There was a jump in research into value funds as investors grew more cautious on growth and tech stocks when US stocks sold off, analysis of Trustnet user behaviour suggests.

Having led the global equity market for a lengthy period of time, US stocks have dipped in 2025 so far on concerns over recession, high valuations and political uncertainty from US president Donald Trump.

Between 16 February and 18 March, the MSCI USA index fell 10.1% – putting it into correction territory. The S&P 500 is down by a similar magnitude while the tech-heavy Nasdaq fell even further.

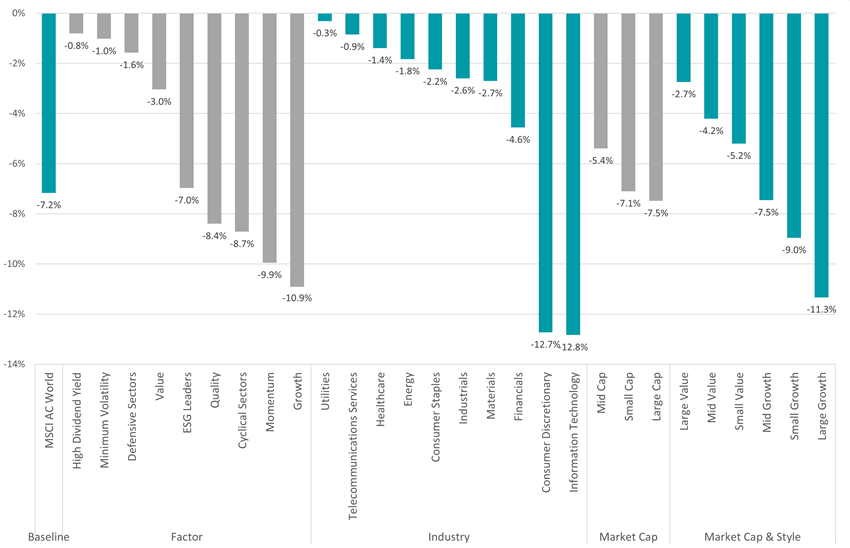

Performance of MSCI AC World and its sub-indices over past 30 days

Source: FE FinXL. Total return in sterling between 15 Feb and 14 Mar 2025

On the global stage, the sell-off in the US has caused the MSCI AC World index to slump 7.2% since 15 February with tech stocks and consumer discretionary companies falling the most.

In terms of investment style, both growth and momentum investing have fared the worst; the MSCI AC World sub-indices for these styles are down 10.9% and 9.9%, respectively. Value investing, on the other hand, has held up better with the MSCI AC World Value index slipping just 3% over the past 30 days.

With this tough backdrop, we examined the research behaviour of the investors who use Trustnet to see which funds they have been paying more attention to. While markets have recovered a little in the past couple of days, it can be enlightening to see what investors turned to during the rout.

To do this, we took the share of factsheet pageviews for each fund in the Investment Association over the past 30 days and compared that with the baseline of research share over the previous 12 months. In doing this, we can see which funds investors have been spending more or less time looking at.

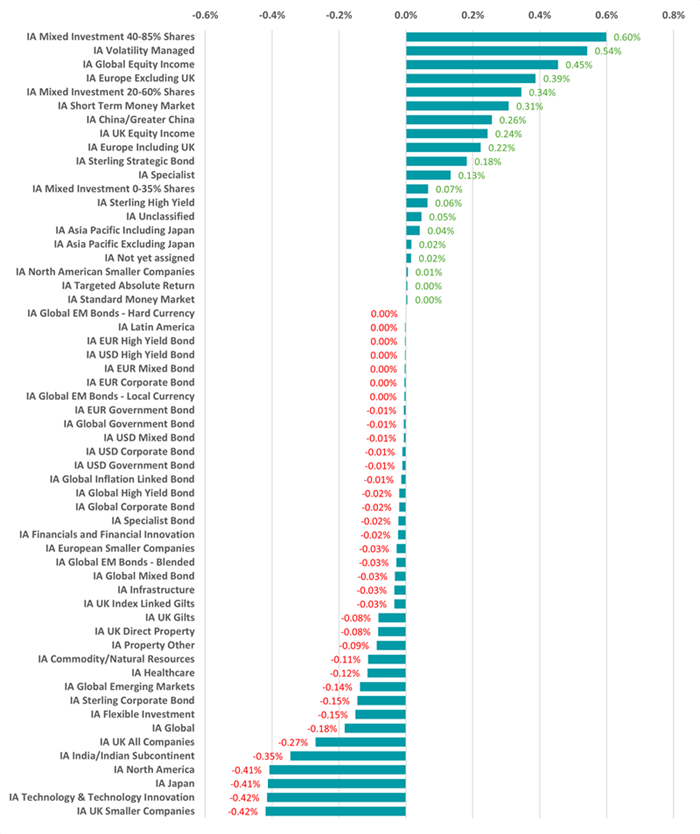

Starting with sectors, the chart below shows that investors have been researching multi-asset funds more in the past month.

