The investment strategy someone adopts when they retire will depend on whether they have excess capital or, conversely, insufficient savings to meet their living standards.

But assuming a middle ground where someone has saved diligently and achieved their goals, their investment strategy is likely to be predicated upon drawing down enough money to live on, whilst preserving capital above inflation for the next 30 or 40 years.

For a medium-risk investor, this translates into a mandate of inflation plus 3-4%, with 3% per annum being the retiree’s income drawdown, said Edward Allen, private client investment director at Tyndall Investment Management.

The amount somebody draws down needs to be sustainable to allow for flexibility in the future, he added. “If you eat into capital, you deny yourself that flexibility.”

Equities have historically delivered inflation plus 7% but Allen prefers to assume a return of inflation plus 5%, which translates into a high-single-digit nominal return.

Government and inflation-linked bonds also have a role to play. Allen gave the example of a gilt maturing in January 2028 with a yield just above 4%. Assuming inflation of 3%, this equates to locking in a return of inflation plus 1% for the next three years. This low-risk income stream can be used to meet a retiree’s near-term income needs, he said.

In between equities and government bonds, Allen suggested a mix of corporate bonds, infrastructure and property to deliver inflation plus 3% and provide diversification.

Putting 30% in these “middle” assets, 60% in equities and 10% in gilts would achieve an overall return of inflation plus 4%, allowing for drawdowns of 3% plus additional income to pay fees, taxes and other costs.

This margin also gives investors the option to add non-yielding assets such as gold for diversification. Allen said putting 5% in gilts and 5% in gold would be a sensible buffer to the vagaries of equity markets.

Below, he suggests some funds to populate the equities and middle buckets.

Equities

Retired investors are looking for a degree of stability and want to know the companies in which they invest will still be around in a decade’s time, Allen said. Therefore, he favours a quality bias and suggested combining quality-growth and quality-value managers, because the two styles come in and out of favour.

For quality-growth, Allen uses GuardCap Global Equity and J. Stern & Co. World Stars Global Equity.

GuardCap follows a disciplined investment process with an emphasis on avoiding mistakes. “They know as well as anyone that when you’re picking those quality compounders, if they fall off the perch, then you’re in trouble,” he observed.

At J. Stern, Chris Rossbach and Katerina Kosmopoulou are trying to build a portfolio of companies that can weather economic storms, which Allen said is an attractive quality for retired investors. They aim to pick winners and hold onto them for the long term, although they are not afraid to ditch ideas if they don’t work out.

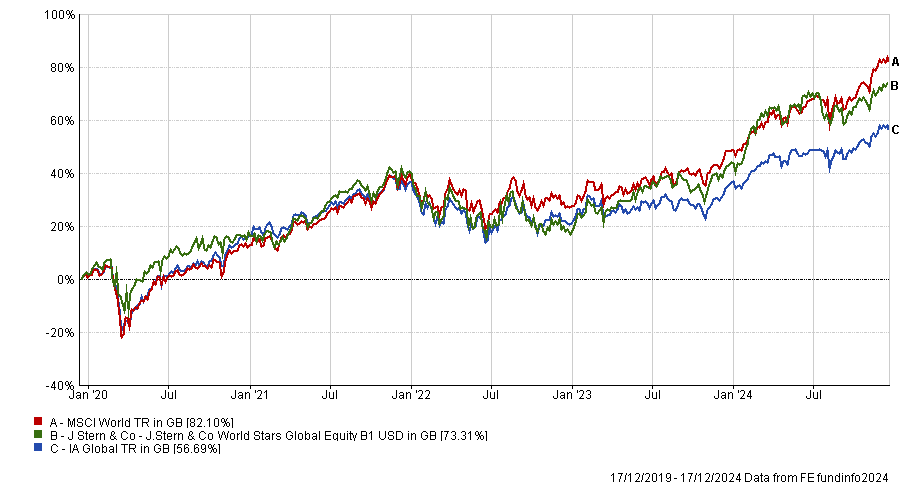

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

On the value side of the fence, Richard de Lisle has found some great ideas in the US small- and mid-cap space for his eponymous De Lisle America fund, Allen said. The fund has traded on a 10%-plus earnings yield over the past few years.

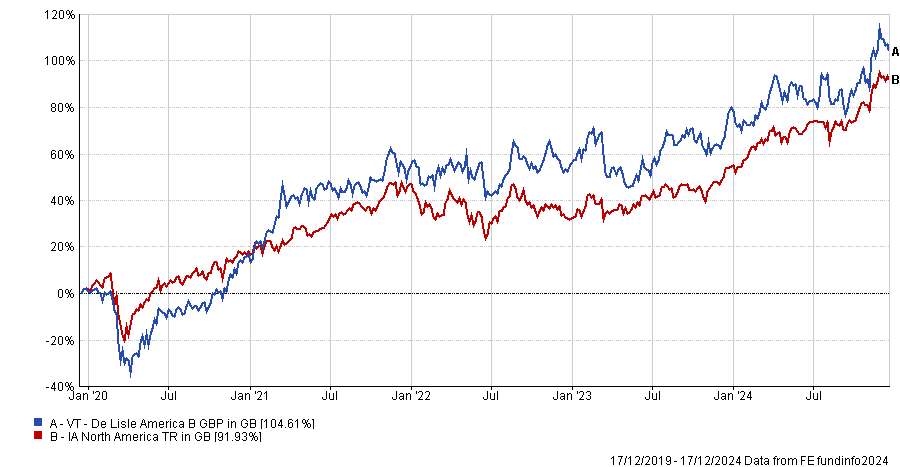

Performance of fund vs sector over 5yrs

Source: FE Analytics

Investors could add niche strategies for diversification, such as a portfolio of insurance companies. Dominic Evans and Nick Martin at Polar Capital Insurance look through their stocks to come up with an average price-to-book ratio of 1.6 and a 16% return on capital. “Dividing one by the other gets you to a 10% prospective return,” Allen said.

