The rotation out of US stocks into more fundamentally attractive and undervalued areas of global equity markets has seemingly commenced. At the moment, European equity markets seem particularly well positioned to receive the capital outflows from the US.

We have been positioned for this scenario, but admittedly too early, which is not unusual for a contrarian equity investor. Our global equity fund, SKAGEN Focus, only has about 10% invested in US equities, due to valuation reasons, and around 40% exposed to highly discounted European cyclical investment situations.

Moreover, the remaining part of the portfolio is concentrated in Japanese, Korean and Latin American markets which also trade at exceptionally low valuations compared to history.

An extreme starting point

We have been through an interesting period – stretching almost 20 years – of US equities outperforming the European small and mid-cap complex. Valuation divergence between the two markets was also at vast levels, particularly for the largest US stocks, making it an unusual investment environment.

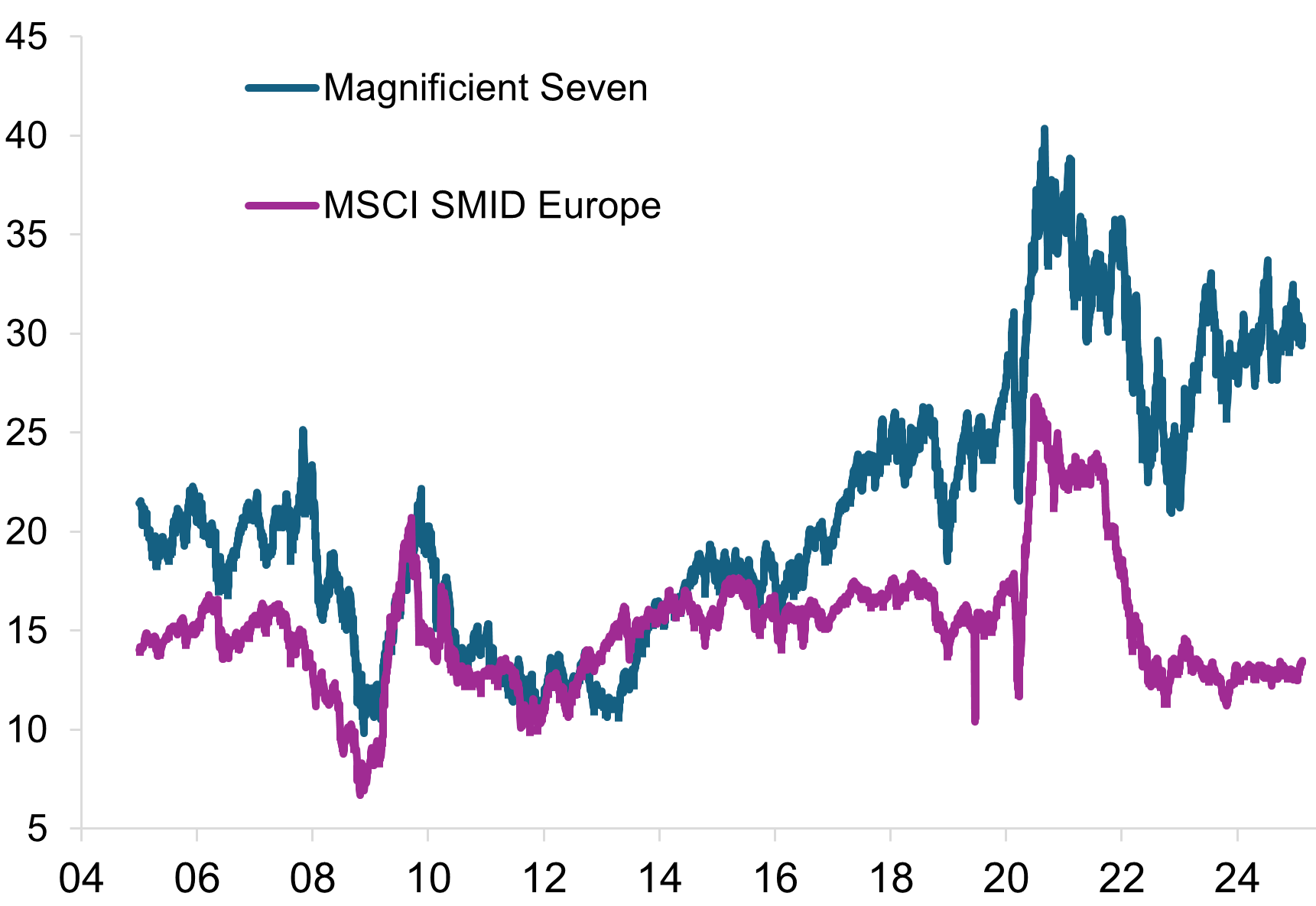

The P/E ratio of the Magnificent Seven and European ‘smid’-caps

Source: Goldman Sachs as at 14 Feb 2025

The valuation discount of European small and mid-caps to the Magnificent Seven is currently 56% on a price-to-earnings (P/E) basis, double its 20-year average (28%) as illustrated above, and the normalization potential seems vast as catalysts for the ‘great rotation’ continue to emerge.

