We’ve seen quite a few investment managers moving out of alternatives in recent months. However, given the structural changes reshaping the financial landscape, it might be wise to pause for thought before rushing back to the traditional 60/40 portfolio.

In the coming years, the traditional benefits offered by negative equity-bond correlations are likely to be challenged by higher inflation, interest rate volatility, larger government deficits, higher starting debt levels and elevated market concentration.

Historically, such periods of higher inflation have led to increased correlation between equities and bonds. To quote Morgan Stanley: “If we go back to the positive correlations that persisted from 1970 to 2000, the challenges to achieving easy diversification will likely increase, producing more volatile portfolio return patterns and increasing the attractiveness of alternative and uncorrelated asset classes like hedge funds and private investments.”

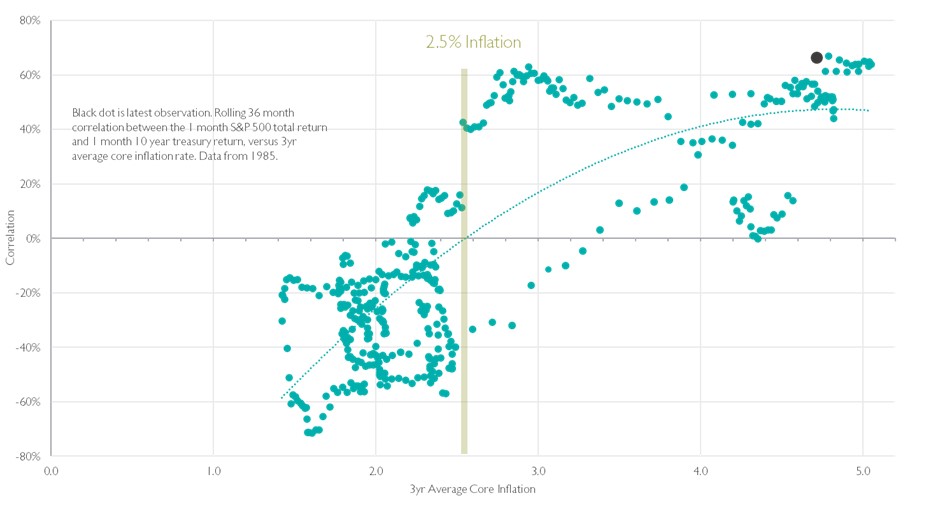

This means that traditional diversification strategies, such as government bonds, may no longer provide the same benefits, particularly as inflation rises above 2.5%, where equity and bond correlations historically tend to turn more positive.

The year 2022 exemplified this shift when equities and bonds moved in tandem, showing that the relationship between the two is not static and cannot always be relied upon for diversification, especially in a higher inflation environment, as the chart below neatly encapsulates.

Correlation between bonds and equities when inflation is higher

Sources: Minack, Bloomberg, Waverton Investment Management; data from Dec 1985 to Jan 2025. The chart shows rolling 36-month correlation between the one-month S&P 500 total return and the one-month 10-year US treasury return, versus the three-year core inflation rate.

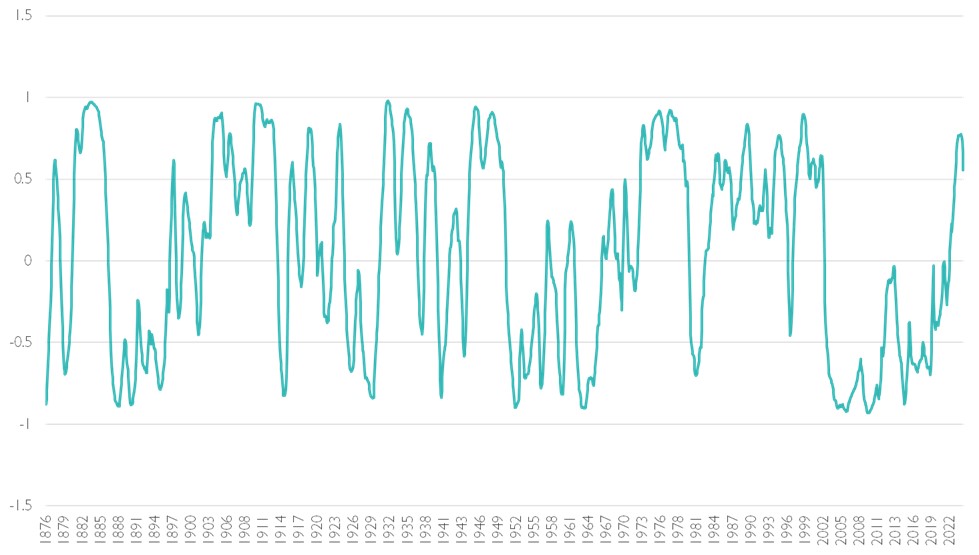

Furthermore, taking a more long-term view sheds a somewhat different light on the ‘traditional’ equity-bond correlation. Looking at data going back to the 1870s, it can be argued that the past 20 years of persistently negative correlation between equities and bonds is more of an outlier than a constant, as the chart below illustrates. The implications for investors could be profound.

Equity-bond correlation since the 1870s

Source: Professor Robert Shiller, Yale University

While it’s true that over the past two years, global equities have performed well, valuations in some public markets are above their historical averages, presenting challenges for asset allocation. Given the current economic context, investors should consider non-traditional assets that either hedge inflation, such as real assets, or deliver returns independent of both equities and bonds, like absolute return strategies.

Real assets, real returns

Real assets are investments in businesses backed by physical assets that generate predictable, often inflation-linked cash flow. These can be property, infrastructure, commodities, asset finance and specialist lending. These assets offer equity-like returns in the long term and provide valuable diversification away from traditional equity and bond markets.

Real assets are characterised by linkage to global economic growth (with returns typically rising in a positive economic environment) and inflation-linked cash flows that offer protection in an inflationary setting.

Cash flows are typically delivered through coupons or dividends, providing attractive income, and due to lower participation from mainstream investors, real assets create a relative value opportunity.

All of the above means that these assets are well-positioned to meet the challenges facing traditional portfolio construction, especially in volatile, high-inflation periods.

Absolute return – the ultimate defensive strategy

For lower-risk investors, traditional fixed income allocations have been challenged in recent years. An absolute return approach – comprising specialist fixed income, structured opportunities and absolute return strategies – offer defensive properties in equity market downturns and weak fixed income environments. These strategies aim to generate returns above what is available in short-term deposits, while providing downside protection and diversification.

While global government bonds may offer short-term appeal in a lower inflation environment, concerns about rising debt levels in the US – even including speculation about America’s very own ‘Liz Truss’ moment – highlight the long-term risks. As the macroeconomic landscape grows more volatile, with greater stock dispersion and less concentrated equity market returns, opportunities for bottom-up alpha generation rise. Absolute return strategies can capitalize on this by generating returns from a range of possible market environments.

Alternatives still essential for diversification

In a nutshell, the challenges presented by high valuations, concentrated equity markets and unstable correlations between equities and bonds should result in investors questioning the traditional diversification offered by the 60/40 portfolio. Investors are increasingly exposed to systemic risks and the global outlook looks like it will remain distinctly uncertain for some time to come. Maintaining diversification into a range of alternative assets is essential to mitigate these risks and ensure your portfolios are best placed for whatever the future brings.

Luke Hyde-Smith is co-head of multi-asset strategies at Waverton Investment Management. The views expressed above should not be taken as investment advice.