With ISA season approaching, it is natural to think about where – and how – to invest for the new tax year. In terms of the where, I must admit I am a little biased. As a multi-asset fund manager, it will be no surprise to you that I believe in a diversified multi-asset portfolio.

But how should we invest? Should we invest in passive funds or active funds?

I think there are good reasons for both approaches, and we can arguably get the best of both worlds by combining both.

The case for passive

Passive funds – arguably one of the most significant innovations in investment history – have gained increased investor attention in recent years. Their lower costs coupled with strong market performance during most of the post global financial crisis period are two key factors that have contributed to their exponential growth, particularly exchange-traded funds (ETFs).

But passive exposure does not always need to be all about cost. Passive funds can often provide an implementation advantage for portfolio constructors. For example, rather than investing in actively managed government bond funds, I instead generally prefer to access the asset class via the use of ETFs.

Active government bond funds are harder to find these days, and when you do find one, they offer limited ability to manage interest rate risk yourself. With ETFs, I can be more selective about what part of the yield curve I target, and therefore be more precise in managing interest rate sensitivity. I can also make a regional call on which bonds to own more or less of.

In some cases, the ‘market’ tends to outperform the average active manager, with US equities being the most prominent example. It is a highly efficient market that can prove difficult to persistently outperform. However, it is now heavily concentrated, with the top five stocks accounting for more of the S&P 500 index than they have done for decades.

With passive funds you don’t just have to own the ‘market’ – you can invest in passive funds with a bit more nuance. For example, an S&P 500 equal weight ETF would reduce that concentration issue. Or for those who believe that those top stocks currently dominating the index will continue to drive performance, perhaps a Nasdaq ETF would suit.

When discussing the merits of passive funds, I tell people that I don’t believe in passive investing, but I do believe in passive investments. I just think they need to be used actively because the nature of markets can (and does) change over time.

The case for active

While passive investments typically track or replicate a given index, active investments are run by managers who select specific investments based on an assessment of their intrinsic value. Rather than ‘owning the market’ they aim to ‘beat the market’.

Deviating from the market inherently means taking active risk, which is often expressed as either active share or tracking error. Generally speaking, the higher the active share or tracking error is, the higher the likelihood that your performance will be different to the market. There is no guarantee that it will be positively different, but the potential is there.

Active investments may be perceived as more attractive in periods when future returns from markets are not expected to be high. It’s worth remembering that since the market trough during the financial crisis, global equities have delivered around 12% annualised for sterling investors. With some equity markets at or close to all-time highs, it would be fair to question how repeatable those returns are over the next few years. Active investments may be needed to generate a higher return than the market can provide.

A further appeal of active management is that, unlike passive investing, it recognises the innate inefficiency and irrationality of markets and their participants. This can be particularly powerful in more specialised areas such as small and mid-caps or emerging markets.

Both of these areas tend to be under-owned and under-researched relative to their larger and more developed counterparts. This relative lack of efficiency creates a richer hunting ground for active managers to generate outperformance. Again, there is no guarantee that they will, but I would argue that they have a greater chance of doing so than in more efficient markets.

I think it also pays off to be more active when investing in corporate bonds, whether it be in the investment grade or the high yield space. There is a significant gap between the highest and lowest quality companies in this space and higher interest rates mean that many of those companies will likely need to refinance at higher costs. Understanding a company’s financial fundamental position by interrogating its business model and financial statements has become more important than it has been for quite some time.

The case for a blended approach

Active investments and passive investments have their own pros and cons. I think that by combining both approaches, your portfolios can benefit from the potential advantages that each have to offer.

In this regard I do put my money where my mouth is. The Summit Growth multi-asset funds that I manage are designed with this very idea in mind and typically have a broadly even split between active and passive underlying funds.

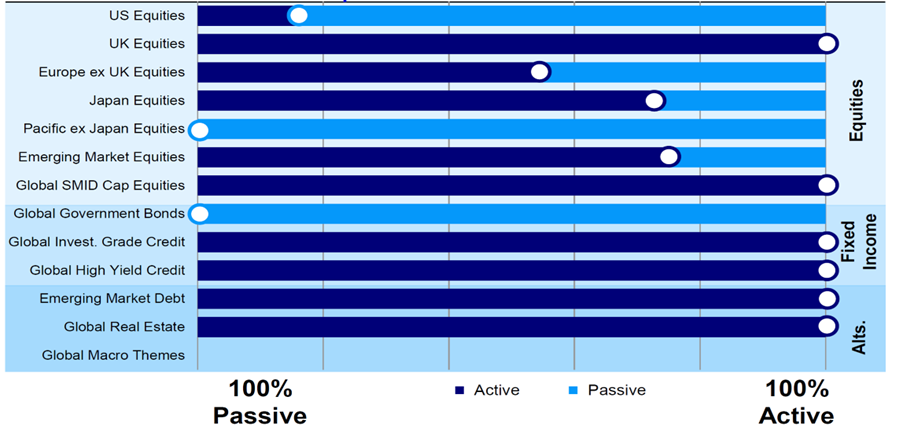

The chart below shows the active/passive breakdown by asset class of the ‘balanced’ portfolio within the range.

Source: Invesco as at 31 December 2023. Data shown is representative of Invesco Summit Growth 3 Fund (UK) used for illustrative purposes.

My aim is to deploy our ‘active risk’ where we have a stronger chance of being rewarded, and to use passive funds (in my case ETFs) where it provides us with a portfolio advantage, for example allowing us to better manage duration.

The chart above is just one example of how an investor can blend the two approaches. Depending on market conditions and other considerations such as cost, any number of blends may prove effective.

Having flexibility is the key. The next few years are likely to see a more unpredictable market environment than we have been used to for much of the past 15 years. I think a blended approach gives investors a better toolkit to navigate it. Something for us all to bear in mind as we consider our next ISA investments. As for me, I’ll be going for a blended multi-asset fund!

David Aujla is a multi-asset strategies fund manager at Invesco. The views expressed above should not be taken as investment advice.