Donald Trump’s policy agenda is a ‘known unknown’. Known because his plans to cut red tape, curb immigration and increase tariffs have been well telegraphed. Unknown because the checks, balances and practicalities of government may temper some of his ambitions.

Schroders senior US economist George Brown thinks the extremes of Trump’s rhetoric will be tempered. “Slim Congressional majorities should limit Trump’s more extreme inclinations but still be sufficient to extend his expiring tax cuts and support his deregulatory efforts,” he said.

“And while we do expect he will implement protectionist policies, we are sceptical they will include a universal baseline tariff. Likewise, we suspect his efforts to expel illegal immigrants may not reach the promised scale of 20 million.”

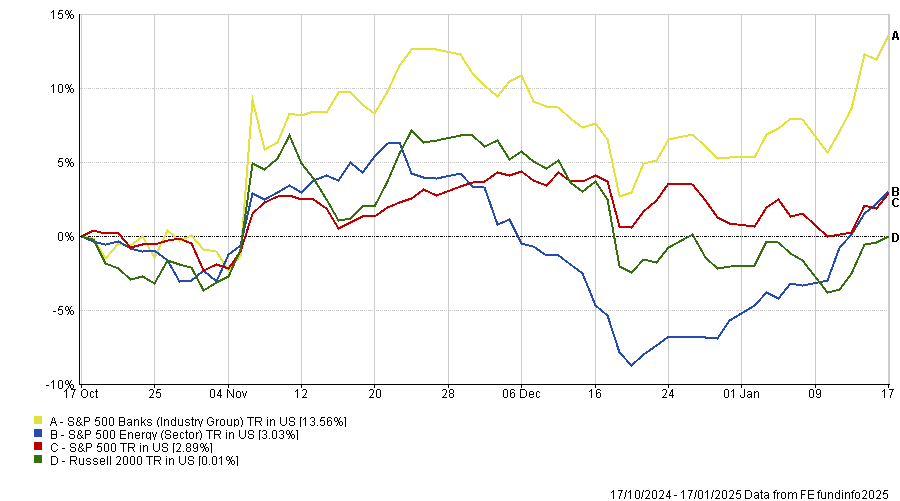

Nonetheless, investors have been piling into ‘Trump trades’ since before November’s election. Financials and energy gained momentum ahead of the result, then the S&P 500 shot up on the back of the Republican victory. Cryptocurrency, prison companies and Tesla have all risen since the election but some areas such as small-caps have given back some of their gains.

Dan Coatsworth, investment analyst at AJ Bell, said: “Investors could have made good money through investing in the obvious ‘Trump trades’ ahead of his inauguration. Nearly all of the obvious winners from his policies are trading higher since the election was called.

“Initial euphoria was driven by investors locking onto the fact Trump is pro-business and is expected to cut taxes and have looser regulation, potentially giving a boost to corporate profit margins and driving greater share buybacks.”

Performance of US small-caps, banks and energy stocks vs S&P 500 over 3 months

Source: FE Analytics

However, Rose Vangerven, CEO-designate at Findlay Park Partners, warned investors not to read too much into market movements around the election.

“The experience of Trump’s 2016 victory suggests one should be careful extrapolating short-term share price moves: banks and small-cap stocks were two of the best-performing areas of the US market from election night to inauguration eight years ago, only to be significant underperformers over the next four years,” she explained.

Ahead of Trump’s inauguration today, the question remains as to whether there is any mileage left in the Trump trades (e.g. positive for small-caps, banks and infrastructure; negative for Europe and China). Are these themes already priced in or do they have further to go?

As Coatsworth said: “There is a big risk that investors have now priced in a lot of potential good news and that markets don’t do as well once Trump is back in power.”

However, Pieran Maru, fund manager in the Liontrust Global Equities team, believes there is plenty more to play for and is looking for companies set to benefit from Trump’s tax cuts and spending priorities.

“We continue to see opportunities for beneficiaries of deregulation across financials, energy, power infrastructure and crypto,” he said.

“We specifically reduced exposure to the artificial intelligence infrastructure build cycle, as well as to mega-cap names, and favour sectors like healthcare, industrials and fintech.”

Dan Scott Lintott, investment analyst at De Lisle Partners, agreed. “Not all Trump trades are created equal, so while the impacts of his presidency will be significant and now anticipated, there is still plenty to choose from amongst the potential winners and losers,” he said.

Nabil Milali, a portfolio manager in multi-asset and overlay at Edmond de Rothschild Asset Management, thinks investors will become more selective between Trump trades, depending on which of his proposed measures get implemented.

Lower taxes, deregulation and upcoming M&A deals are all positives. “In particular, US small-caps more sensitive to Trump's policies are holding up well, while the US banking sector may have suffered in the December equity index correction, but it is once again outperforming the S&P 500 as it is expected to be one of the main beneficiaries of deregulation,” he said.

On the flip side, soaring government bond yields and concerns about the inflationary impact of immigration curbs and tariffs are weighing on stock markets, but not as much as historical sensitivity might suggest, Milali continued.

“We adjusted our view on equity markets a few weeks ago to neutral (versus overweight previously) due to the very high level of sovereign rates and real rates in particular,” he said.

“Caution is still the appropriate approach at these levels, but more encouraging signals on inflation or less inflationary measures from Trump would ease the pressure on the Federal Reserve and fuel a return of risk appetite.”

Ultimately, the Trump trade story isn’t over yet, said John Plassard, senior investment specialist at Mirabaud Group, but it is evolving. “Donald Trump’s return to the White House promises to be as disruptive and transformative as his first term. For those ready to adapt and seize opportunities amid volatility, this presidency could shape a uniquely rewarding investment landscape,” he concluded.