The UK’s prolonged withdrawal from the EU proved to be damaging time for the domestic economy as investors ditched UK equities due to the perceived uncertainty of what post-Brexit Britain would look like.

Investors typically prefer stability, and the four-and-a-half year period from the referendum vote in June 2016 to the official withdrawal at the end of 2020 was anything but.

Nevertheless, there are a selection of funds that have managed to navigate the uncertainty and outperform their peers, revealing some key trends.

Using data from FE Analytics, Trustnet wanted to find out what UK funds have achieved the highest level of returns between 23 June 2016 and 31 December 2020.

The findings will be broadly split into three categories and will comprise both investment trusts and open-ended funds. These include the strategies in both universe’s UK All Companies, UK Smaller Companies and UK Equity Income sectors to gauge the performance of these different vehicles.

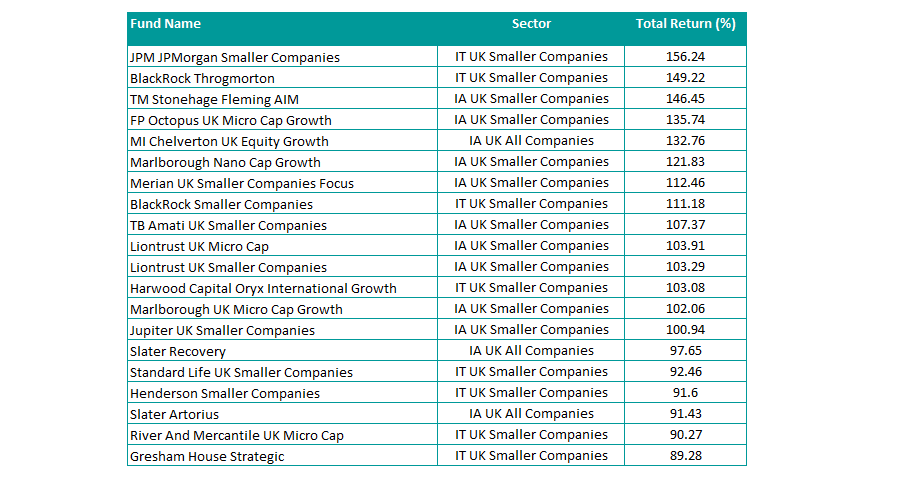

Top-performing UK funds across all sectors

Source: FE Analytics

Across all the Investment Trust (IT) sectors and Investment Association (IA) sectors, the dominance of small-cap funds was evident. In terms of total return, 17 of the top-20 sat in the UK smaller companies space, spread across investment trusts and open-ended funds.

The best performing fund was the £271.6m JPMorgan Smaller Companies Trust, which has been managed by Georgina Brittain since 1998 and achieved a total return of 156.24 per cent over the period. This was followed closely by the £677.3m BlackRock Throgmorton Trust, which posted a return of 149.22 per cent.

The first open-ended fund in the top performers is the £90.3m TM Stonehage Fleming AIM fund, which sits in the IA UK Smaller Companies sector and has been managed by veteran stockpicker Paul Mumford since 2005.

The fund mainly invests in UK Alternative Investment Market (AIM) stocks and has made 146.45 per cent since the Brexit referendum.

AIM stocks performed strongly in 2020 as investors sought companies with good growth prospects, which helped boost the performance of the fund relative to its benchmark.

The £1.1bn MI Chelverton UK Equity Growth fund is one of the few UK All Companies funds to make the list of top performers. Headed up by James Baker since launch in 2014, its inclusion in this sector is perhaps misleading considering that 40 per cent of its holdings are AIM listed, while the remainder predominantly sit in the FTSE UK Small Cap sector.

Liontrust Asset Management has two small-cap strategies in the top performers, the Liontrust UK Micro Cap fund and Liontrust UK Smaller Companies fund, which returned 103.91 and 103.29 per cent respectively.

