China has too much political risk, a high level of debt and too many economic challenges to have a positive view on, while India is a mirror image of China but with a slowing momentum which is starting to chip away at share prices, according to Austin Forey and John Citron, managers of the JPM Emerging Markets trust.

In an uncertain world and a noisy political environment, one way to invest in emerging markets, they said, is to “own the best business that give customers something that they want”.

Markets seem to want artificial intelligence (AI), which was indeed the main driver behind the trust’s performance, as emerged in the trust’s half-year results to December 2024, published this morning.

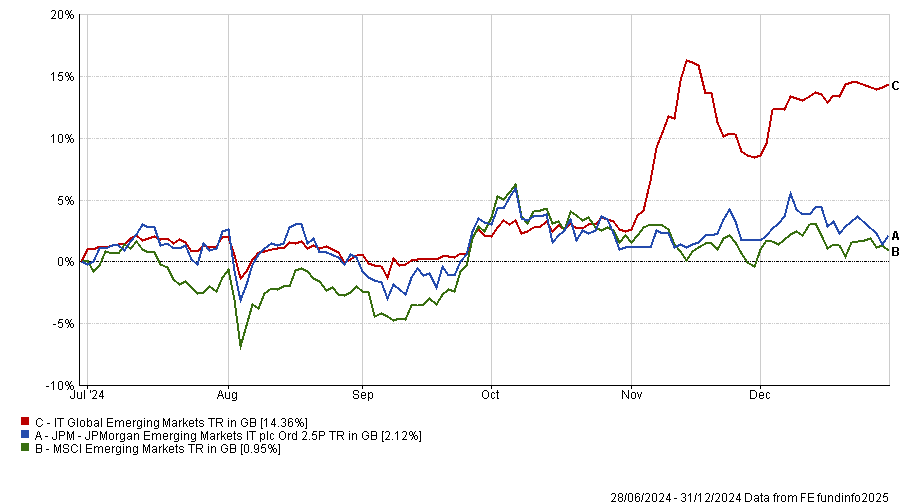

During this time, the net asset value ('NAV') per share on a total return basis was 2.8%, while the total return to shareholders was 2.1%. This compared with a 1.0% increase in its benchmark, the MSCI Emerging Markets index with net dividends reinvested.

The performance of the technology sector in emerging markets has been “strong” and dominated especially by Taiwan Semiconductor (TSMC), which alone accounted for more than half the return of the entire emerging markets index in 2024.

“The extraordinary performance of businesses in the US linked to AI, most notably Nvidia, would not be possible without the manufacturing capabilities of companies in Korea and Taiwan and this has been reflected in share prices,” the managers said.

“Fortunately, we have had a large investment in TSMC for many years as well as in a number of other businesses in the hardware supply chain, which were notable contributors to performance in the latest period.”

Performance of trust against index and sector in the second half of 2024

Source: FE Analytics

Beyond Taiwan, the two markets that have dominated the mindset of the managers have been India and China. Allocations to the latter made a net loss for the trust over the past six months, with stock price moves “heavily influenced by the government's attempts to shore up a struggling economy”.

These produced a very sharp rally at the end of September, the managers explained, though the market subsequently drifted back down as the effectiveness of the policies began to be questioned.

“Our structural view on China remains a negative one; while there are some very impressive businesses that we are happy to own in your portfolio, political risk remains an ever-present factor and the economy is facing significant challenges as a result of over-investment and high levels of debt,” they wrote.

India is almost a mirror image of China: the economy has been growing robustly and the equity market has been “on fire”, with rising valuations contributing half of the market's 50% rise in the past couple of years.

“We felt that share prices were getting stretched in many places, and did not capture all of that rise; but in the past six months, as the momentum in the market has stalled and many stocks began to correct, your company's investments eked out some small gains while the market as a whole declined.”

As a result, India was the market with the largest positive contribution to the company's relative performance in the latest half year.