The cheapness of investment trusts is both a problem and a boon to investors, who can access great investment opportunities at a bargain, but also risk a lot if the discount on their trust of choice becomes entrenched.

More than 30% of trusts with a five-year track record are now trading at double-digit discounts, so there’s plenty to choose from. That’s why it’s crucial to be able to tell the lost causes apart from the discounts that are untenable and possibly ready to close.

Below, Winterflood’s Shavar Halberstadt and James Wallace select the trusts that they believe are ready to re-rate.

US equities

Pershing Square Holdings has been an excellent performer, beating the S&P500 over the past 12 months bolstered by payoffs from tail-risk hedging strategies that were designed to limit both costs and downside risks.

Yet it has been trading at an entrenched discount for several years (currently 24.4%) without a clear motivation, according to Halberstadt.

Performance of trust against sector over 1yr

Source: FE Analytics

There are several reasons why he thinks the shares may re-rate this year. Firstly, it recently announced measures to reduce the manager’s variable performance fee provision, which should be well received among institutional investors.

Pershing chief executive officer and activist hedge fund investor Bill Ackman is also intending to launch a prospective US fund, whose fees earned could be used to reduce costs on the present trust, Halberstadt noted.

The impact on management time should also be limited by portfolio similarity, given that the overwhelming majority of the Pershing Square Holdings portfolio is invested in very large and liquid US stocks.

“On top of that, Ackman’s controversial media prominence has coincided with a narrowing of the discount and this is likely to increase over the coming months, as the new fund is launched,” the analyst said.

Biotech

In a much less-loved sector, RTW Biotech Opportunities stood out to Halberstadt for the number of milestones hit in 2023, including Merck’s takeover of the trust’s holding Prometheus, netting $92m of proceeds.

This coincided with a 4% NAV uplift from the top holding Rocket Pharma as well as a number of successes in 2024 from another company started by the trust, Ji Xing Pharmaceuticals.

Performance of trust against sector over 1yr

Source: FE Analytics

“The fund’s company formation efforts seem to be successful, while investment selection more widely has been validated by transaction evidence,” the analyst said.

“We expect the relaxation of monetary policy will have a beneficial impact on high-growth sectors in general, and given that the biotech sector is particularly interest-rate sensitive, we would not be surprised to see a re-rate as a result.”

Tech

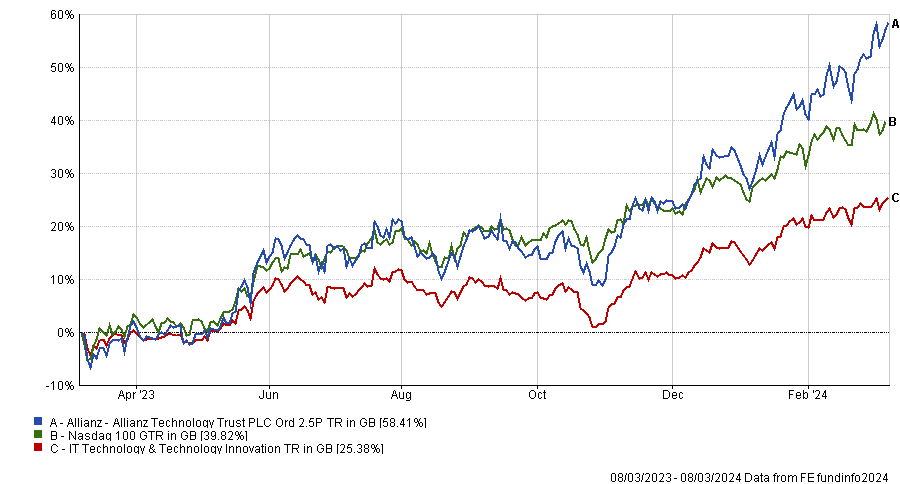

On an active buyback program, the Allianz Technology Trust is struggling to contain its discount, currently at 13% – well wider than its long-term average.

Its performance, however, has been surprising given its mid-cap bias in a period when a select number of mega-cap tech stocks are proving dominant. Against all odds, the trust’s NAV total return has kept pace with the Dow Jones Global Technology Index over the past 12 months and outperformed the NASDAQ 100, as shown in the chart below.

Performance of trust against sector over 1yr

Source: FE Analytics

“The alignment of portfolio construction to structural themes such as cybersecurity, cloud and artificial intelligence has driven these returns, yet this has not been fully recognised in the share price,” Halberstadt said.

“Rate cuts over the year should certainly benefit the sector and, should the concentration of market leadership disperse over this year, we expect this trust to fare particularly well.”

Infrastructure

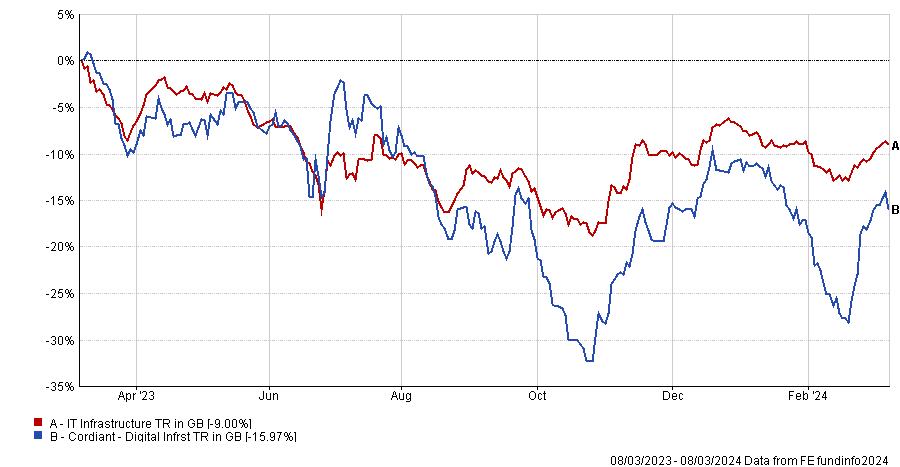

Moving away from equities, Cordiant Digital Infrastructure is another currently that represents “an interesting discount opportunity” as it trades at a 43% discount to net asset value (NAV).

This level of cheapness is usually reserved for trusts that are struggling with stretched balance sheets, hold speculative assets or are in managed wind-down, but none of these characteristics apply to Cordiant Digital Infrastructure.

Performance of trust against sector over 1yr

Source: FE Analytics

“The steep discount has been driven by the struggles of its closest peer, Digital 9 Infrastructure, which is facing severe cash constraints, forcing a dividend suspension and eventual sale of its 'crown jewel' asset,” Wallace explained.

“The companies in the Cordiant portfolio are significantly more mature and have significantly lower capital expenditure requirements. Once the dissimilarity with its troubled peer is fully absorbed by the market, we believe the trust is set for a re-rating in 2024.”

It has “strong” dividend coverage of 1.5x adjusted funds from operations (AFFO) and dividend yield of 6.3%, he concluded.