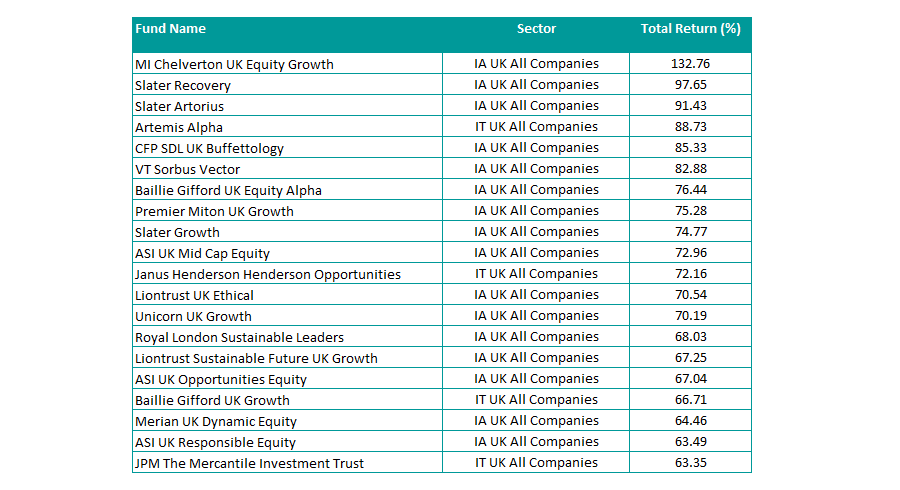

Top-20 UK All Companies funds

Source: FE Analytics

In second place is the £147.9m Slater Recovery fund, managed by FE fundinfo Alpha Manager Mark Slater, which achieved a total return of 97.65 per cent. The five FE fundinfo Crown Rated fund has a core of growth stocks that is supplemented by other assets including, bonds, warrants and options.

One of the few investment trusts to feature in the UK All Companies top performers is the £153.1m Artemis Alpha Trust, which made 88.73 per cent since the vote to leave the EU.

Positive news on Covid-19 vaccines gave a boost to the fund’s cyclical and virus-affected holdings in airlines, banks and house builders. EasyJet was one such outperformer, rising by 59 per cent.

Another recognisable name on the list is the £1.5bn CFP SDL UK Buffettology fund, managed by Keith Ashworth-Lord – an ardent admirer of famed investors Benjamin Graham and Warren Buffett, which made a total return of 85.33 per cent over this period.

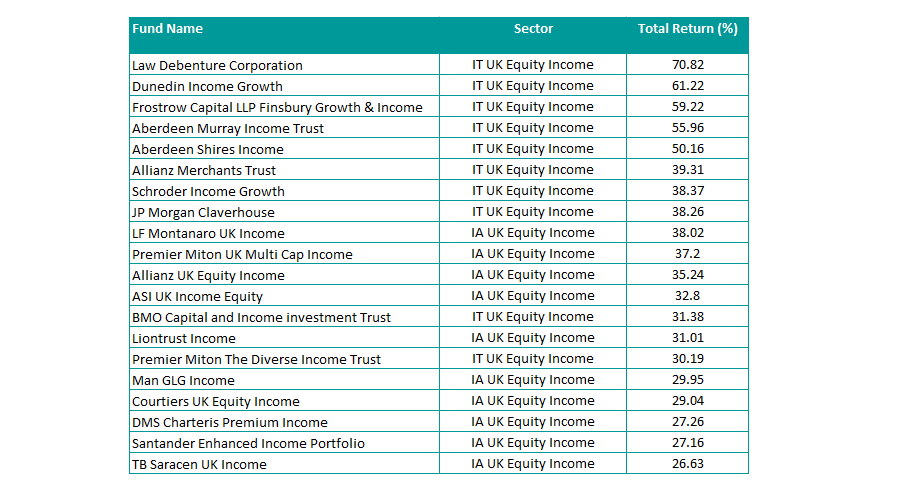

Top-20 UK Equity Income funds

Source: FE Analytics

Given the strong representation of small-cap strategies, we have focused instead on the UK Equity Income space, closed-ended strategies dominated, taking the first eight positions on the list.