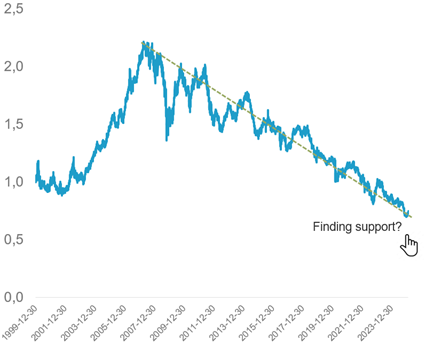

Relative performance of MSCI ACWI Small and Mid-Cap Europe versus MSCI USA since 1999

Sources: SKAGEN, Bloomberg

The very strong performance of European small and mid-caps versus US stocks from 2001 to 2006 may be a distant memory, particularly as they have since steadily underperformed over a staggering 20-year period.

The US correction

We believe the recent correction in US equity markets – the S&P 500 index fell over 10% from its February all-time-high – is due to a rapid increase in the political country risk premium of the equity market.

The sell-off has been particularly painful for US mega-cap tech stocks, which entered the year with stretched valuations and very high expectations.

Most indications suggest that Trump is willing to endure economic and market weakness in pursuit of long-term goals, such as tariffs and a smaller government.

A wave of anti-US sentiment has been unleashed in Europe, Canada and most probably in many other countries. The US administration’s highly erratic and unpredictable policy communication, particularly around tariffs, is creating a vacuum that has caused paralysis among corporates and concerned investors about the negative impact on aggregated US earnings.

The equity markets are starting to anticipate a wave of downward earnings revisions or at least a slowdown in earnings momentum compared to the rest of the world, and in particular to European equities. Recent readings on consumer sentiment in the US have indeed been very poor.

The close relationship between the leaders of the monopolistic tech giants and the US administration is highly problematic. If more ethical red lines are crossed, the pace of capital outflows from the US equity markets could accelerate. That poses a huge problem for global passive investors since the US country weight in the MSCI World Index just peaked at around 70%.

The case for European equities

You may remember Mario Draghi’s “whatever it takes” statement during the 2011 Eurozone debt crisis which paved the way for a gargantuan rescue package within the region. Using similar language, Germany’s new chancellor Friedrich Merz promised to do “whatever it takes” to restart and defend the European economy in this new political and financial landscape.

The proposal includes measures such as the exemption of all expenses in the German defence budget above 1% of GDP from the national debt brake and the establishment of a special fund to fix Germany's outdated infrastructure, which will also be exempt from the current debt brake (€500bn over 10 years).

This is potentially a game-changer for Europe, ironically fuelled and accelerated by the new policies of the US administration.

It is worth pointing out that the US exceptionalism of the past decade is partly attributable to the country’s 7% deficit, while Germany’s is running at 1%. Now the US wants to cut its deficit, while Merz is seeking to increase Germany’s.

A ceasefire in Ukraine and peace dividend for Europe would also act as a powerful growth injection into European economies. We would expect the massive investment into infrastructure and defence to not only propel expansion in those sectors, but also awaken entire value chains across Europe, such as companies providing construction equipment, raw materials, steel and chemicals.

A few recently initiated companies in the SKAGEN Focus fund are especially well-placed in this environment. Austrian brick and pipe producer Wienerberger would benefit from increased construction activity and the re-building of Ukraine in a post-war scenario. Overlooked German chemicals producer Wacker Chemie provides thousands of products for many industries, particularly the construction sector which generates a substantial part of revenues.

Dutch Aperam and Spanish Acerinox provide stainless steel in Europe and would stand to benefit from increased demand from the defence and construction industries. And lastly, we have several construction machinery companies in the fund with large operations in Europe, such as Japanese Takeuchi and Korean Doosan Bobcat.

The great rotation in motion

There are several indicators that a substantial rotation is underway in global equity markets that could potentially signal a larger shift out of US stocks into discounted and ignored equity markets overseas. The vast amounts of capital invested into passive global equity mandates during the past 10 years have the potential to accelerate the rotation if fund flows reverse.

We believe the largest potential upside lies in small and mid-cap areas in Europe but also elsewhere outside the US, especially in the cyclical elements of the global investment universe.

Jonas Edholm is portfolio manager of the SKAGEN Focus fund. The views expressed above should not be taken as investment advice.