Change in sector research share over the past 30 days

Source: Trustnet, Google Analytics. Change in share of pageviews to Trustnet fund factsheets between 15 Feb-14 Mar 2025 and 14 Feb 2024-14 Feb 2025

IA Mixed Investment 40-85% Shares is the sector with the largest increase in research (it accounted for 9.03% of Investment Association pageviews over the 12-month baseline; this ticked up to 9.63% in the past month). IA Volatility Managed and IA Mixed Investment 20-60% Shares funds are also being researched more.

This could be down to investors seeking out funds that are diversified over asset class, geography and sectors, recognising that markets have been led by a small group of US tech stocks for some time but this trade is under pressure.

A desire for diversification away from the US and tech stocks can also been seen in the increased research share of the IA Global Equity Income, IA Europe Excluding UK, IA China/Greater China and IA UK Equity Income sectors.

The IA Short Term Money Market sector was also being researched more as investors looked at safe havens amid the volatility.

Correspondingly, IA Technology & Technology Innovation and IA North America were among the sectors with the largest falls in research among Trustnet users. There was also less interest in IA Global funds (which tend to have a higher US allocation than global equity income strategies) as well as the IA UK Smaller Companies, IA Japan and IA India/Indian Subcontinent peer groups.

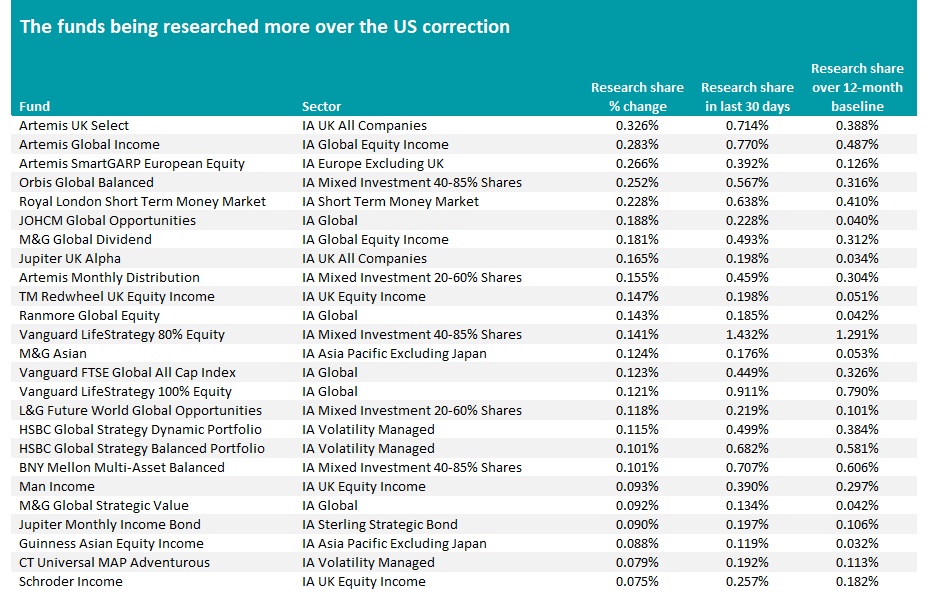

Source: Trustnet, Google Analytics. Change in share of pageviews to Trustnet fund factsheets between 15 Feb-14 Mar 2025 and 14 Feb 2024-14 Feb 2025

However, a look at the individual funds being researched more suggests that the investment approach being used by managers might be just as important to investors as their geographical focus.

Although research into the IA UK All Companies sector declined, the individual fund with the largest jump in investor interest is a member of this peer group: Artemis UK Select.

Run by FE fundinfo Alpha Manager Ed Legget and Ambrose Faulks, the £3.8bn fund has been one of the best performers in its sector and is currently among the top three IA UK All Companies funds over one, three and five years. Over five years, it has made a total return of 182.3% compared with just 78.3% from its average peer.

Artemis UK Select has a high-conviction yet flexible stock selection approach, which has delivered strong long-term gains but with higher levels of risk. Analysts at FundCalibre said investors need to be prepared for the risk of drawdowns during times of market stress – shown by the fund's third-quartile 4.1% loss over the past month.

However, they also said: “This fund stands out as one of the premier UK equity funds due to the impressive track record of its managers. Ed Legget has consistently delivered exceptional performance over his career, and alongside Ambrose Faulks, the fund has thrived since their partnership began in late 2015.”

This was not the only Artemis fund that Trustnet users have been researching more during the US sell-off as Jacob de Tusch-Lec’s Artemis Global Income and Philip Wolstencroft’s Artemis SmartGARP European Equity funds round out the top three.

These three Artemis funds use a blend of value and growth investing principles in their processes. Other funds with a ‘blended’ approach that investors have been researching more include Orbis Global Balanced, JOHCM Global Opportunities and M&G Asian.

However, the biggest uptick in research has gone into value funds. Many of the funds above that are being researched more use the value style, such as M&G Global Dividend, Jupiter UK Alpha, TM Redwheel UK Equity Income, Ranmore Global Equity, Man Income, M&G Global Strategic Value, Guinness Asian Equity Income and Schroder Income.

As suggested above, this research is likely down to the recent turnaround in performance of value investing. The style had lagged behind for a long period – the MSCI AC World Value index was up just 128.2% for the 10 years to the end of 2024, compared with a 282.8% total turn from the MSCI AC World Growth index.

Over 2025 so far, however, the growth index has dropped 7.3% while the value index is up 1.6%.