The top performer was the £807.9m Law Debenture Corporation Trust, managed by James Henderson and Laura Foll, which achieved a total return of 70.82 per cent.

Running a diversified portfolio of stocks, the fund’s value tilt also enjoyed in the shift towards the unloved cyclical names towards the end of 2020 as the vaccine news emerged. It also has one of the higher yields amongst the top performers, at 5.7 per cent.

In second place was the £435.6m Dunedin Income Growth Investment Trust, managed by Aberdeen Standard Investments’ Ben Ritchie and Georgina Cooper, which made 61.22 per cent.

The £2bn Finsbury Growth & Income Trust, managed by Alpha Manager Nick Train, whose bottom-up stockpicking approach made a total return of 59.22 per cent over the period.

The top-performing open-ended strategy was the £15.8m LF Montanaro UK Income fund, managed by Charles Montanaro and Guido Dacie-Lombardo, making 38.02 per cent.

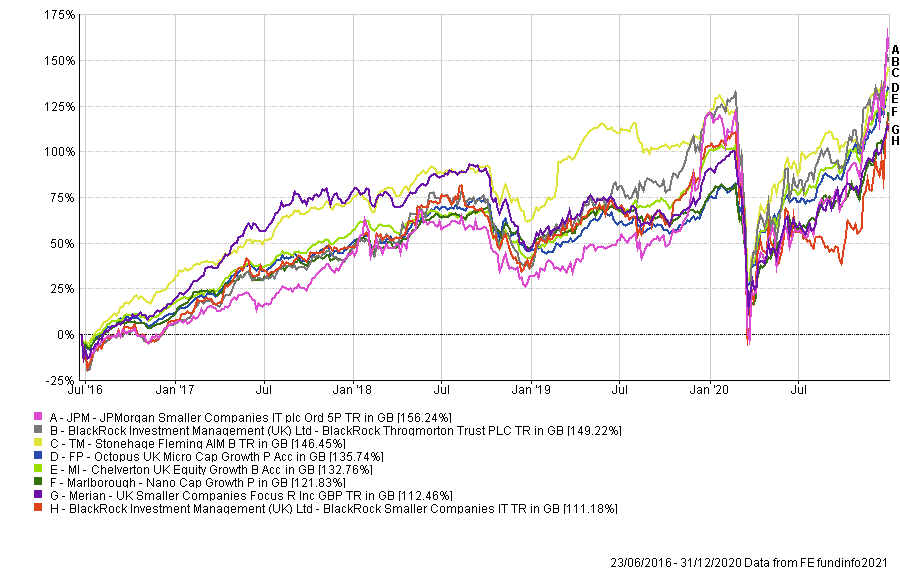

Top-performing funds from 23 June 2016 to 31 December 2020

Source: FE Analytics

During the interim period between the EU referendum and departure of the UK from the bloc, the data shows that growth orientated, small-cap focused strategies did well.

This may not be that surprising given that investors have favoured higher growth strategies over the past decade as the low-rate investment environment has forced investors higher up the risk scale in search of returns.

However, a Brexit deal and prospect of viable Covid-19 vaccines have given the UK market greater certainty – highly valued by many investors.

The tilt towards value and cyclical names in November gave in a glimpse to what 2021 could offer, and global investors could be enticed back given that UK valuations remain at historical lows.

In terms of income strategies, the data showed that investment trusts were able to deliver stronger returns during a period of uncertainty for the UK market. This may reflect closed-ended funds ability to ‘gear’ or leverage to enhance returns and also the popularity of trusts which are able to ‘smooth’ dividends from capital reserves during periods where payouts are low