Investors could be missing out on some long-term gains by dismissing the opportunities that the Covid-19 pandemic has offered for UK value stocks, says RWC Partners’ Ian Lance.

Value stocks have underperformed for some time as market conditions have favoured companies with more reliable growth prospects, opening up a wide valuation gap between the two.

“Valuations have become very irrational and have reached the point where they are excessively punished for a temporary earnings decline,” said Lance, who oversees the £269m TM RWC UK Equity Income fund. “Therefore, we believe that the current market throws up the opportunity to buy great companies with long-term returns and earning potential.”

Lance said some of the most interesting investment opportunities throughout the crisis have been in value stocks.

And with the value stocks showing signs of outperformance more recently, investors could be poised for a change in market leadership.

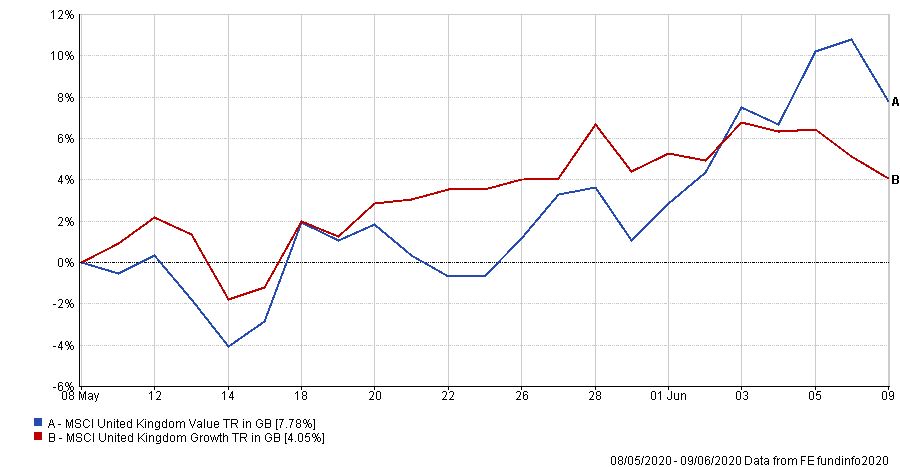

As the below chart shows, the MSCI United Kingdom Value index is up by 7.78 per cent, compared with a gain of 4.05 per cent for its growth counterpart over the past month.

Performance of indices over 1mth

Source: FE Analytics

As such, Lance has highlighted some stocks below where he believes their value lies in the highly profitable subsidiaries that make up parts of the group. What links them all, however, is that they’re all unloved and have decent long-term potential.

“Each of these companies has a strong franchise within them that is being undervalued by a market that is fixated on short-term earnings momentum and hence creating some genuine bargains in the market today,” he said.

Royal Mail

Starting with profitable subsidiaries, the Royal Mail Group has been one of the success stories of the past few weeks. While the stock crumbled to a low of around 120p in the middle of April, it has since rallied by more than 40 per cent.

Royal Mail owns European parcels business, General Logistics Systems (GLS), which makes a 6-7 per cent margin in a normal market environment and has been the beneficiary of the considerable structural growth of online retail, according to Lance.

In 2019, GLS made an operating profit of £180m and is therefore worth £2bn assuming a price-to-earnings (P/E) multiple of 11x.

“The current market cap of the entire group is £1.7bn and therefore the UK business is not just in for free but actually valued at around £300m,” said the UK income manager.

Royal Mail is a top-10 holding in the TM RWC UK Equity Income fund, representing 4.4 per cent of the portfolio.

BT

The recent decision to suspend its annual divided until 2022 sent BT’s market value to an 11-year low.

However, there has been a resurgence in its share price since stories surfaced that BT might be about to monetise a stake in subsidiary Openreach, according to Lance.

Operating the UK’s nationwide broadband network, BT’s Openreach division generates £2.6bn of earnings before interest, tax, depreciation and amortisation (EBITDA) which the RWC manager values at £22bn.

Considering plans to bolster its fibre broadband infrastructure and adoption of 5G networks is encouraging for BT’s core earnings. “The enterprise value of the entire group is currently £31bn meaning that all the other businesses are being valued at £9bn, which is only 3x their historic cash EBIT [earnings before interest and tax] of £2.8bn,” said the TM RWC UK Equity Income fund manager.

Marks & Spencer

Marks & Spencer have a food retail business which makes £237m in earnings before interest & tax (EBIT), according to RWC’s Lance.

“If we value this at 12x historical EBIT, add their £750m investment [in online supermarket] Ocado at cost – less the future performance payments, take away net debt and give no benefit for the company’s freehold property, the total is around £2bn,” said the manager. “Which is in line with today’s market cap.”

“The entire clothing and home business, which is still the largest clothes retailer in the UK and which last year made a profit of £224m, is therefore in for free.”

