Knowing when to sell is a crucial skill for investors. All too frequently people act at the wrong time, panic-selling when funds things look dire and buying in more positive times when they are reaching the top.

At times of heightened volatility, fear can lead to investors questioning if now is the time to sell their underperformers and recycle their money into more profitable areas.

Sometimes this works, while at others patience is a virtue. Knowing the difference, however, is the difficult part. So below, we asked experts which funds they think are worth holding on to despite recent underperformance.

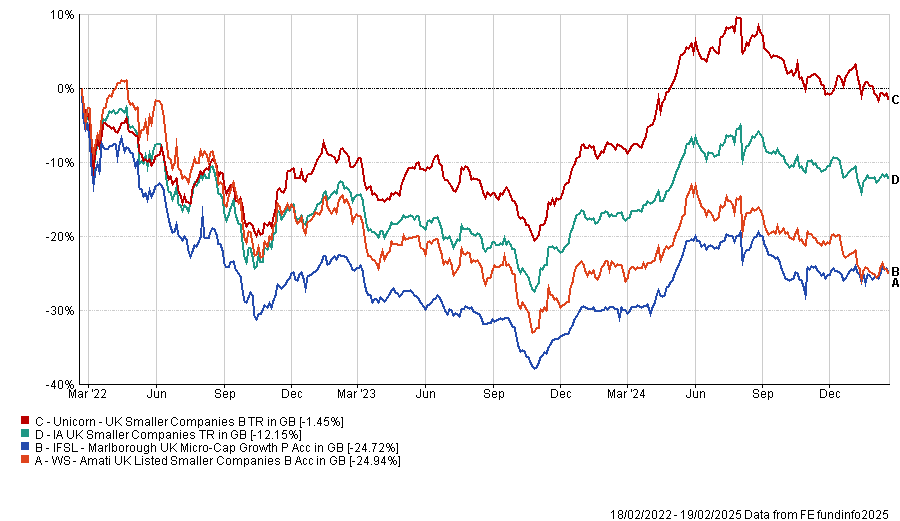

FundCalibre managing director Darius McDermott picked the battered sector of UK small-caps which, when compared with their larger counterparts, are currently experiencing their longest period of underperformance in years. History tells a different story, however, as over most long-term timeframes, small-caps outperform FTSE 100 constituents.

“We’ve survived the Budget, mergers and acquisitions are growing and we continue to see UK smaller companies buy back their shares – major giveaways that they believe their businesses are cheap. We believe there is considerable upside potential in this market and, for bottom-up stock pickers, a generational investment opportunity,” he said.

“With UK valuations at compelling lows, interest rates easing, and foreign buyers showing renewed interest, now presents an ideal entry point for investors into the sector.”

His picks in this space were WS Amati UK Listed Smaller Companies, Unicorn UK Smaller Companies, and IFSL Marlborough UK Micro-Cap Growth. All three have “outstanding” long-term track records but have faced headwinds in recent years as small-cap growth investing in the UK fell out of favour.

Performance of funds against sector over 3yrs

Source: FE Analytics

Also, they all have significant exposure to the Alternative Investment Market (AIM), where sentiment softened ahead of the Autumn Budget and has remained subdued ever since, despite chancellor Rachel Reeves’ business property relief cuts being less severe than expected, said McDermott.

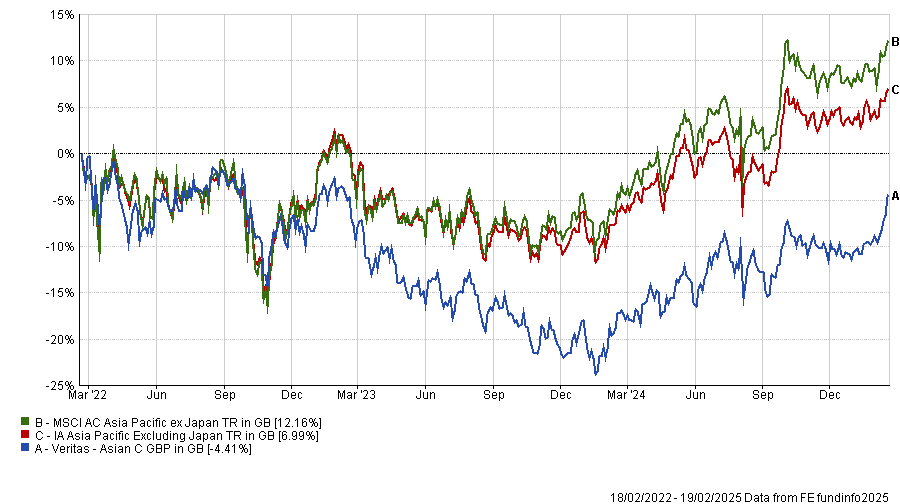

Further afield, Meera Hearnden, investment director at Parmenion, is sticking with Veritas Asian, managed by FE fundinfo Alpha Manager Ezra Sun, although the past three years have been a tricky period, as the chart below shows.

