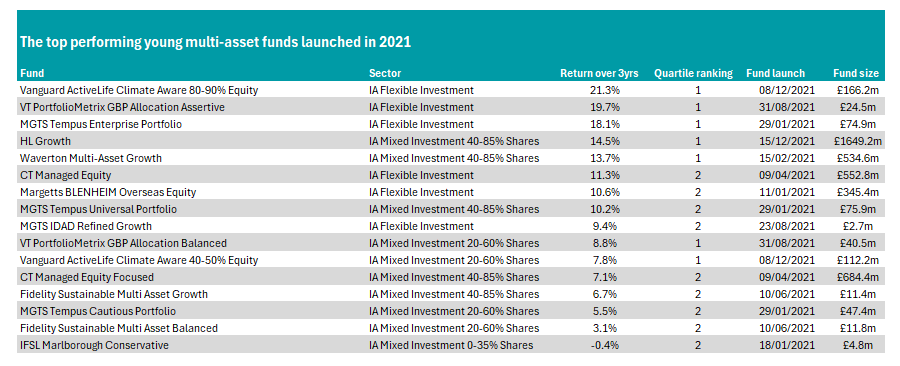

Investors who backed a newly launched multi-asset fund in 2021 had a good chance of picking up an outperformer, according to data from FE Analytics.

Of the 28 funds launched in the IA Flexible Investment, IA Mixed Investment 40-85% Shares, IA Mixed Investment 20-60% Shares and IA Mixed Investment 0-35% Shares sectors that year, some 16 beat their average peer, while 12 underperformed.

Investors often wait for a fund to pass through its three-year anniversary to measure its performance but getting in early can lead to greater returns, as evidenced in this study.

Trustnet looked at multi-asset funds launched in 2021, which passed through their three-year track record last year. We compared the performance in sterling terms over three years to the end of 2024, to give each fund an even footing.

The top performer over this time was the Vanguard ActiveLife Climate Aware 80-90% Equity fund, which made 21.3%, the fourth-best return in the IA Flexible sector.

Funds in this sector tend to perform better as there is no restriction on how much they can hold in equities. This fund self imposes a limit of between 80% and 90%.

It was not alone in the sector, with VT PortfolioMetrix GBP Allocation Assertive and MGTS Tempus Enterprise Portfolio also registering top-quartile returns, while CT Managed Equity, Margetts BLENHEIM Overseas Equity and MGTS IDAD Refined Growth sat in the second quartile over three years.

Source: FE Analytics

In the IA Mixed Investment 40-85% Shares sector, HL Growth came out on top, with a 14.5% gain. Managed by Ziad Gergi, it invests in passive funds predominantly from Legal & General, with L&G Future World ESG Developed Index Fund making up more than a third of the portfolio. The fund was one of a handful of names given an FE fundinfo Crown Rating of five at its first attempt.

It was followed by Waverton Multi-Asset Growth, which also made a top-quartile return in the sector during its first three years. Run by James Mee, the portfolio invests in individual equities but predominantly uses Waverton’s in-house funds for its fixed income exposure.

In the IA Mixed Investment 20-60% Shares sector, VT PortfolioMetrix GBP Allocation Balanced came out top among these young funds, with a return of 8.8%. Managed by Alex Funk, Phil Wellington and Oliver Jones, the fund is entirely invested in passive funds.

It was joined in the top quartile of the peer group by Vanguard ActiveLife Climate Aware 40-50% Equity, the less equity-heavy cousin of the Vanguard ActiveLife Climate Aware 80-90% Equity fund mentioned above.

There were no top-quartile funds from the IA Mixed Investment 0-35% Shares sector. Despite making a 0.4% loss, IFSL Marlborough Conservative’s performance was enough to place it in the second quartile of the most cautious sector.

Run by Nathan Sweeney, the portfolio is a blend of both active and passive strategies. Its top five holdings are all in passive bond funds, while the highest weighted active fund is M&G Emerging Market Bond, which is the sixth largest position in IFSL Marlborough Conservative.

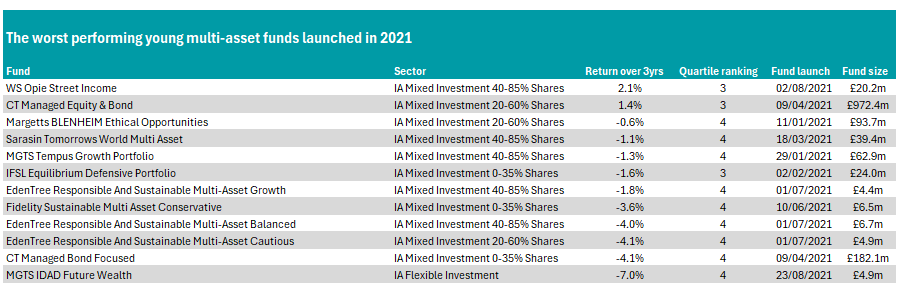

Not all funds launched in 2021 were an immediate success, however. MGTS IDAD Future Wealth was the worst performer, losing 7% over the three years to the end of 2024, the second-worst return in the IA Flexible Investment peer group during this time. However, its more recent returns have been stronger, with the fund up 17% over the past 12 months.

Source: FE Analytics

CT Managed Bond Focused was the worst performer among those in the IA Mixed Investment 0-35% Shares sector, down 4.1%. Run by Alex Lyle, the portfolio is currently 30% invested in equities with the remainder in fixed income. It is a fettered fund-of-funds, meaning it invests solely in Columbia Threadneedle’s in-house funds.

In the IA Mixed Investment 40-85% Shares and IA Mixed Investment 20-60% Shares peer groups, the worst funds both came from EdenTree, with the Responsible and Sustainable Multi-Asset Balanced and Responsible and Sustainable Multi-Asset Cautious funds both making fourth-quartile losses of around 4%.

Managed by Chris Hiorns, both funds struggled mightily in 2022, registering losses of 14.1% and 12.7%, respectively. Things were better in 2023, when they both sat in the second quartile of their respective sectors, but fell to the bottom 25% again in 2024.

Run with a sustainable mindset, the funds invest in direct equities predominantly in the UK and are underweight the US, with just 11.9% exposure to the country. This may have impacted returns in recent years, as a small band of US stocks known as the Magnificent Seven have continued to dominate the global equity landscape.