outside just the domestic market, which gave it a much higher return on capital. He argued that this distinguished it from other quality businesses in the UK, which were “structurally more biased towards the commodity and banking sectors”.

Moreover, he explained the business is growing at a fast rate. Recent acquisitions of businesses such as Refinitiv in 2019 have led to growth in the company’s data usage and ability to provide that data to clients. He argued that this has made it a much more interesting and higher-margin business that is continuing to grow. Indeed, LSEG has continued to expand its operations, with the purchase of Axoni last year and Acadia in 2022.

“There are a lot of strings to its bow. In terms of revenue exposure, it is not as focused on the actual exchange itself”, making it a great diversifying addition to the portfolio, Mortimer explained.

AMETEK

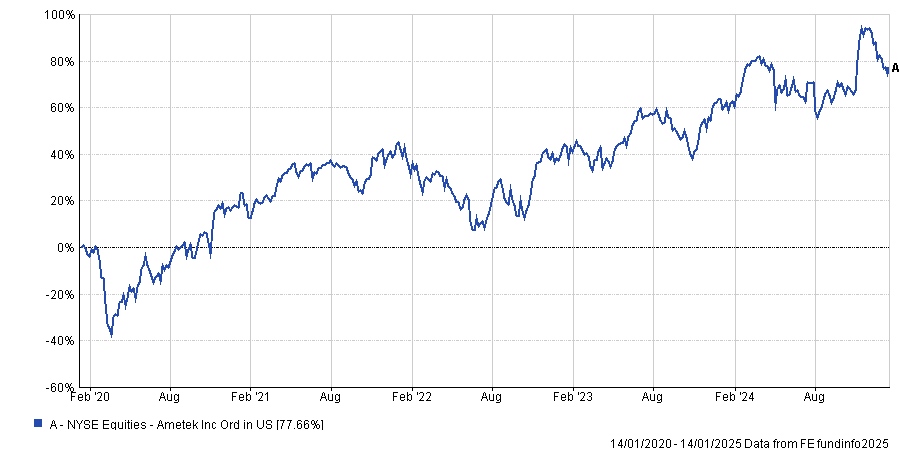

Finally, he identified electronic equipment and device manufacturer AMETEK, which is up by 77.7% over the past five years.

Share price performance of AMETEK over 5yrs

Source: FE Analytics

Despite industrials being a traditionally cyclical sector, Mortimer explained that companies such as AMETEK have been appealing from a “re-rating perspective”.

Mortimer said industrial firms are taking advantage of secular growth trends such as the ongoing interest in AI. Greater exposure to data centres, he added, has led to demand for wider infrastructure, such as power grids, interconnectors or electronic identifiers that AMETEK provides.

As a result, the Guinness Global Innovators manager argued the business has significant long-term growth potential. This conviction is reflected by the fact that it is the third-largest position in the portfolio.

He said: "I do not think we are breaking the mould on AMETEK. But I think it is quite interesting how there are good areas for this kind of quality growth companies outside of tech, and it is a long-term trend that looks attractive.”