There has been a 40% increase in retail ownership of investment trusts over the past five years, the latest State of the Nation report by Association of Investment Companies (AIC) has confirmed today. However, the rise of retail ownership has gone hand in hand with a lower share held by wealth managers, who have ditched both equity and alternative trusts.

Wealth managers now hold 24% of the investment company sector, down from 27% in 2022, with their stake in alternative investments dropping sharply from 24% to 17%, the report found. Institutions now hold 48% of the sector, private investors 26%, wealth managers 24% and adviser platforms 2%, as the chart below shows.

Changes in shareholder base of investment companies since 2022

Source: AIC/Argus Vickers

The differences are notable on a sector basis too. Wealth managers own 28% of equity investment companies, compared to just 17% in alternatives and prefer infrastructure assets, where they hold 32% of shares. On the other hand, private investors prefer equity trusts, where their stake has risen from 35% to 37%.

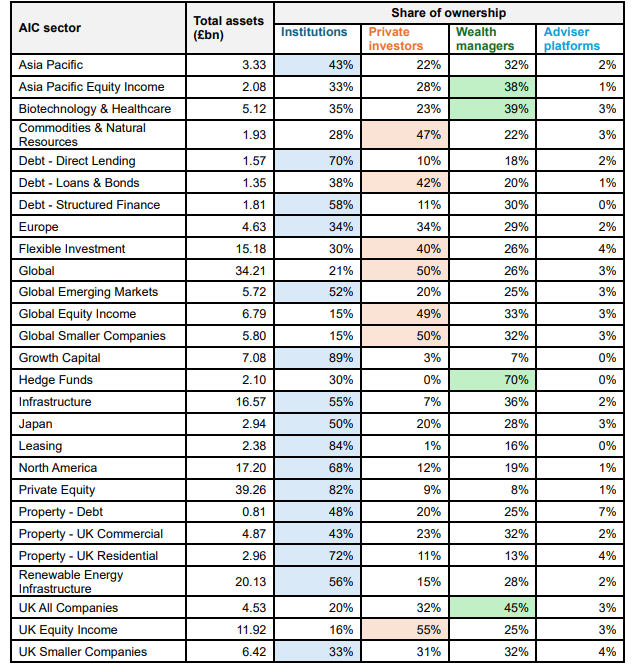

Institutions are the most significant shareholders in most sectors but private investors dominate several equity sectors, including IT Global (50%) and IT UK Equity Income (55%), and while wealth managers hold more than two-thirds of the IT Hedge Funds sector, as well as nearly half the IT UK All Companies sector, as illustrated by the table below.

Trust ownership by sector

Source: AIC

While investment companies continue to attract a broad range of investors, their shareholder base is changing, according to AIC chief executive Richard Stone. He attributed this to a number of factors. For retail and institutional investors attractive discounts have encouraged more buying, while confusing cost disclosures was one of the reasons wealth managers may be leaving the trust space.

“Wealth managers have been under pressure to sell investment companies due to the frustrating cost disclosure rules, which have made portfolios containing investment companies look artificially expensive. This has had a particularly acute impact on the alternatives sectors,” he said. “Meanwhile, we’ve seen an increase in interest from investors attracted by deep discounts, including overseas investors, which has boosted the share held by institutions.”

Another reason keeping wealth managers from investing more money in trusts is market concentration and industry limitations, according to Gravis managing director William MacLeod, who said wealth manager cannot put their money to work where they want to due to their size.

Investment companies have been combining and getting bigger, but scale means having a limited number of people who can manage portfolios, a limited number of analysts who can study investments and limited possibilities to access the small trusts universe.

“If a sizable firm with, say, £30bn to £50bn of assets under management spread between 500 holdings is looking to deploy £100m in the trust universe, there is a very limited number of companies it can buy, not all of which are of scale,” he said.

“The £100m in a company with £1bn of market cap would represent too high a percentage of the trust’s portfolio, and I can't believe an investment manager would want to own 10% of any company. Even assuming a 5% position, there actually aren't that many companies to have a market cap of £1bn. So deploying their investors’ capital has become very difficult within the investment company sectors.”

Finally, Ben Mackie, portfolio manager at Hawksmoor, said that sentiment hasn’t been helped by some high-profile blow ups either, including that of Digital 9Infrastructure and Home REIT, both of which are winding down.

“This raises questions about the veracity of valuations, although we’re encouraged by the fact that many alternative trusts have been selling assets in line with or above carrying value so validating the net asset value,” he said.

“There are definitely some structural issues facing the sector and we’ve been active in impressing on boards the importance of capital allocation and trying to find new buyers. There also needs to be a reduction in supply. There are too many sub-scale trusts that lack relevance. Thankfully, we’re seeing a marked pick up in corporate activity with a number of mergers, wind-downs and take privates.”