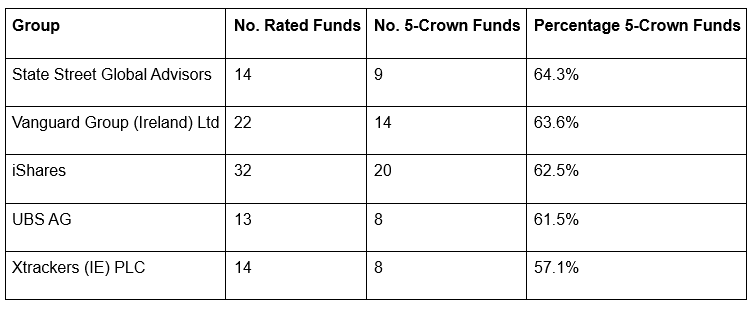

Investors looking for passive funds should consider State Street Global Advisors, as the firm has the most funds with an FE fundinfo Passive Fund Rating of five.

Of the firm’s 14 tracker funds, nine hold the highest score of five, or 64.3%. Investors had similar chances of picking a top-rated fund from Vanguard Group Ireland, which was in second place with 14 of its 22 funds (63.6%) achieving top marks.

iShares (which is part of BlackRock) and UBS AG were the other two firms with more than 60% of funds achieving a passive fund rating of five.

Leading passive fund providers

Source: FE fundinfo

Unlike traditional ratings that consider fund managers’ skills, these rankings do not account for stock selection or tactical asset allocation decisions. Instead, they focus on how well funds track their respective benchmarks and prioritise consistency and efficiency over time. The ratings also look at key performance indicators, including excess return, tracking error and cost.

Around the world, passive investing is surging. It has risen from around 1% of the total market (active and passive combined) in the early 1990s to more than 50% today, according to research from The London School of Economics (LSE).

Charles Younes, deputy chief investment officer at FE fundinfo, said: “Passive funds have become a compelling option for retail and institutional investors alike. We’ve seen an increased concentration in equity markets, which has led to many securing returns from the Magnificent Seven through passive funds.”

In terms of asset classes, investors looking for top-rated passive funds have the highest hit rate in US equities, with 29 of the 53 tracker options here (54.7%) getting a passive fund rating of five.

Gilts were the only other asset class where investors had a higher than 50% chance of picking a top-rated passive fund, while global equity funds (49.1%), Japanese trackers (34.6%) and European passives (27%) rounded out the top five.