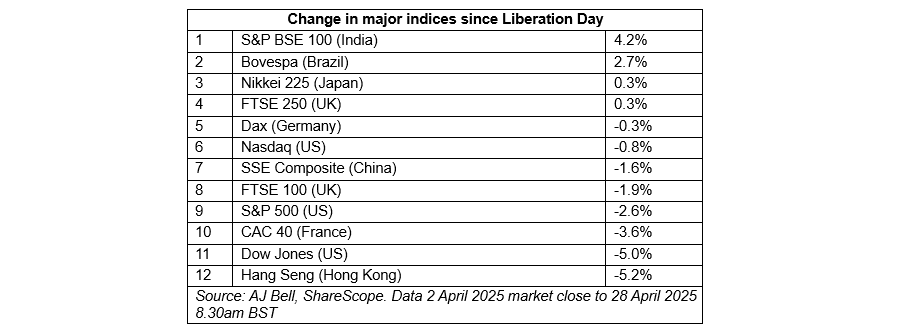

Markets have been in flux since the announcement of tariffs from US president Donald Trump, but not all have suffered equally, according to data from AJ Bell.

Some $8.6trn was wiped from global stock markets between 2 April and 8 April, as investors panicked about the impact of tariffs on the economy and some markets are still feeling the effects, with the main US, Chinese and French indices all in the red after ‘Liberation Day’.

However, the UK, Japan, Brazil and Indian markets are all staging a comeback, recovering most of their initial losses. Dan Coatsworth, investment analyst at AJ Bell, said: “It goes to show the importance of being patient with investing and not racing for the sell button every time markets go through a particularly dreadful day.”

Source: AJ Bell

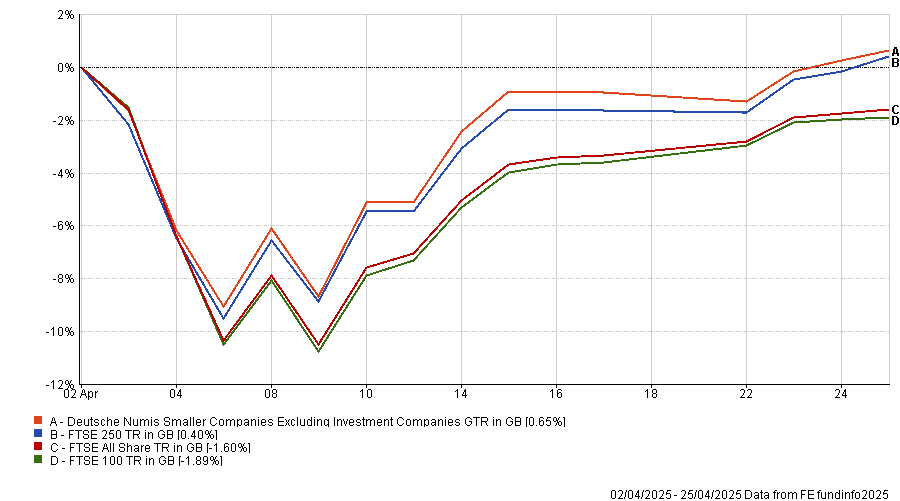

In the UK, the mid-cap FTSE 250 is up by 0.3% since 2 April, better than the large-cap FTSE 100 and the FTSE All Share, which shed 1.9% and 1.5%, respectively. The small-cap Deutsche Numis index is also in the black.

Coatsworth explained this is because the UK mid-caps and small-caps have a more domestic focus, making them less exposed to US tariffs than the more international large-cap index.

Performance of indices since 2 April

Source: FE Analytics.

“Twenty-five companies across the FTSE 350 – the combination of the FTSE 100 and FTSE 250 – are up by more than 10% since the market closed on 2 April,” Coatsworth added.

Leading the charge are retailers and housebuilders such as Dunelm and Berkeley, up 20.7% and 14.9%, as well as the supermarket giant Sainsbury, which surged 11.7%.

Neil Wilson, investor strategist at Saxo Markets, added: “The FTSE has a lot of defensive characteristics. There are plenty of stocks [in the UK] with hefty dividend yields, which can be seen as a place of relative shelter from instability and volatile markets.”

While the FTSE 100 is down since ‘Liberation Day’, Wilson explained that 25 April marked the 10th straight day of gains for the index – its best continuous run since 2019, suggesting that it may also be on the road to recovery. “The FTSE 100 may be like an old blanket that you can wrap yourself in when times are tough and the shiny stuff breaks”, Wilson concluded.

The UK is not the only market where investors' patience was rewarded. In absolute terms, India is leading the recovery, with the S&P BSE 100 up by 4.2% as of 28 April.

Coatsworth explained that this is due to India’s low reliance on US trade compared to other Asian markets. This has made it a comparative haven for investors searching for markets insulated from the impact of tariffs.

Multi-asset managers from Fidelity agreed, piling into the region following ‘Liberation Day’ because its services-based economy makes a great hedge against tariffs.

Brazil’s Bovespa index follows, up 2.7% since ‘Liberation Day’, the second-best performance among the major stock market indices. Coatsworth explained that, as high tariffs force China to look for trading partners beyond the US, Brazil is an “obvious place” to turn to due to vast supplies of meat, poultry and soybeans.

Dina Ting, head of global index portfolio management at Franklin Templeton, agreed with Coatsworth and added that Brazil is also benefiting from a wealth of natural resources, a large labour force and cotton exports that surpassed the US.

Elsewhere, the Nikkei 225 also gained ground and is up 0.3%, the same as the FTSE 250.

This is the result of two main factors, according to Coatsworth. On the one hand, Japan is home to a “rich bounty of interesting companies on cheaper valuations than you would find stateside”. This made the region attractive for investors who wanted to diversify away from the US following recent volatility.

Secondly, tens of thousands of US troops are stationed in the region, close to Russia, North Korea and China, in case geopolitical tensions reach a breaking point.

Coatsworth said: “While Japan is still negotiating trade deals with the US, investors buying the region might be taking the view that Trump cannot risk causing too much economic damage through tariffs to its Asian ally.”

“Anyone who held their nerve and did not panic sell when markets started to crash on 3 April will now be reaping the rewards for sitting tight," he concluded.

However, Coatsworth cautioned that we are not out of the woods yet. While markets such as Germany may be “within a whisker” of a full recovery, “Trump could easily hit a raw nerve and upset markets again”. For example, markets were on tenterhooks again last week as the US president feuded with Federal Reserve chair Jerome Powell.

As Wilson concluded: “Some calm has returned to equity markets – it will not last.”