Royal London has topped the rankings for the most consistent mixed-asset cautious funds of the decade, data from FE Analytics has shown.

Coming out on top of the cautious multi-asset Investment Association sectors, the Royal London Sustainable Managed Growth Trust and the Royal London Sustainable Diversified Trust have achieved what none of their peers have – beating the sector average in nine years of the past 10.

Both funds are run by FE fundinfo Alpha Managers – the former by Shalin Shah, and the latter by Mike Fox. For both, 2022 was the culprit year that spoilt an otherwise almost-perfect track record.

RSMR analysts praised the good performance of the whole Royal London sustainable multi-asset range, which, they said, “is testament to the in-depth analysis carried out by the team, which should be capable of continuing to deliver competitive risk adjusted returns whilst focusing on investments which are helping to make a positive change to society and the environment”.

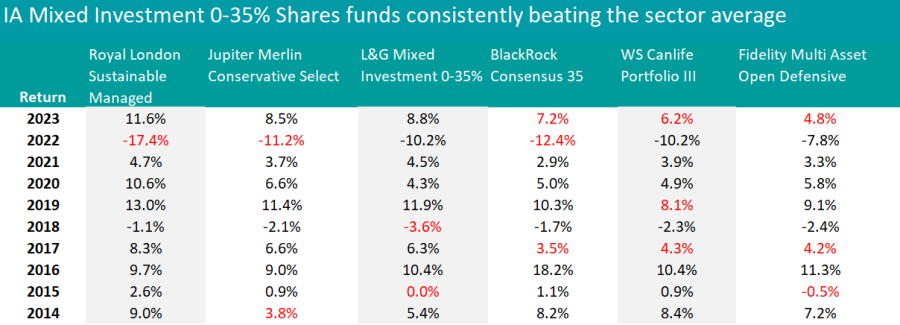

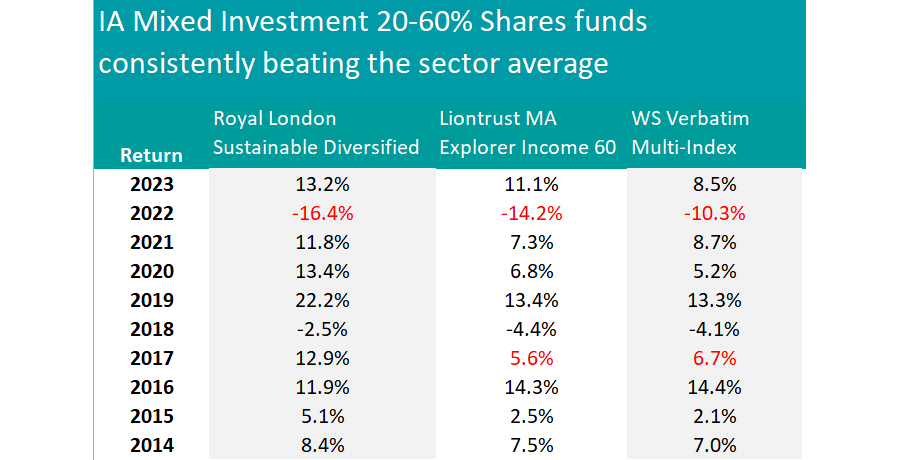

These results of the two vehicles are unparalleled in both their sectors – the IA Mixed Investment 0-35% Shares and the IA Mixed Investment 20-60% Shares, where most strategies failed to outperform the average peer in more than five years of the past decade.

A handful of funds however were a bit more consistent than that, outperforming the sector average in seven or more years. We highlight them below.

In the IA Mixed Investment 0-35% Shares, Jupiter Merlin Conservative Select and L&G Mixed Investment 0-35% stood out by beating their peers in eight years out of 10.

Source: FE Analytics. The red highlight represent underperformance against the sector average.

With Alpha Manager John Chatfeild-Roberts at its helm, Square Mile analysts said Jupiter Merlin Conservative Select has one of “the most respected and experienced fund of funds teams in the UK market”.

“Overall, we hold this team in high regard and consider this a strong offering for investors seeking a product run by experienced and proven investors.”

The strategy is conviction-led and focuses on experienced fund managers with established track records. The top holdings include many of company’s own funds (Jupiter Corporate Bond makes up 33.8% of the portfolio), paired with other names such as Allianz Strategic Bond and WS Evenlode Income.

L&G Mixed Investment 0-35%, with its £849.9m of assets under management (AUM), was the largest fund in the list, despite having shrunk since April last year, when it held £1.2bn.

Its top-10 holdings are all L&G’s own bond funds or index trackers.

BlackRock Consensus 35, WS Canlife Portfolio III and Fidelity Multi Asset Open Defensive were also of note, beating their peers in seven years over the past decade.

Moving up the risk scale to the 20-60% Equity sector, Liontrust MA Explorer Income 60 and WS Verbatim Multi-Index Portfolio 4 have beaten their average peer in eight years since 2014.

Source: FE Analytics. The red highlight represent underperformance against the sector average.

Th Liontrust management team follows the philosophy that limiting losses in falling markets enhances long-term returns and bases its decision on valuations, increasing exposure to an asset class when it looks cheap and reducing it when it appears expensive. Currently, the main allocation is to global fixed interest (24.2%), followed by US equities (18.4%).

The WS Verbatim Multi-Index Portfolio 4 meanwhile is mainly invested in investment grade bonds (34.4%) and UK equity funds (14.7%).

Many more funds managed to enter the list when the hurdle was dropped to seven years out of 10, most notably Vanguard LifeStrategy 40% Equity, by far the most popular fund on the list, with an AUM of £6.2bn.

At £1bn, the second-biggest was CT Managed Equity & Bond, managed by Alex Lyle. This fund too is a collection of the asset manager’s own offering, with the top 10 holdings dominated by Columbia Threadneedle solutions, with an almost 50-50 split between equities and bonds.

Artemis Monthly Distribution also stood out for being “a strong option within a large sector”, according to RSMR analysts, who liked the blend of global equities, bonds and cash “to create a well-diversified underlying portfolio”.

The managers aim to deliver strong levels of income as well as capital growth with an “attractive” historic risk-adjusted returns.

This article is part of an ongoing series on consistency. Find the previous instalments here: Emerging Markets, IA Global, Europe, IA UK Equity, IA UK Equity Income, UK Small Caps, UK bonds.