Mixed-asset portfolios are popular among investors who like the peace of mind that comes from delegating their investment decisions to expert managers who can allocate across equities, bonds and alternatives. But peace of mind doesn’t mean one should rest on their laurels when those managers aren’t delivering.

In the research below, Trustnet highlights the multi-asset funds that are undergoing a reversal of fortunes – either in the positive, rising from the bottom quartile of their peers over the past decade to the top quartile over the past 12 months, or in the negative, going from a top-tier long-term track record to a struggling position in the short term.

The sector where there was the most upheaval in the short term was the IA Mixed Investments 40-85% Shares, which had the highest number of long-term heroes struggling, while no former laggards rose to the top.

One of those recent laggards is the £1.9bn Jupiter Merlin Balanced Portfolio, a fund of funds co-managed by FE fundinfo Alpha Manager John Chatfield-Roberts.

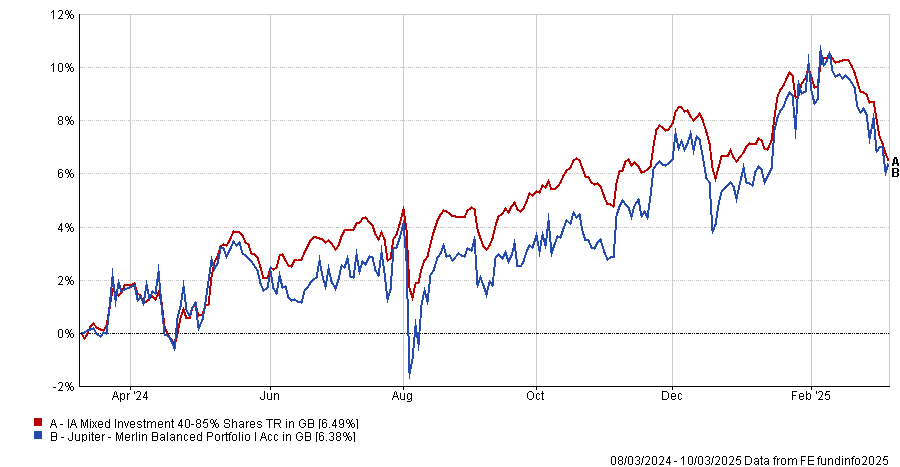

While Jupiter's Merlin team remains one of the most respected and experienced teams in the UK market, according to Square Mile analysts, its short-term performance hasn’t kept up with its peers, as the chart below shows.

Performance of fund against index and sector over 1yr

Source: FE Analytics

The team's success in managing multiasset portfolios across several economic and market cycles has attracted a sizeable level of assets that “could present some challenges around liquidity and the ability to refresh the portfolio”, the analysts said. Nevertheless, their concerns were “somewhat reduced” given the nature of the approach and the managers' experience, which make the fund “a strong offering”.

Square Mile analysts also continue to rate Premier Miton Diversified Growth, another long-term outperformer that slipped over the past 12 months. Neil Birrell is responsible for the overarching asset allocation of the fund, currently distributed between equities (56.7% of the portfolio), fixed income (18.9%), alternatives (18.9%) and property (10.6%).

Each of these sleeves is run by different sub-managers at the firm, who invest following their own individual approaches.

Thanks to this structure, costs are kept low at 0.56%, a plus point for Square Mile analysts.

“The fund is competitively priced through leveraging the specialist investment teams from across the business, who are responsible for managing their portion of the portfolio directly. The diversified range of assets and the flexible and active approach are a standout at the price point,” they said.

Sustainable strategies have been facing challenges of late and Janus Henderson Global Responsible Managed hasn’t been spared. The portfolio is comprised of three subportfolios, each run by a different manager, philosophy and approach to environmental, social and governance (ESG) principles.

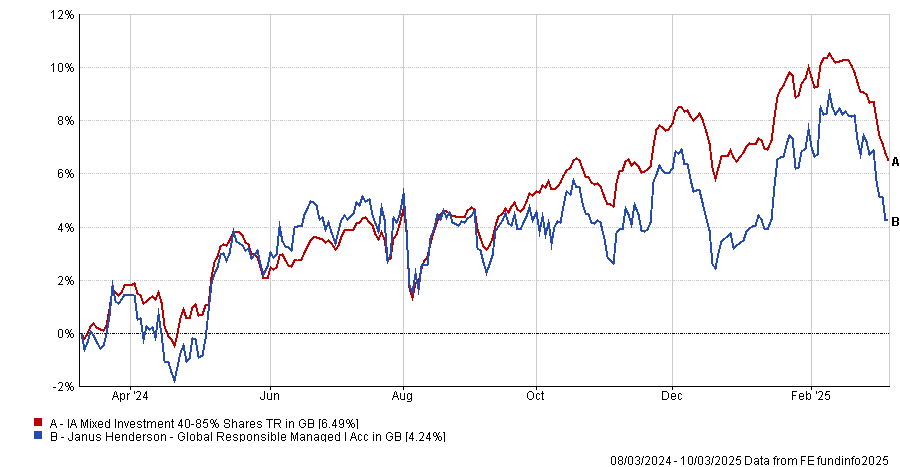

Although Microsoft and Nvidia, globally two of the best-performing stocks of the past few years, are the top positions in the fund, respectively at 3.1% and 2.6%, its distance from the rest of the market has grown larger in the past six months, as illustrated in the chart below.

Performance of fund against index and sector over 1yr

Source: FE Analytics

Square Mile analysts note the style diversification provided by the UK sleeve as a positive for the fund, as the manager's income focus will lead it to have more exposure to high-yielding value stocks, which gives balance to the growth bias of the global sleeve.

“The fixed income sleeve is usually the smallest component but acts as a useful volatility dampener through a portfolio of G7 government bonds and global credit,” they said.

“This diversified approach across asset classes, regions and styles differentiates it from the majority of responsible multi-asset funds in the peer group, which tend mainly to be more growth-orientated. As such, we would expect the fund to perform relatively differently than more growthfocused peers across the cycle.”

Although it is not a “pure impact fund”, nor does it invest entirely in sustainable solutions providers, it “represents a sound offering for investors looking to invest in a globally diversified multi-asset portfolio that excludes harmful industries and fully integrate ESG into its investment processes”.

In the IA Mixed Investment 20-60% Shares sector there was another struggling ESG vehicle, Liontrust Sustainable Future Defensive Managed. The management house had portfolios going in each direction, however, with two multi-asset strategies that struggled in the past 10 years but rose higher more recently, Liontrust MA Monthly High Income and Liontrust MA Explorer 35, as the tables below show.

TABLE285

Source: Trustnet

Other notable names that were able to turn long-term underperformance into a strong 2024 include Carmignac Portfolio Patrimoine and Coutts Managed Cautious.

This article is part of an ongoing series. Previous instalments include: European funds, global emerging markets, UK small-caps, IA UK All Companies and IA Asia Pacific Excluding Japan.