ITV

“ITV is, in effect two business,” Lance said. “Broadcasting which is very reliant on advertising revenue and content production.”

In 2019, the content production business made EBIT of £267m and can be valued at around £3.5bn (or 13x EBIT).

Nevertheless, the enterprise value of the entire group is £3.8bn meaning that the broadcast business which last year made £500m of EBIT is being valued at around £300m in the stock market.

“Another way to think about this is that companies like Netflix spend around $15bn a year on content production,” he said. “For a fraction of this, they could have ITV’s entire back catalogue and all future content.”

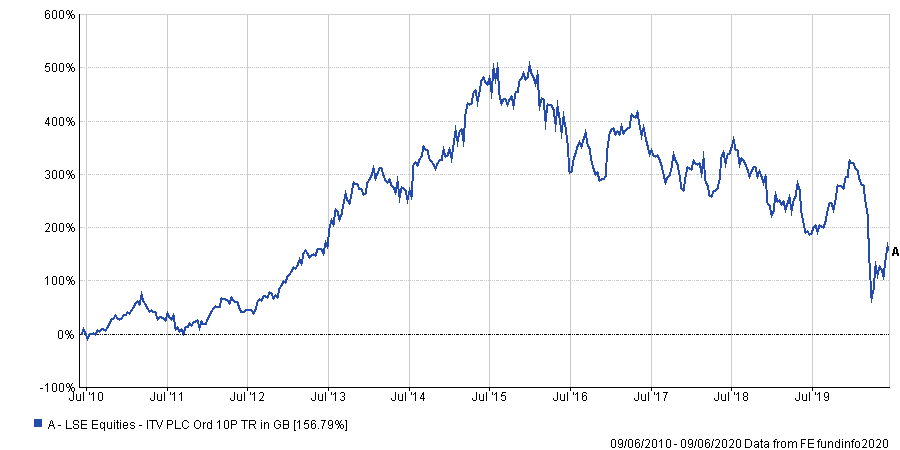

Performance of stock over 10yrs

Source: FE Analytics

Data from FE Analytics shows the stock has made a total return 156.79 per cent over the last decade, having fallen by 39.02 per cent since the start of the year.

Capita

Finally, services provider Capita has a software business which made just over £100m of EBIT during 2019.

“As these businesses are high margin – which is 28 per cent in this case – they tend to be valued quite highly,” the RWC manager said.

Compared to the other peers, using a relatively low multiple of 15x would value this division at £1.5bn, which Lance said is not far short of the enterprise value of the entire group at less than £2bn.

“The rest of the businesses, which in 2019 made around £200m are thus only being valued at around 2x EBIT,” he explained.

The share price was trading at £35.76 on 1 June compared to a low of £24.13 on 1 April.

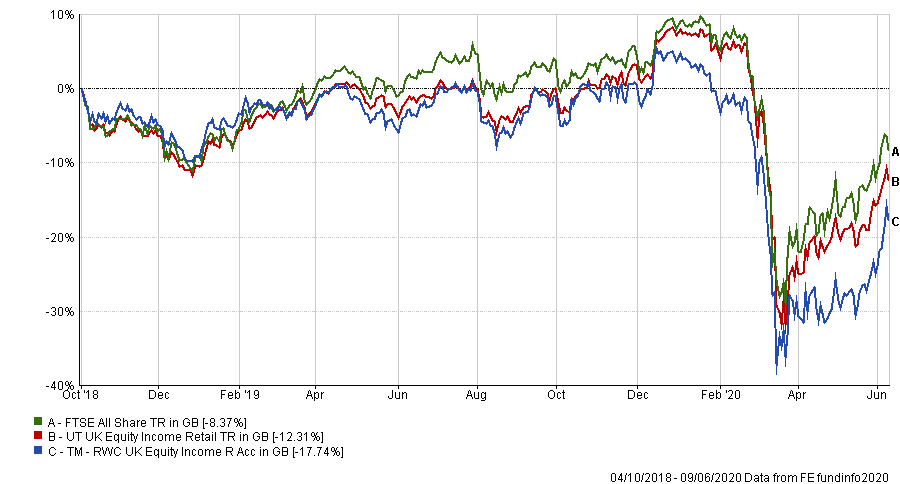

The TM RWC UK Equity Income fund has been managed by Lance and Nick Purves since launch in 2018. It invests across the UK market cap spectrum, with the managers sourcing opportunities from stock market overreactions.

The fund has made a loss of 17.74 per cent since launch underperforming the IA UK Equity Income average (a loss of 11.22 per cent) and its benchmark, the FTSE All Share index, which made a loss of 8.37 per cent.

Performance of fund vs sector & benchmark since launch

Source: FE Analytics

It has an ongoing charges figure (OCF) of 0.8 per cent and a yield of 5.2 per cent.