Asia has been struggling as a region, not least because of China (which makes up 27% of the fund’s assets). But there are other macro drivers at play, such as the strong dollar resulting in weaker returns.

Some parts of Asia have weathered the storm better than others, including India (17.8% of the Veritas portfolio) or Taiwan (20.4%), so the question is: Why has Veritas Asian underperformed?

Performance of fund against index and sector over 3yrs

Source: FE Analytics

For Hearnden, this was largely due to a style factor – over the past three years, growth funds in Asia (which includes Veritas Asia) have fared worse than value strategies. Its large-cap focus was also detrimental, as larger companies provide greater liquidity but were surpassed by Asian mid- and small-caps over the past few years. Nevertheless, there are still reasons to stay invested.

“Around 18 months ago, the fund had a sizeable exposure to China but began to pare this back in favour of better stock opportunities in countries such as Taiwan and South Korea. More recently, South Korea has been subject to some political uncertainty so the fund’s focus there has shifted towards structural growth trends rather than the consumer where recovery is likely to be weak. These are sensible decisions, which demonstrate the manager still has his eye on the ball and has been active,” she said.

“Importantly, the fund’s process hasn’t changed, and the manager remains very disciplined in looking for long-term growth opportunities.”

Although the fund has underperformed the wider peer group, it stacks up favourably against other Asian large-cap growth funds both for returns and on various risk metrics.

“And when coupled with other fundamental metrics such as the fund’s return on equity, return on capital and debt to equity ratios, these are far more favourable than its benchmark. So, on balance, the fund is looking very attractive on this basis and I’m confident that patience will be rewarded,” she concluded.

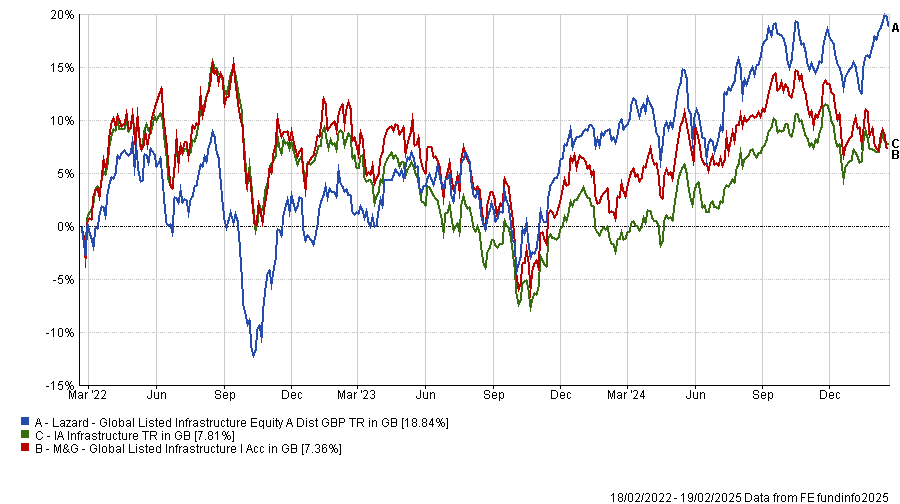

Another fund that has come off the boil but is still worth considering, according to iBoss managing director Chris Metcalfe, is M&G Global Listed Infrastructure. The manager, Alex Araujo, has been at the helm since 2017 but was joined in 2023 by Nicholas Cunningham as deputy manager.

“Whenever there are changes to the published manager lineup, we pay closer attention to how performance develops,” Metcalfe said.

“To this end, we have had more contact with the team and remain convinced that this recent dip in performance is due to normal market dynamics, where sectors come in and out of favour.”

Being in the global sphere, this fund also has a dominant exposure to the US at circa 62%, but this wasn’t a problem for Metcalfe, as in his portfolios, he is pairing it with the Lazard Global Infrastructure fund, which has only 22% US exposure.

Performance of funds against sector over 3yrs

Source: FE Analytics

“Intuitively, it always feels like you should want all your funds doing well all the time. However, in reality, you want your funds in each respective sector to be successful in the medium-to-long term but not all in a highly correlated fashion,” Metcalfe concluded.

