Life has been frustrating for UK equity managers in recent years, even for the best performers amongst them. The FTSE All Share gained 9.5% last year, an above-average return with a steep climb from mid-February to mid-May, although pessimism returned with the autumn Budget.

Henry Dixon, who manages the £1.9bn Man Income fund, hoped the general election would be a “clearing event” but said political certainty quickly turned into economic uncertainty.

“You remain frustrated as a UK investor,” the FE fundinfo Alpha Manager said. “You’ve obviously got to be conscious that a well-trodden human emotion is envy and clearly there have been much faster returns elsewhere in the world, namely America.”

Dixon is also concerned about de-equitisation due to companies listing elsewhere, share buybacks, mergers and acquisitions. Reform to encourage pension funds to increase their allocations to domestic equities remains elusive, he said.

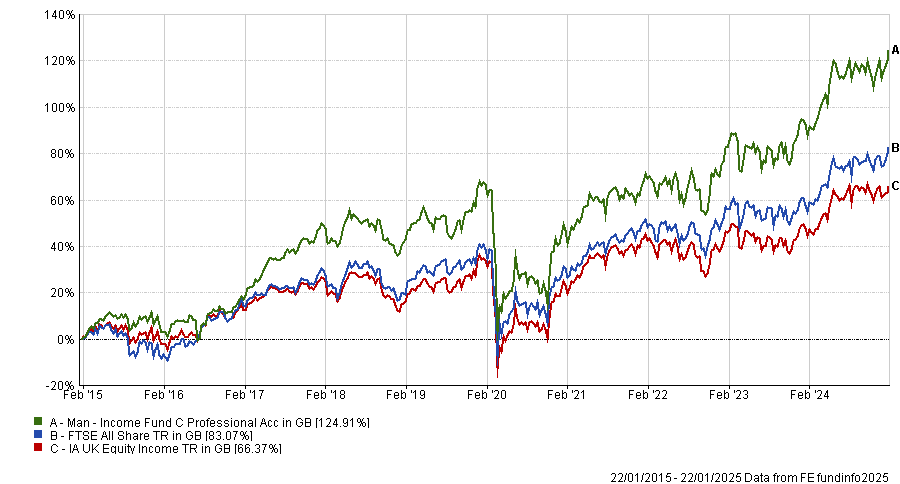

Man Income has weathered the storm better than most. It is the best-performing fund in the IA UK Equity Income sector over 10 years and the second-best over three years.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

Below, Dixon explains why Barclays was the fund’s top performer last year and why he believes housebuilders have huge potential.

What is your investment process?

The two things investors like to see from an income fund are capital appreciation and a growing dividend stream. With regards to capital appreciation, we're absolutely determined to start cheaper than the wider market. We look for businesses that would be difficult to replicate and companies whose return on capital is quantifiably undervalued.

Then we want to see dividend streams with headroom to grow, which comes from a strong balance sheet and dividends being covered by free cash flow.

We have more than doubled the fund’s dividend stream over 10 years. Today, the UK market is yielding just under 4% and the Man Income fund is yielding slightly more than 5%.

Why should investors buy your fund?

The Man Income fund is cheaper than the wider market. We certainly have better asset backing than the wider market and a balance sheet position that is stronger than the market average. Those three things are highly relevant in an environment of higher interest rates and value investing has become more in vogue.

The other thing that sets our fund apart is paying monthly dividends, which certainly seems to be popular with investors. It's more representative of a pay packet.

Why do you have such a large overweight to financials (37.5% versus 24.4% for FTSE All Share as of 31 December 2024)?

At the start of last year, valuations were incredibly modest. We were bumping into trough valuations seen at acute points of real uncertainty, such as the global financial crisis, Brexit and Covid. The return of interest rates was helpful for banks that have more deposits than loans. Additionally, during the past two years, banks have been able to repatriate earnings to shareholders.

