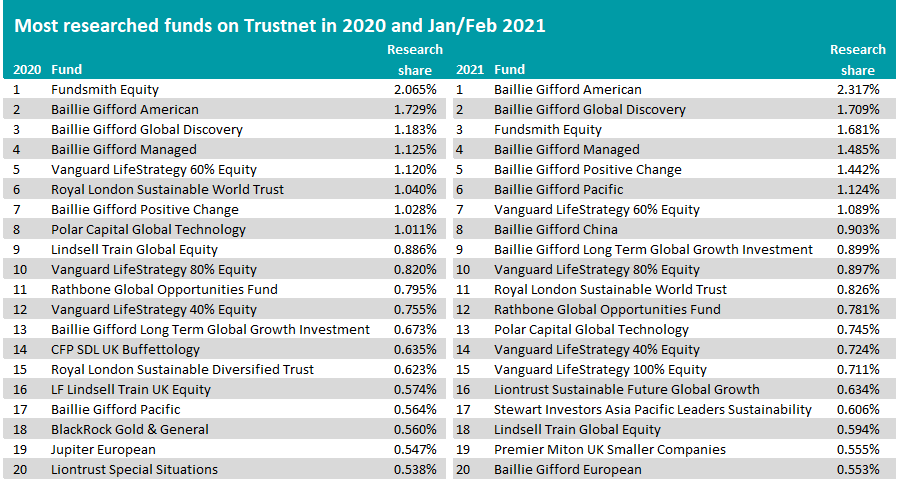

Baillie Gifford American is currently the most-researched fund on Trustnet, knocking Fundsmith Equity off the top spot after generating the industry’s highest return in 2020.

For several years, the £22.6bn Fundsmith Equity fund had the most viewed factsheet on Trustnet, reflecting its strong track record and the fact that it is one of the largest funds in the UK.

This proved to be the case again in 2020, when it accounted for just over 2 per cent of all the factsheet views into Investment Association funds on Trustnet, putting it in first place.

However, as the table below shows, Fundsmith Equity was pushed into third place over the opening two months of 2021 as its share of research fell to 1.68 per cent.

Source: Trustnet

Baillie Gifford American became the most-heavily viewed Trustnet factsheet after accounting for 2.32 per cent of research into the Investment Association universe in January and February.

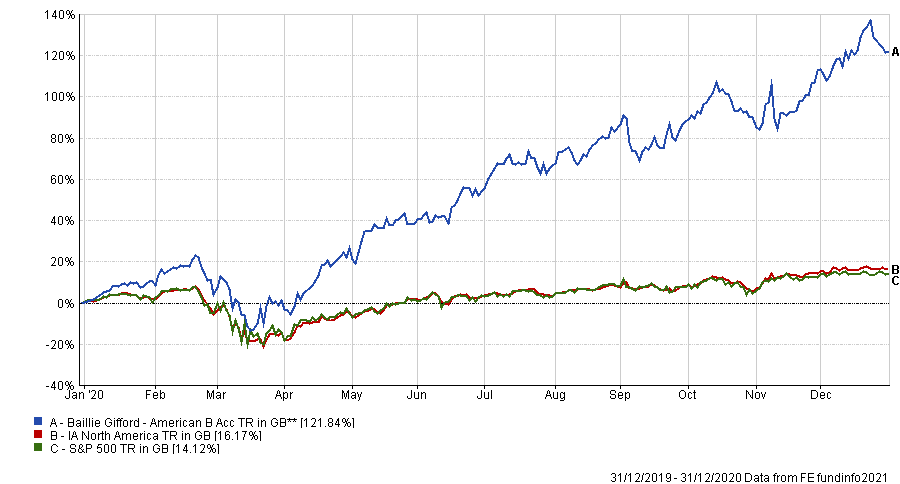

As will no doubt be familiar information by now, the £7bn fund made a total return of 121.84 per cent in 2020 – which was the highest return of the entire Investment Association universe. The average IA North America member, on the other hand, was up just 16.17 per cent.

The fund, which is run by FE fundinfo Alpha Manager Tom Slater and his team, is built around a concentrated portfolio of “exceptional growth businesses” and takes a view of at least five years.