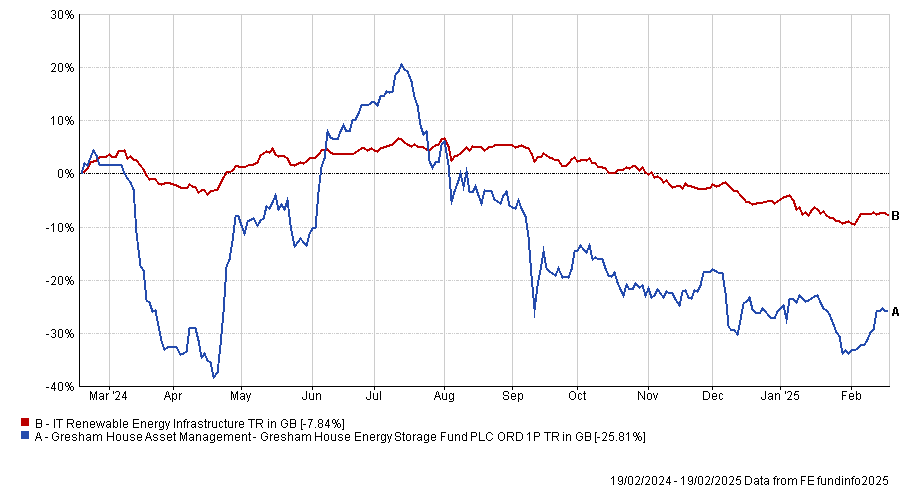

Elsewhere, investment trusts have been struggling but some sectors have been in the doldrums more than others. One such sector is battery storage, where trusts such as Gresham House Energy Storage have been having a tough year, as the chart below shows.

Performance of trust against sector over 1yr

Source: FE Analytics

The vehicle has faced a sharp de-rating due to the collapse of UK battery revenues, resulting in the suspension of the dividend while it completed its construction projects, said Winterflood researcher James Wallace.

“Looking forward, all current construction projects are set to be completed by the end of the first quarter of 2025 and battery revenues are improving, which is expected to result in a return to dividend payments this year, providing a key positive catalyst for a rerating,” he said.

“Furthermore, as a result of the build-out of renewable generation, we expect to see increased power price volatility and a value transfer to energy storage assets, most notably battery energy storage”.

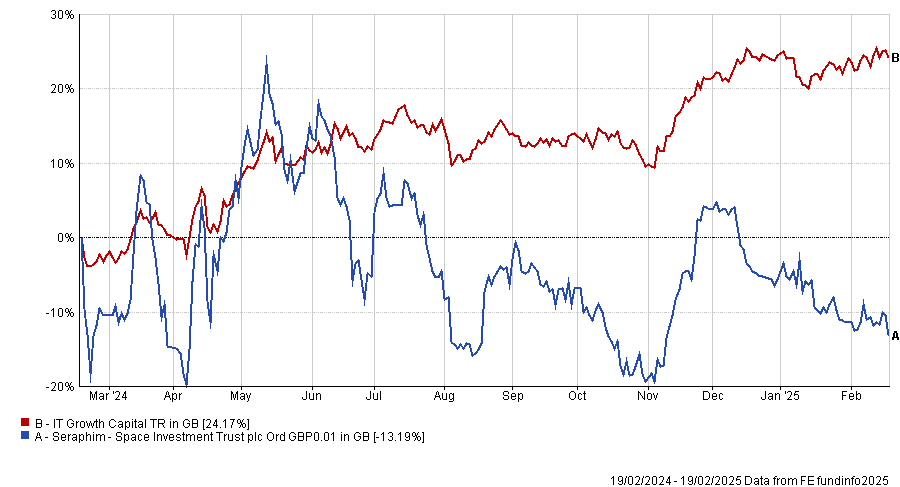

Finally, Winterflood’s Shavar Halberstadt highlighted Seraphim Space. It was the top-performing investment trust over the calendar year 2024, but has had a tough start to 2025 and over 12 months its share price total return was -13%.

Performance of trust against sector over 1yr

Source: FE Analytics

He said: “This performance is not based on fundamentals and likely reflects a mix of shifting interest rate expectations and volatility inherent in smaller-sized mandates. The companies in the portfolio have steadily continued to strike long-term, revenue-generating partnerships with major government agencies and global corporates, and the backdrop of rising defence expenditure is highly supportive.”