One of the main purposes of capitalism is to incentivise investment in companies that use capital the most productively, with the stock market playing a major role in streamlining this process.

But for Ben Peters (pictured), co-manager of the Evenlode Global Income fund, one of the keys to outperforming the stock market is to find the companies where the laws of capitalism don’t seem to apply.

Peters aims to deliver a growing income distribution to clients through holding high-quality companies that have strong competitive positions and need limited amounts of capital reinvestment to drive their growth.

“If you find those two things, what you end up with is a good level of free cash flow in the company, which can be used to do things with – one of which is pay a dividend,” he said.

To find these companies, Peters begins screening for certain financial characteristics such as a high return on capital and high levels of free cash-flow generation. He will carry out further research on the companies that make it through these screens, using broker notes and analysis from competitors, before going to the original source of the data to obtain “an unfiltered view” on the financials.

However, the manager said that more important than this quantitative analysis is qualitative analysis: “Once we've identified a company with these financial characteristics, we then ask, why does this company have those characteristics and how likely are those characteristics to persist into the future and therefore deliver that income stream for our clients?”

Peters spends a lot of his time thinking about a company’s competitive position, in particular who is the customer, why do they go to that company and why do they value that company's goods and services?

This leads him to the most important question of all: why is that customer willing to pay over the odds to have access to that company’s goods and services?

“Capitalism and competition would suggest that if a company has attractive economics, then those attractive economics should eventually be competed away,” he added.

“But there are some companies where that doesn't seem to be the case. We need to ask the question why, and if we can satisfy ourselves that there is a good chance of the company persisting with its attractive financials into the future, and it ticks our boxes, it will go into our investable universe.”

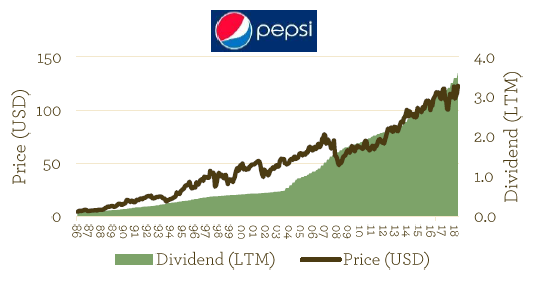

Performance of stock since 1986

Source: Evenlode

It is only after a company has made it through these filters that Peters will start looking at valuations, with the manager aiming to fill Evenlode Global Income with the highest quality companies available at the best prices.

The manager said that you often need to wait for up to five years before the economics of these companies are reflected in their valuations, and cautions against investing for a shorter period.

And, as a long-term investor, he said he has a responsibility to take a proactive approach to the businesses he holds.

“That means engaging with companies where we have a considered opinion about a certain matter and encouraging boards to better outcomes, in terms of things like governance structures,” the manager continued.

“Remuneration schemes have been a hot topic recently and obviously the environmental agenda has come very much to the fore in the last year or two. So we are engaging with companies on that sort of stuff, which we view as part of being good stewards of our clients' capital over the long term.”

Peters has been reasonably happy with the performance of his underlying holdings this year, saying the vast majority have coped well with the extreme conditions caused by the coronavirus crisis.

He has made a few disposals, however, and one of the stocks he ditched was Sabre, which operates a global distribution system for airline tickets. The manager noted the company has tended to be quite stable in past recessions, but pointed out its core business operates in one of the sectors that has suffered the most from the specific nature of this year’s downturn.

While its replacement – events ticketing business CTS Eventim – has also been hit hard, Peters said the difference between the two is that Sabre has debt while CTS has lots of cash.

Another stock he has sold out of is Disney.

“A surprisingly large amount of Disney's profit comes from operating theme parks,” he said.

“Ordinarily that is very stable and it will be a stable business in the future.

“Disney+ has also been very successful. While we think that if you are going to subscribe to any family entertainment package, Disney+ is probably going to be the one, we wonder what the cost is going to be of competing with Netflix and all the others in this space.

“The other thing is the media network which consists of things like ESPN, which is very difficult in this digital world because people are subscribing away from bundled TV packages and those divisions have some structural challenges.

“And Disney has debt after it acquired 20th Century Fox. It may work out OK, but we think the probability is our clients' capital is better elsewhere.”

Peters said the most important course of action he has taken throughout the crisis has been supporting Evenlode Global Income’s holdings to ensure they make it through the other side. And, even though he runs an income fund, he said this means backing company management when they announce a dividend cut or suspension.

“Dividend growth will be challenged this year, which will be undesirable but unavoidable,” he continued.

“But we are very supportive of companies taking difficult decisions. Companies that hang on to their dividend through hell and high water are doing their investors a disservice, and we appreciate a more flexible approach.”

He added: “We launched the UK income fund in the depths of the financial crisis in 2008, so it didn't necessarily feel like the most sensible thing to be doing with our careers at that point, but with the benefit of hindsight it was actually a pretty fantastic time to launch.

“What we saw then, and this will probably be the case after this crisis, is that of those companies that are weaker in terms of their competitive position and balance sheet, some will fall by the wayside. But you will also see those companies that are well resourced will come out with improved competitive positions.

“Although blind optimism might be taking it too far, this crisis will eventually pass and the companies we invest in are strong and will be able to thrive.”

Data from FE Analytics shows Evenlode Global Income has made 25.97 per cent since launch, compared with 25.59 per cent from the MSCI World index and 9.06 per cent from the IA Global Equity Income sector.

Performance of fund vs sector and index since launch

Source: FE Analytics

The £704m fund has ongoing charges of 0.85 per cent and is yielding 2.3 per cent.