The board of The North American Income Trust has selected Janus Henderson as its new investment manager. The appointment will take effect in the third quarter of the year, pending the trust’s passing of the continuation vote.

This decision comes after a review of its existing management arrangements with abrdn and engagement with several other management groups.

The North American Income Trust’s board highlighted Janus Henderson’s “large and well-resourced” North American analyst team as a benefit for shareholders.

Board members expect this switch will lead to the creation of a portfolio of high-quality companies, characterised by revenue, earnings and dividends growth as well as to the reduction in the investment trust’s management fee.

Current manager Fran Radano will remain at the helm of the trust. He resigned from his role at abrdn and has agreed to join Janus Henderson where he will be supported by a team of 36 US equity analysts.

Dame Susan Rice, chair of The North American Income Trust, said: “Radano has managed the company’s portfolio for over 10 years and we believe that working closely with Janus Henderson’s broad and experienced equities desk in the US will bolster his ability to continue to find attractive investment opportunities in the North American market.

“Janus Henderson has strong credentials in North American equity income investment and we believe that this will lead to improved NAV performance while maintaining the company’s attractive dividend.”

The US equity team at Janus Henderson manages £180bn of assets and consists of 15 portfolio managers headed by head of US equities Marc Pinto.

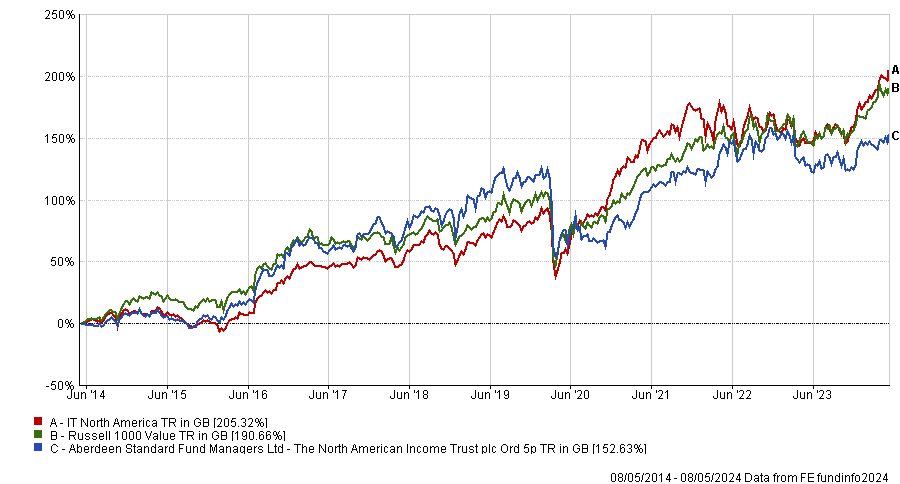

Performance of investment trust over 10yrs vs sector and benchmark

Source: FE Analytics

Over the past decade, The North American Income Trust has lagged both its benchmark and the IT North America sector, having only outpaced Middlefield Canadian Income Trust. It also sits at the bottom of the sector over five years.

Ewan Lovett-Turner, head of investment companies research at Numis Securities, said the move was “interesting”, noting that shareholders should benefit from a 13 basis point reduction in fees. Janus Henderson is also waiving three months’ worth of fees for shareholders while the trust moves across.

“However, some shareholders may have been hoping for more radical changes, given underwhelming relative performance under abrdn,” he said.

“It will be interesting to see if this is enough to stimulate additional demand with the shares currently trading at a 14% discount.”