One of the main selling points of active investing is fund managers’ ability to beat a reference benchmark, but not all strategies are equally good at that.

Experts measure the success of active decisions through alpha, an indicator for how much a manager has outperformed a relevant index.

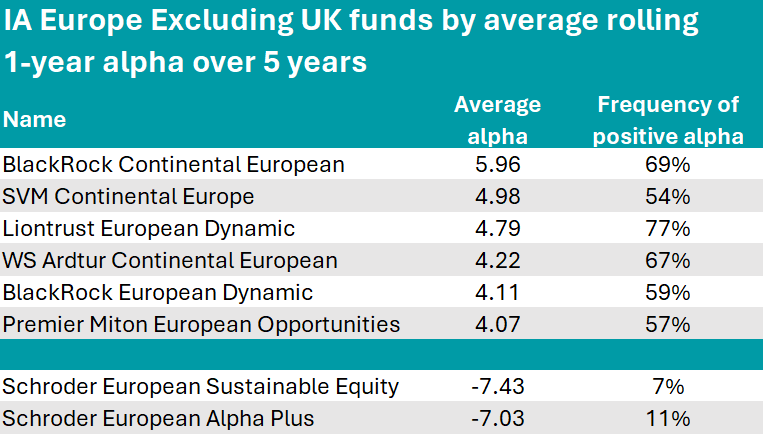

Below, we highlight European equity funds that excelled in the past five years by measuring their alpha scores in 61 year-long periods since the beginning of 2018 until today and averaging it.

We begin with the IA Europe Excluding UK sector, where the clear winner, standing one whole point above its next competitor, was the BlackRock Continental European fund, with an average alpha of 5.96.

Co-managed by FE fundinfo Alpha Manager Giles Rothbarth and Stefan Gries, this active strategy was described by Rayner Spencer Mills Research (RSMR) analysts as a good core fund.

“BlackRock has an extremely strong European equity team. The two experienced co-managers are backed up by the company’s very large, experienced and stable research resource,” they said.

“Performance has been consistent and the fund is managed with a well-defined investment process which is consistently applied.”

The managers focus on companies with sustainable cash returns and unique franchises. There is a tilt towards growth and a distinct bias towards large-cap holdings, although the fund can invest across all market capitalisations.

Source: FinXL

BlackRock made the list a second time with the BlackRock European Dynamic fund, also managed by Rothbarth. This vehicle is not constrained to any particular style of investing, allowing him the flexibility to take advantage of opportunities.

The fund’s main overweights against the FTSE World Europe ex UK index are consumer discretionary stocks, industrials and technology companies, while it is underweight healthcare and financials.

With an average alpha of 4.79, the £1.4m Liontrust European Dynamic fund stood out for keeping a positive alpha in 47 of the 61 periods considered – the longest among those in the table.

Co-managed by James Inglis-Jones and Samantha Gleave, this five FE fundinfo Crown-rated strategy invests in attractively valued, cash-generating companies run by managers who are committed to using cash flow in an intelligent manner, as noted by Square Mile analysts.

“There is a high representation of quality companies in the portfolio and the longterm performance record of the fund is excellent and suggestive that the managers are identifying anomalously priced securities,” they said.

“We like the managers’ adherence to their process, but this can mean that there will be periods where the market does not reward their stocks. This strategy is unlikely to suit investors who are looking for brief forays into Europe or for those seeking indexlike returns.”

Premier Miton European Opportunities, co-managed by FE fundinfo Alpha Managers Carlos Moreno and Thomas Brown, flanked by Russell Champion, concludes the list.

At the foot of the table, with active portfolio decisions detracting from the funds’ performance, are two Schroders funds, Schroder European Sustainable Equity and Schroder European Alpha Plus, with alpha scores averaging at -7.43 and -7.03, respectively.

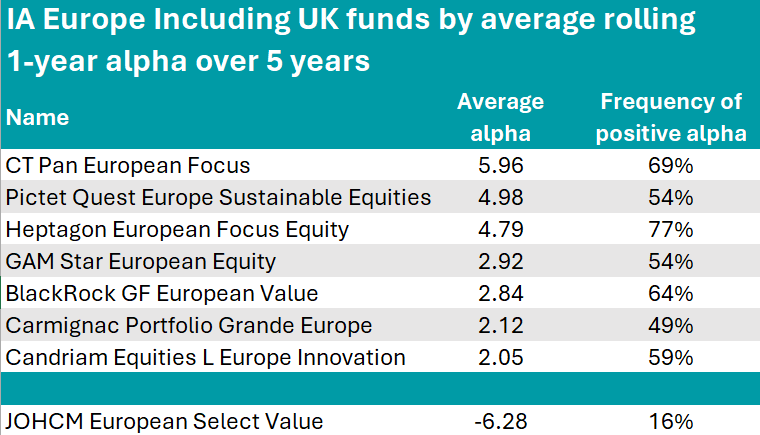

Moving on to the IA Europe Including UK sector, CT Pan European Focus topped the table.

This small strategy, with just £69.4m of assets, is managed by FE Alpha Manager Frederic Jeanmaire, who takes a high-conviction approach, investing in companies whose current share price in his view does not reflect the business’ future prospects.

The portfolio holds 43 stocks, including Rolls-Royce (5.8%), French defence company Safran (5.3%) and French automation and energy management company Schneider Electric (5.1%).

Source: FinXL

The €1.6bn Pictet Quest Europe Sustainable Equities fund was another good performer, achieving a FE fundinfo Crown Rating of five and an average alpha of 5.06. Over the past 61 year-long periods, Laurent Nguyen’s active decisions contributed positively to performance 89% of the time.

Financials and industrials are the key sector exposures, while geographically, the fund is tiled towards the UK (25.7%), Switzerland (15.2%) and France (12.8%).

The €70m Heptagon European Focus Equity managed by Christian Diebitsch came in third with a portfolio of just 22 holdings selected through a bottom-up, low turnover strategy. Its top-three positions are Novo Nordisk (9.3%), ASML (6.7%) and Hermes International (6.2%).

The sore thumb in this sector was the JOHCM European Select Value fund, which had a negative average alpha of -6.28. During the past few years, value strategies in general have struggled.

Sectors previously in this series: UK Equity Income, UK All Companies, Global, Global Equity Income, Sterling bonds, smaller companies, global bonds, cautious funds, balanced and adventurous funds.