Funds run by Royal London, Man Group and Hargreaves Lansdown have all achieved a FE fundinfo Crown Rating of five, having recently amassed the requisite three-year track record to become eligible

The rankings, which are rebalanced twice a year, look at three main factors: alpha, relative volatility and consistently good performance over the past three years.

The top 10% of funds are awarded five FE fundinfo crowns, the next 15% receive four crowns and each of the remaining three quartiles will be given three, two and one crowns respectively.

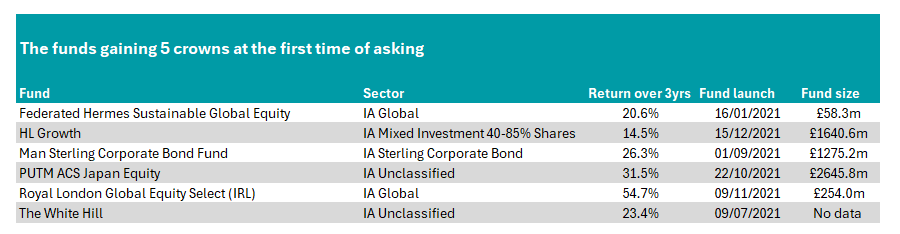

Two global funds achieved the feat at the first time of asking. Federated Hermes Sustainable Global Equity is one of the pair. Managed by Martin Todd, the portfolio aims to have a reduced environmental footprint compared to the benchmark MSCI ACWI index, measured using carbon, water and waste metrics.

Over three years, the £58.3m fund has made a 42.2% gain, good enough for its performance to rank 101st in the 493-strong IA Global sector. Top holdings including Microsoft and Nvidia, which have soared in recent years on the back of the artificial intelligence (AI) boom.

This may not be the case in 2025, however, as tech stocks have come under pressure to start the year. The launch of DeepSeek – a Chinese AI app developed at a fraction of the cost of competitors using older, reduced-capacity Nvidia chips – caused tech stocks such as Nvidia and Broadcom to plunge, while Microsoft was hit after revealing slower-than-expected growth for its Azure cloud computing business.

The other global fund was Royal London Global Equity Select (IRL). It appeared in Trustnet’s study of the young global funds shooting the lights out over three years and the fund’s performance has been rewarded by the crown ratings.

With £253.7m in assets under management, the fund has grown steadily since its launch in November 2021 and its performance has been strong, up 70.8% over the past three years – the second-best return in the sector.

Investors should note, however, that the fund has been closed to new investors since February 2024 and current managers Francois de Bruin and Paul Schofield only took over the fund in November 2024.

Source: FE Analytics. No data is available for the fund size of The White Hill.

Elsewhere, in the IA Sterling Corporate Bond sector, Man Sterling Corporate Bond Fund was given a top score. Managed by FE fundinfo Alpha Manager Jonathan Golan since its launch in 2021, it has been the best performer in the peer group over the past three years, up 29.3%. Golan was brought in from Schroders, where he had a four-year tenure on the Schroder Sterling Corporate Bond fund.

Recommended by analysts at FE Investments, they said: “Golan protected better relative to peers in difficult 2022 rates markets, despite his credit selection centring on unloved ‘deep value’ issuers. He was then rewarded for the accuracy of his free-cashflow analysis with exceptional outperformance of market/peers from the fourth quarter of 2022 onward.”

Charles Younes, deputy chief investment officer at FE fundinfo, said inflation has been a key factor in the outperformance of both the Royal London and Man Group funds.

“Inflation remained persistently above target in the second financial half of 2025, compelling central banks to maintain restrictive policies, while portfolios with high-interest rate sensitivity faced another difficult six months.

“Against this backdrop, funds such as Man Group’s Sterling Corporate Bond and Royal London Global Equity Select delivered exceptional performances. Both achieved five crown ratings for their ability to deliver consistent returns for investors and maintain foresight in volatile economic environments.”

The inclusion of Man Sterling Corporate Bond also pushed the asset manager to the top of the rankings for most five-crown-rated funds relative to their overall number of portfolios available. With five funds achieving the top score out of 12, some 41.7% of Man Group’s range have the highest rating available.

It beat out Aegon Investment in second (38.5%) and Artemis Fund Managers (31.8%), which came in third. Royal London was fourth, with Invesco rounding out the top five.

Another fund to achieve a five crown rating at the first time of asking was HL Growth, which has been the 11th best fund in the 196-fund IA Mixed Investment 40-85% Shares sector over the past three years.

Up 26.1%, the £1.6bn fund managed by Ziad Gergi invests in passive funds predominantly from Legal & General, with L&G Future World ESG Developed Index Fund making up more than a third of the portfolio.

Lastly, two funds in the IA Unclassified sector achieved the feat. These were PUTM ACS Japan Equity and The White Hill.