Technology continued its bear phase in March, taking last month’s negative returns to new lows, while India turned around.

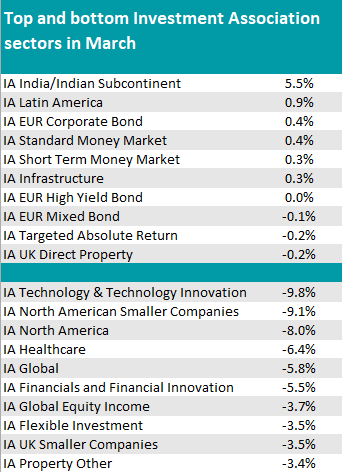

The IA Technology & Technology Innovation sector lost 9.8% in March, a few points below its February result of -6.2%. “What goes up comes crashing back down again” was the view of Ben Yearsley, director at Fairview Investing.

He said: “Blood bath is too strong a phrase; however it hasn’t been pretty. The Magnificent Seven pushed the market higher and has brought it back down again. The bottom of the tables focused on US and tech funds – there was no real respite. There wasn’t even the saving grace of a weak pound for UK investors as the pound gained versus the dollar in March.”

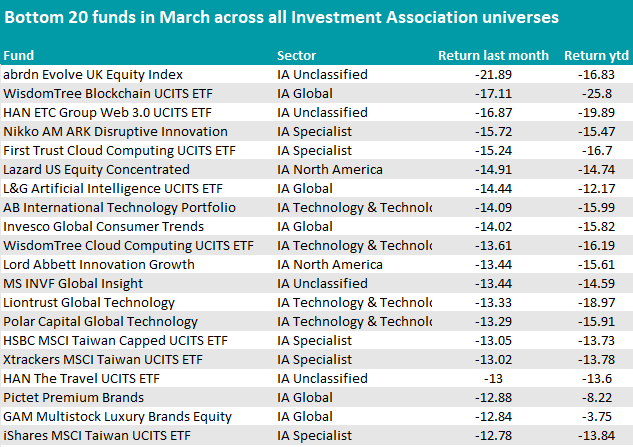

Funds and exchange-traded funds linked to the tech theme were among the worst performers of the month, including WisdomTree Blockchain UCITS ETF (bottom of the IA Global sector and the second-worst performing fund across all Investment Association universes, at -17.1%), HAN ETC Group Web 3.0 UCITS ETF (-16.9%) and Liontrust Global Technology (-13.3%).

Poor performance spread out to the broader US market as well, with the IA North American Smaller Companies and IA North America sectors falling almost as much as their technology plays (9.1% and 8%, respectively).

Source: FE Analytics

Tariffs have been one of the key stories here, according to Yearsley.

“Globalisation is in retreat though with long-term impacts and consequences in many areas. The Russian invasion of Ukraine is now more than three years old and the cost to the US taxpayer is clearly a bug bear,” he said.

“Donald Trump dominates the narrative and is likely to continue to do so until the end of his presidency. It doesn’t matter whether it’s Ukraine or tariffs, it has knock-on impacts in the investing world and the real world with budget deficits and how to fund them.”

The rest of the table is dotted with American strategies, including Lazard US Equity Concentrated (-14.9%) and Lord Abbett Innovation Growth (-13.4%). Consumer-focused strategies, such as Invesco Global Consumer Trends (-14%) and Pictet Premium Brands (-12.9%), also made an appearance. A number of Taiwanese ETFs also made the list.

The Invesco fund’s largest holdings are Amazon, Facebook, Tesla and Nvidia so it “looks exactly like a tech fund”, Yearsley said.

On the positive side, India made a complete 180, having been the worst sector in February and having somewhat slipped under the radar after a poor few months. It now soared to the top with a 5.5% return.

Source: FE Analytics

“India has suffered due to high valuations, concerns over long-term growth prospects and whether companies really have large addressable markets. Some estimates suggest India has a middle class with disposable income of only 50 million people compared to 300 million in China. Are super high valuations justified?” Yearsley asked.

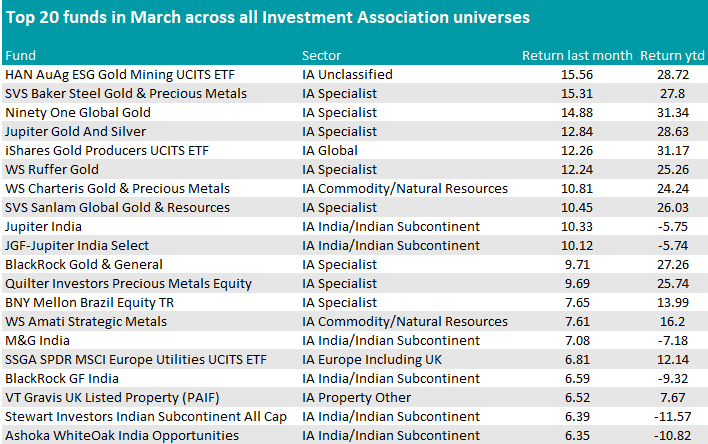

In the IA India/Indian Subcontinent sector, Jupiter India was the top performer, gaining 10.3%, followed by M&G India (7.1%).

India wasn’t the absolute winner, however. Gold was the dominant theme amongst the best-performing funds as it crashed through $3000 an ounce, propelling gold miners higher, as Yearsley noted.

Eight of the top 10 were gold and precious metals funds with Baker Steel Gold & Precious Metals topping the actively managed list with a rise of 15.3%.

The only non-gold funds in the top 10 were Jupiter India and India Select, both gaining just over 10%. Many more India funds were just outside the top 10.

Source: FE Analytics