What does it take for a manager to sell a holding? For Julian McManus, who runs the £712m Janus Henderson Global Select fund, it took a trip to Silicon Valley and a bad meeting with Ruth Porat, president and chief investment officer at Alphabet and Google, to completely sell out of his holding.

“I got the sense that Google had lost its way, that the company had become complacent,” McManus said. “The officer's attitude was off, not taking notes and giving answers that fell short. This was right on the heels debacle of the Gemini launch.”

Gemini, Alphabet’s answer to Microsoft’s release of OpenAI, was launched hastily in February 2024 but came under heavy criticism for having racial biases and showing inaccurate results that were “clearly not what they had in mind”.

Alphabet represented 2.1% of the Janus Henderson portfolio as of 30 November 2023 – today, that’s nil. But the manager is looking to change that.

“It turned out that when I met with Google it was darkest just before dawn. Now, involvement from the founders has increased again and the company is regaining its hunger and the sense of urgency it had lost,” he said.

“In hindsight, it was a mistake to sell. I should have had a more open mind to things getting better. In the spirit of keeping an open mind, I am looking at it again right now.”

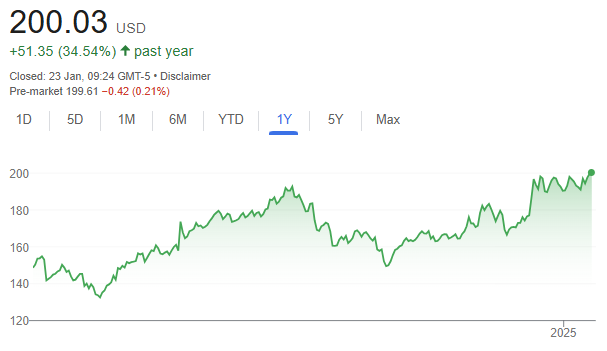

Alphabet’s share price over 1yr

Source: Google Finance

By contrast to a sluggish Alphabet, the manager said Meta never lost its “entrepreneurial, aggressive and faster-moving culture”. He has continued to hold the stock as “one of the more attractively priced” of the Magnificent Seven (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta and Tesla).

What renewed McManus’ interest in Meta was its “compelling” growth, the returns on its artificial intelligence (AI) spending and the possibility of replacing Apple as the interface of choice.

“Meta is investing a lot in developing a next-generation interface in the form of augmented-reality glasses. If it can combine that with next-generation AI, there's a possibility its glasses could replace the handsets and iPhones,” he explained.

“If that's the case, Meta is not priced for that at all and frankly Apple is not priced for that risk either.”

As with Apple, the manager isn’t too sold on Tesla, preferring its competitor Toyota (a 2% to 3% holding in the portfolio).

Tesla’s valuation is many times the multiple of Toyota, but its sales stopped growing last year, as people started to realise that electric vehicles had their limitations in the near term and went back to buying more hybrid cars.

“Toyota cracked the code in terms of next-generation battery technology, so it'll probably lead there over Tesla,” he said.

As a stock picker, McManus focuses on free cash flow growth that is undervalued by the market. His fund was among the top-performing global funds last year, a result he achieved without solely relying on Nvidia, which at 2%, is a key underweight in the Global Select fund.

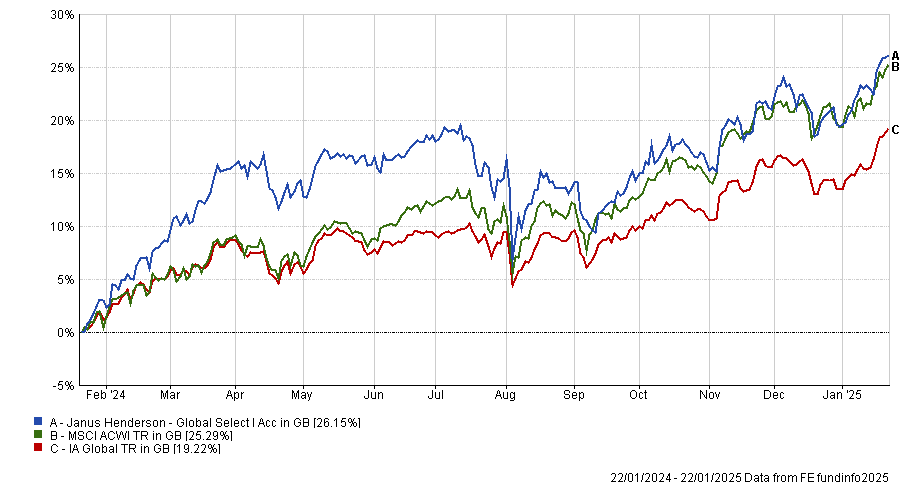

Performance of fund against sector and index over 1yr

Source: FE Analytics

The position that contributed most to his performance in the past year was power producer Vistra. Again, that Silicon Valley trip and a visit to a data centre were pivotal.

“The a-ha moment was when I walked into this data centre and saw a plaque on the wall saying: ‘Last year uptime: 99.99%’. It is so important to have a perfect uptime,” the manager said.

“Also, they were starting to change out some of the servers from classic-compute to high-performance compute and AI server racks, which meant power consumption would be going up exponentially. That helped cement in my mind that US power demand, which had not been growing for the past 20 years, would suddenly be growing quickly.”

This realisation was at the root of his decision to make Vistra a 4% holding – an example of McManus’ concentrated, high-conviction approach, whereby he takes a differentiated view and puts a lot of capital behind it.

“It was just mispriced. We were able to look forward three years, which is a time horizon the market is not really using, and identify that this was a stock that if it continued buying back its shares at a discount at the rate [it was doing], it would be on a 30% free cash flow yield in 2026,” McManus said.

“The stock more than tripled and a large part of the reason why was the valuation’s starting point.”

Vistra was the best-performing stock in the S&P 500 last year, outperforming Nvidia, as the chart below shows.

Share prices of Vistra (red line) and Nvidia (blue line) over 1yr

Source: Yahoo! Finance

Now, it’s a 3.3% position in the Janus Henderson fund.

“If we had done nothing to it and let our winners run, it would be a 12% plus position by now, which is just too large from a risk-control standpoint,” the manager said.

“It's now come in from a 30% free cash flow yield to 7%, so it's no longer mispriced the way it was, but I still feel much better owning more Vistra than, say, more Nvidia or Tesla, which I think are just overvalued.”