He has also invested in frontier markets, which offer double-digit growth and 5% dividend yields, with stocks trading on very reasonable multiples. “You get the best of both worlds – apart from the fact that every so often it’ll blow up.”

Allen holds the BlackRock Frontiers investment trust and Fiera Oaks EM Select.

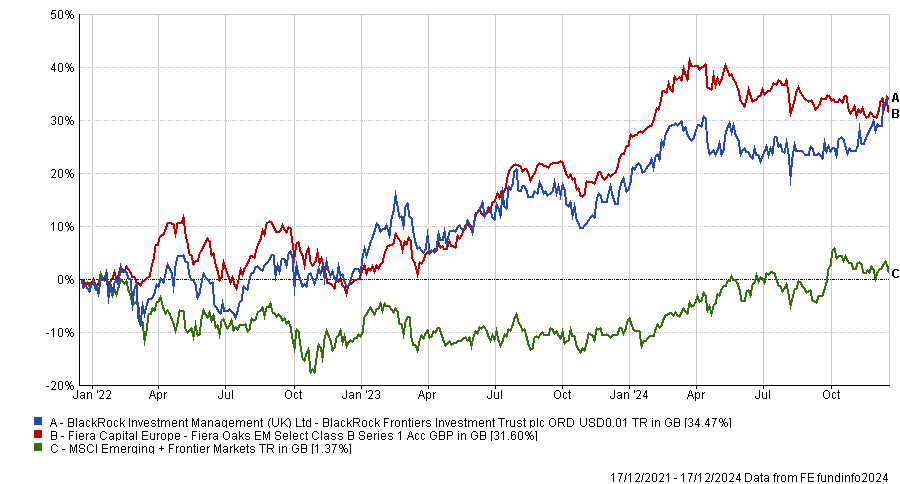

Performance of fund and trust vs MSCI Emerging + Frontier Markets over 3yrs

Source: FE Analytics

Sam Vecht and Emily Fletcher at BlackRock Frontiers have extensive experience, love what they do, travel a lot to see companies and “kiss a lot of frogs”, and have BlackRock’s deep resources at their disposal. The one drawback is the fund's performance fee, said Allen, who believes performance fees are “counterproductive to long-term returns”.

Stefan Böttcher and Dominic Bokor-Ingram at Fiera Capital are also very experienced, know their companies well, are prepared to travel and are not bound by a benchmark. Their investment in Greek equities has been a tailwind for the past few years.

Diversifying ‘middle’ assets

Several infrastructure and renewable energy investment trusts are trading at decade lows in terms of their discounts to net asset value (NAV), Allen said.

He highlighted International Public Partnerships, a core infrastructure trust with a 6.8% dividend yield, which is well covered, and a 20% discount to NAV. About 70% of its earnings are tied to inflation, so if inflation rises 1%, its earnings will increase by 0.7%.

He also likes Greencoat UK Wind, which has consistently increased its dividend yield (currently 8.5%) along with inflation.

Allen recently reduced his allocation to credit because spreads are so tight. Here, he favours strategic bond managers who can tactically adjust their exposure to credit risk and duration, such as TwentyFour Dynamic Bond and Schroder Strategic Bond.

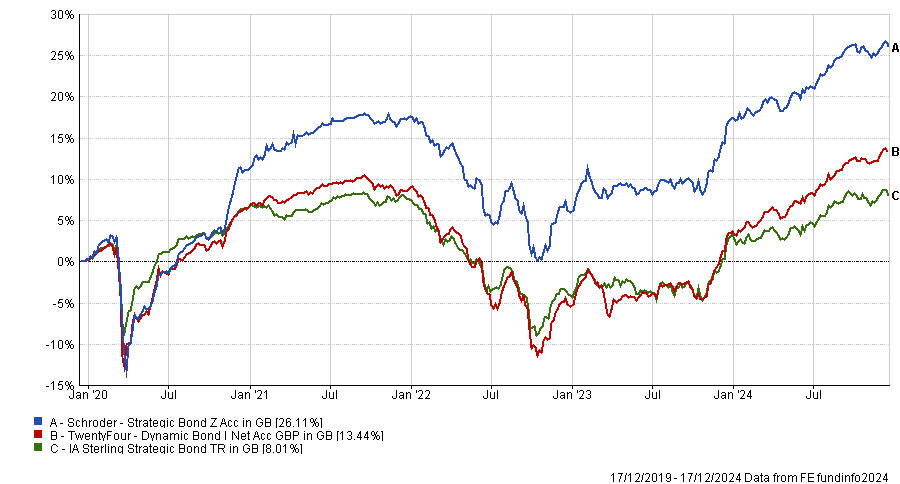

Performance of funds vs sector over 5yrs

Source: FE Analytics

TwentyFour Asset Management takes a pragmatic approach, endeavouring to make decent returns for the risk taken and avoiding areas where that isn’t possible. The fund’s allocation to Additional Tier 1 (AT1) bonds has been “a real kicker”.

Schroders’ bond team has astutely chosen when to increase credit risk and has kept duration short through the recent cycle, he noted.