Activist investor Saba Capital Management has launched a second campaign against investment trusts. This time, instead of asking trusts to replace their boards of directors and potentially change manager and investment strategy, Saba has suggested a simpler course of action: rolling or converting into an open-ended fund.

Saba is targeting four investment trusts in its new campaign: two from its original campaign (CQS Natural Resources Growth & Income and European Smaller Companies) and two new targets (Middlefield Canadian Income and Schroder UK Mid Cap).

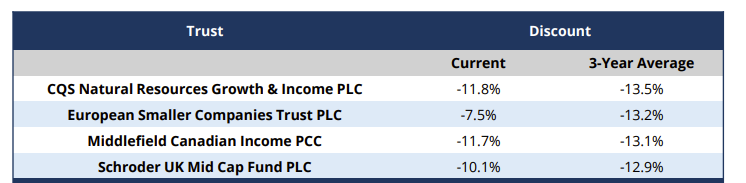

Boaz Weinstein, Saba’s chief investment officer, said shareholders in these trusts “have been trapped in closed-end vehicles trading at deep discounts for years”.

Discounts of the trusts Saba is targeting

Sources: Saba Capital Management, Bloomberg, data to 6 Feb 2025

Saba has requested general meetings so shareholders can vote on whether to transition an open-ended structure and “receive long-overdue liquidity at net asset value”, he said.

Transition to an open-ended structure would eliminate the discount in each of these trusts and would enable shareholders to remain invested in the same strategy with the same manager, Weinstein argued.

Saba expects that shareholders would be able to roll over into an open-ended fund without triggering a capital gains tax liability.