Generative artificial intelligence (AI) has the potential to create huge growth opportunities but the tricky part for investors will be discerning which companies stand to benefit the most – and they may not necessarily be the Magnificent Seven.

To that end, Trustnet asked some of the best performing US equity managers (all of whom have been nominated for the FE fundinfo Alpha Manager of the Year awards) whether the market got too carried away with AI hype and whether they are finding better value elsewhere.

AI has torn up the rule book

Tom Slater, who manages Baillie Gifford American and Scottish Mortgage, said generative AI has created new rules and new business models, which for investors will require new ways of evaluating stocks.

“A technology’s architecture can determine the strategies and business models open to a company. This dynamic is often underappreciated,” he said. The cloud and mobile internet era favoured a small number of dominant giants but going forward, “AI dictates a new set of rules regarding what is possible”.

“We have yet to determine the limits of this technology or how quickly it will continue to improve. The applications and the impacts will get more dramatic the longer we stay on the current trajectory of progress. For the growth investor, things are just starting to get interesting,” he observed.

“Where we find signs of traction, we must be prepared to embrace ‘growth at an unreasonable price’. This means that for the eventual winners, the opportunity will be massively underestimated, and the others will have been vastly overpriced.”

To find those winners, Slater is looking for companies that are still run by their founders, as they can react in ”radical ways” if they believe it is in their long-term interests, he said.

“Tobias Lütke at the e-commerce platform Shopify pivoted from building an infrastructure for online deliveries to focusing on AI within Shopify’s core products, to ensure it remains competitive. David Bazucki at gaming platform Roblox is growing its population rapidly, helped by real-time AI-powered translation removing communication barriers amongst users worldwide.”

Within healthcare, several companies are using technology to provide better standards of care to patients while lowering costs to healthcare systems, he continued, highlighting Moderna and Inspire as two portfolio holdings with significant potential.

Slater thinks excessive attention has been paid to the Magnificent Seven, making this “a particularly rewarding time to search for growth outside of the noise.”

The hallowed seven are only ‘magnificent’ if you pretend 2022 didn’t happen

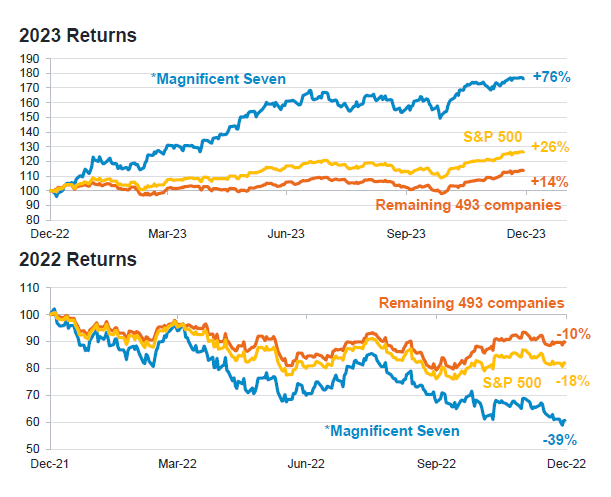

Aziz Hamzaogullari, founder, chief Investment officer and portfolio manager of the Growth Equity Strategies team at Loomis, Sayles & Co., said investors have become too short-termist when it comes to the Magnificent Seven, noting their performance last year was on the back of a disastrous 2022.

“The market’s obsession with the Magnificent Seven over the past year is emblematic of the pervasive short-sightedness that characterizes much of our profession. Their 2023 price performance was only magnificent if you pretend 2022 didn’t happen,” he said.

In 2022, the shares of each of the seven names declined between 26% and 65%, meaning that over the entire two-year period, an equal-weighted portfolio made up of just the select few US stocks would have made a cumulative return of just 8%.

“Of course, most investors did not experience even this return, because they define risk in terms of price volatility. As a result, we saw many of our peers sell those names in 2022 only to add back higher after much of the rebound had occurred in 2023,” he said.

Loomis, Sayles' Growth Equity Strategies team owns six of the seven (it has never owned Apple) but these are long-term investments with an average holding period of 12 years.

“We believe their strong and sustainable competitive advantages, attractive industry dynamics, compelling cash flow generation, visionary management teams and secular growth drivers will enable them to remain leaders,” he explained.

Returns from the Magnificent Seven in 2022 and 2023

Sources: Fidelity International, LHS Goldman Sachs Global Investment Research, returns in dollars.

There is life beyond the Magnificent Seven

Rosanna Burcheri, manager of Fidelity American Special Situations, said the US equity market has broadened out since the start of this year and a whole range of companies look attractive.

Several names have a return on invested cash flow above 25% including Aon, Lowe’s and McKesson. Companies with earnings per share growth for 2024-25 above 25% include Intel and Baker Hughes.

“The message is that there is life beyond the Magnificent Seven and there are an amazing amount of companies you can invest in,” she said.

A value strategy such as Fidelity American Special Situations offers diversification against the concentration of the benchmark in mega-cap tech, she suggested. Buying stocks at more attractive valuations also bakes in a margin of safety in case the market falters.

Arriving late to the party is risky

James Bullock, portfolio manager of the Lindsell Train North American Equity fund, believes technological advances will create wealth for investors but it is impossible to know the full impact of AI yet.

“History suggests that when a small number of stocks have driven performance, arriving late to the party is risky. Like the pandemic-induced shift to digital in 2021, AI has been the engine of optimism for many of these companies over the past year, though it is easy to forget that 18 months ago it was feared as a ‘Google-killer’,” he pointed out.

“As longer-term investors, we wonder whether it really was, or is, possible to know AI’s eventual impact, evolution and regulation.”

Bullock has found plenty of companies outside the Magnificent Seven that are benefitting from technological advancement.

“We view ownership of differentiated intellectual property and data as one of the more predictable ways to profit from its increased use. Fund holdings Adobe, Intuit, Verisk, S&P Global, CME, Visa, Equifax, Amex and PayPal all possess unique, industry-leading datasets serving important and growing end markets,” he explained.

Tech stocks will continue to benefit from strong tailwinds

Like Lindsell Train and Loomis, Sayles, the GQG Partners US Equity fund has a substantial technology allocation and is also overweight in the communication services sector. The fund’s managers, Rajiv Jain, Brian Kersmanc and Sudarshan Murthy, expect companies in these sectors to continue benefitting from “fundamental improvement, increasing product demand and upside from recent advances in generative artificial intelligence (AI) applications”.

They are also overweight utilities as they believe “demand for power is inflecting higher in certain areas of the US due to increased consumption”.