Its top holdings include many so-called ‘coronavirus winners’ such as Amazon, Shopify, Netflix and Google parent Alphabet. Tesla, Baillie Gifford American’s biggest position, was up more than 700 per cent in 2020, although this year is proving tougher for the electric-car maker.

Performance of fund vs sector and index in 2020

Source: FE Analytics

Baillie Gifford American isn’t the only fund run by Baillie Gifford to prove popular with Trustnet readers, as Baillie Gifford Global Discovery is in second place with 1.7 per cent of factsheet views.

In 2020, six of Baillie Gifford’s funds were in the website’s 20 most-viewed factsheets, but this rose to eight in the opening months of 2021. Seven of the current top-10 are Baillie Gifford-run strategies.

This is down to the fact that Baillie Gifford American wasn’t the only fund from the group to make strong returns in 2020, with several of its other strategies topping their respective sectors. Baillie Gifford Long Term Global Growth Investment, for example, was the best performer in the competitive IA Global sector.

Index-tracking giant Vanguard is also proving popular with Trustnet readers in 2021. Four of the Vanguard LifeStrategy funds – multi-asset portfolios built from underlying Vanguard trackers – are among the top-20 most-viewed factsheets.

The five funds in the LifeStrategy range have become popular core holdings and are used by many financial advisers as building blocks in client portfolios.

LF Lindsell Train UK Equity has fallen out of the 20 most-researched factsheets so far this year.

The £6.4bn vehicle, which is headed up by FE fundinfo Alpha Manager Nick Train, is in the IA UK All Companies sector’s bottom decile over 2021 so far as market leadership moves away from the growth stocks preferred by the fund towards value.

However, stablemate Lindsell Train Global Equity – which has one of the IA Global sector’s strongest track records – remains in the 20 most-viewed Trustnet factsheets. Its rank has slipped from ninth in 2020 to 18th this year, however.

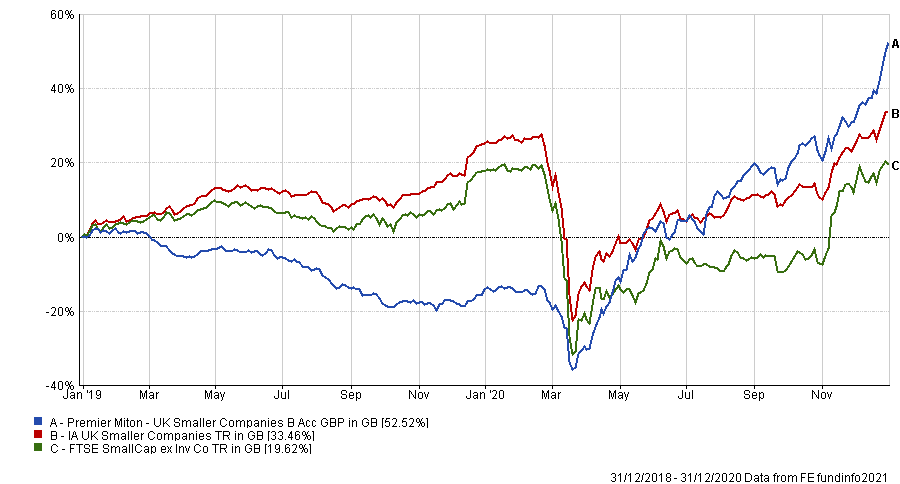

Meanwhile, Gervais Williams and Martin Turner’s Premier Miton UK Smaller Companies fund is the most popular UK strategy among Trustnet readers this year.

The fund recovered from a 2019 in which it was one of the worst smaller companies funds (losing 14 per cent when its average peer was up 25 per cent) to become the seventh-strongest fund in the whole Investment Association universe last year with a 77.33 per cent total return.

Performance of fund vs sector and index over 2019 and 2020

Source: FE Analytics

It’s also the highest returner over 2021 so far out of the 381 funds in the IA UK All Companies, IA UK Equity Income and IA UK Smaller Companies sectors, gaining 18.76 per cent in the first two months.