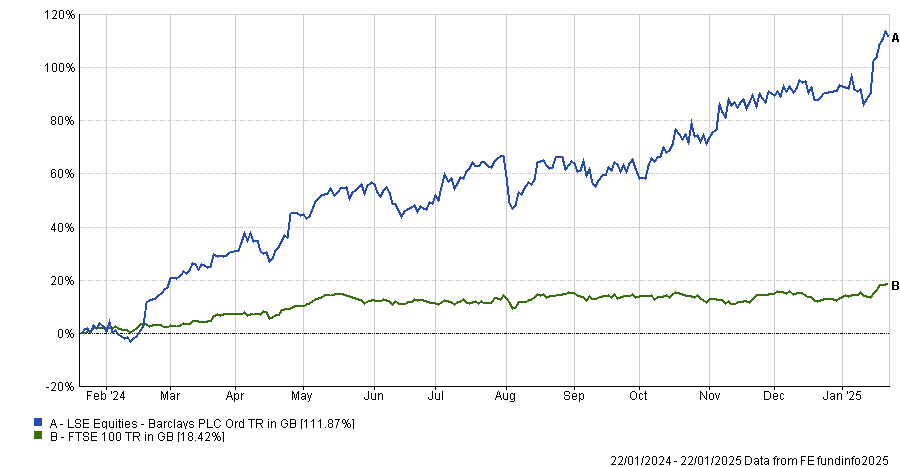

For Barclays, which was our best performer last year, the starting valuation was about 4x earnings and the price-to-book ratio was 0.4x. Returning almost 10% of its market capitalisation to shareholders via a buyback at that valuation has really spurred performance and there has also been a slight re-rating.

Barclays rose 82.3% last year, which shows the amazing accretion that can be delivered from returning capital to shareholders at that valuation.

We'd held Barclays for at least three years but we were front-footed in making sure Barclays was a big position in the latter half of 2023 and in 2024.

Barclays vs FTSE 100 over 1yr

Source: FE Analytics

We've taken some profits in the banking sector as valuations have normalised above book value and we’ve reduced our exposure to Barclays, but we remain pretty well-weighted to it. Its price-to-book valuation is on a discount to the wider sector and it’s certainly on a big discount compared to international peers.

The other area of financials we are exposed to is the non-life insurance sector, with Beazley and Lancashire. They have similar characteristics now to banks a year ago.

Valuations are very modest, around 6x earnings, and we're starting to see rapid growth in book value. In certain cases, share prices have pushed on a bit, but I don't think they've kept pace with some of the price-to-book moves we’ve seen.

What areas of the portfolio haven’t worked as well?

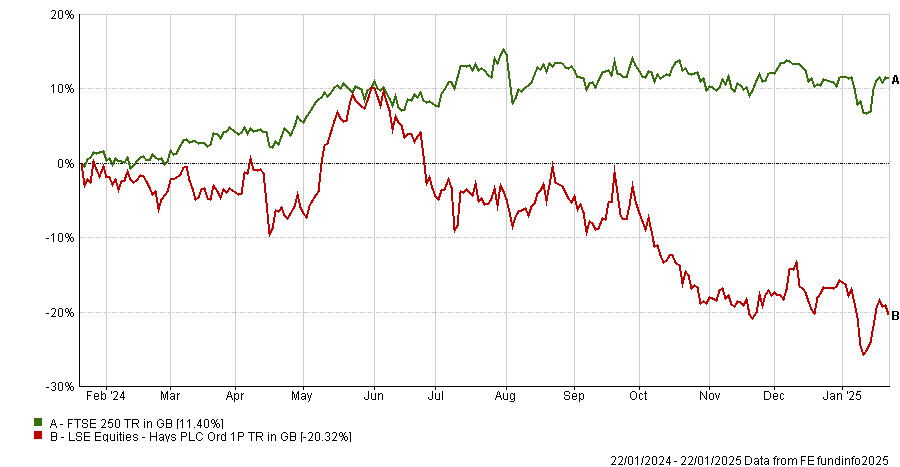

Hays, which is a geographically diversified recruiting company, has been our worst performer. Candidates are reluctant to move and the Autumn Budget, with increases in National Insurance contributions and the living wage, caused a sharp downturn in sentiment.

Hays vs FTSE 250 over 1yr

Source: FE Analytics

We continue to hold Hays. It is on a crisis valuation. The business is net cash and the positive working capital balance means the balance sheet is getting stronger as the going gets tougher, which provides us with a lot of comfort.

Where else are you finding opportunities?

Energy company Centrica made it back into our top 10 late last year. It has a really low valuation at 3x earnings and a net cash balance sheet, which provides the company with a lot of options regarding capital allocation.

We also think there is huge potential in construction, given that volumes are about as low as they were during the global financial crisis so there is clear potential for recovery.

We've had a lot of contact with housebuilders since Labour's election win. They are all very positive about planning and regulatory changes, which they think should spur a resurgence in output.

But it’s early days and the picture is less clear now, given the rise in long-dated gilt yields, which is precipitating quite a bit of weakness in certain housebuilding shares. Where we had taken profits, we've been keen to add back.

How has your investment process evolved over the years?

We’ve learned to be quicker with sizing our new positions because historically we may have taken too long to scale into a name. We now look to build a reasonable position within one or two months, whereas it used to take two or three.

We also want to guard against having a long tail of small holdings. A high threshold of competition for capital within the fund is vital and the way to maintain that is not allowing yourself to have too many positions. Currently our holdings are in the mid-60s and the danger zone would be getting meaningfully above 70.

What do you enjoy doing outside of investing?

I enjoy spending time with my children, keeping fit in the gym and I take something approaching 70 on the golf course.