Investors sold out of equity funds in January, according to the latest fund flow data from Calastone, with the UK being the most sold area despite the FTSE reaching a record high.

The Calastone Fund Flow Index revealed a net £640m was redeemed from equity funds over the course of January after a period of sustained inflows.

This means the month was the only one since late 2023 to see outflows, aside from October 2024 when net selling was driven entirely by investors crystallising profits ahead of the anticipated capital gains tax hike in October’s Budget.

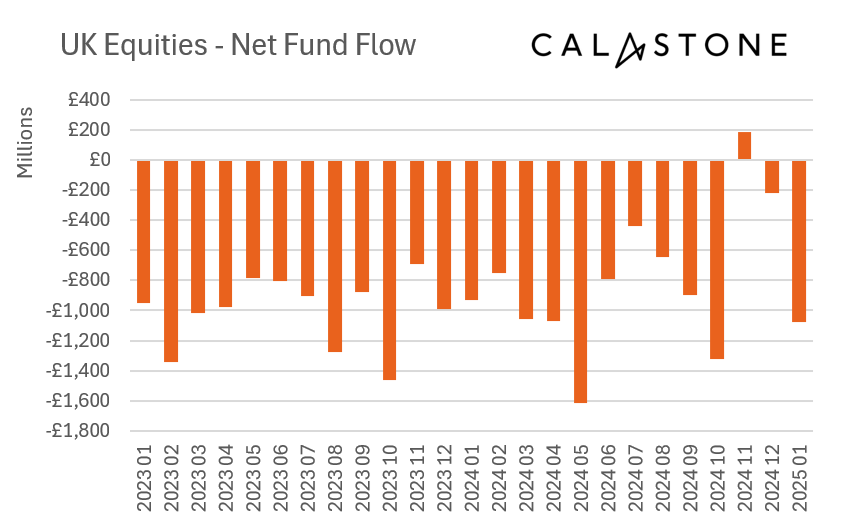

UK-focused equity funds were hardest hit once again. Investors pulled £1.07bn out of these funds last month, which makes January the sixth worst month on record for UK equity funds.

Source: Calastone Fund Flow Index – Jan 2025

Net selling of £265m from European equity funds put January in the top 20 worst months for that fund sector. Meanwhile, funds investing in Asia-Pacific, Chinese and Japanese stocks had net outflows.

Edward Glyn, head of global markets at Calastone, said: “UK fund investors seem to have given the government’s fretful growth narrative a clear thumbs down. The UK stock market reached all-time highs in January, but investors merely took this as an opportunity to get out while the going was good.

“Meanwhile, political instability and increasing anxiety about the economy have put Europe back on the sell list after a strong 2024 for inflows driven by rising share prices.”

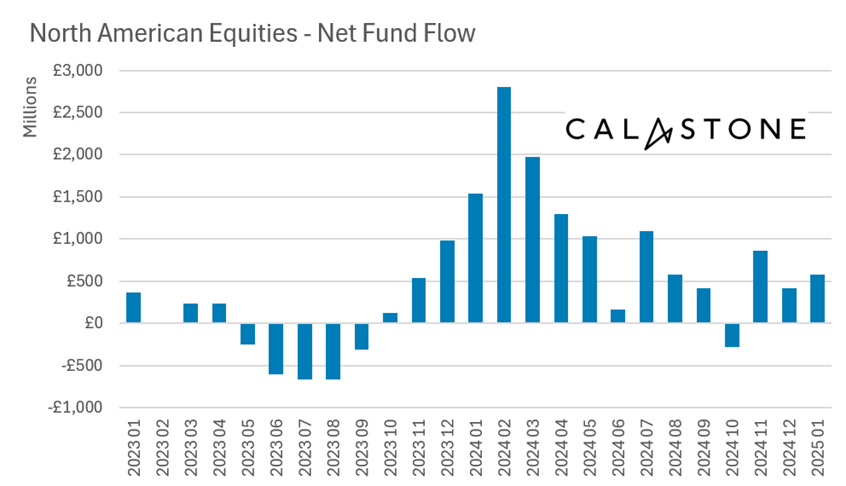

Some fund sectors captured net inflows. North American equity funds took in £576m during the month, while global equity funds also had a strong month.

Source: Calastone Fund Flow Index – Jan 2025

“Apparently nothing can dent the enthusiasm for US stocks,” Glyn added.

“Even the DeepSeek AI shock that happened late in the month spurred appetite rather than fear. The day after technology companies saw $1trn wiped off their market value, North American equity funds had their best day of the month with £167m of net inflows.”

Elsewhere, inflows into fixed income funds dropped by two thirds month-on-month to £267m, which was their weakest showing since investors took profits in September at the end of a long bond-market rally.

Government-bond funds suffered the biggest drop-off in interest, as inflows fell by almost nine-tenths to £41m. Net buying of corporate bond and high yield bond funds held up better.

“Bond markets had a terrible start to 2025 with yields on benchmark US treasuries and on UK gilts surging to their highest level since before the global financial crisis (bond prices fall when yields rise),” Glyn said.

“Investors bought into this market decline in the first half of the month – enabling new capital to lock into these ultra-high yields, before turning net sellers as calm returned. This is a pattern we often see in the millions of trades Calastone processes every month. Bond yields remain high, with the outbreak of an inflationary trade war potentially keeping them at elevated levels.”

Meanwhile, inflows to mixed asset funds dropped to £960m.