Nick Train has apologised to shareholders for “disappointing” performance in the Finsbury Growth and Income trust’s half-year report after a poor set of results.

In the six months to 31st March 2022, the net asset value (NAV) was down 2.2% while the share price declined 3%. It means that the portfolio underperformed its peer group, which returned 4.7% over the same period.

The popular investment trust has been a top performer in the IT UK Equity Income sector over the past decade, up 186% but has dropped to the bottom quartile over the past one- and three-year periods.

Its growth bias has left it vulnerable in recent months, and it is down 8.7% over one year, 15.8 percentage points below the FTSE All Share benchmark.

Total return of trust vs sector and index over the past year

Source: FE Analytics

Some shareholders may be naturally disappointed, with Train stating it was “fine” for people to disinvest if they believe there are better opportunities elsewhere, noting that he has no intention of altering his strategy.

“Of course, shareholders may decide that this strategy is not for them and they prefer another style. That is fine, but I hope our consistency of approach and the clear articulation of the approach is valuable for shareholders when they make their, preferably, infrequent decisions about where to entrust their precious savings,” he said.

While some may be getting cold feet over the extended period of underperformance, Train himself has doubled down, increasing his personal investment in the company from £3.1m to £3.6m.

“As a significant shareholder myself, I remain convinced that our investment philosophy – of running a concentrated, low turnover portfolio, comprising shares in outstanding companies held for the very long term – remains the best way for me to deliver the returns we all hope for,” he said.

The board also believed the trust was good value over this time, opting to buy back almost 1.7 million shares at a cost of £14.4m.

Tracy Zhao, senior fund analyst, interactive investor, said: “His sizeable holdings in this trust means he is serving up far more than platitudes to shareholders.

Despite its poor performance, Finsbury Growth and Income was able to increase dividend pay outs by 3.8% per share compared to the year before.

Train also added that it would be a “disservice to shareholders” if he changed his philosophy of holding a concentrated number of assets while keeping turnover low, particularly at the moment when global stock markets are “apprehensive”.

“In such circumstances, I always remind myself of this, paraphrased, advice from the late, great investor Sir John Templeton: ‘The best time to buy sound common stocks is when events look most uncertain.’

“This is indeed great advice. Often events don’t work out as badly as people fear; but even if they do, owning shares in solid companies is a good strategy to see you through to the better days to come.”

There are currently 22 assets in the portfolio, with consumer staples and discretionary companies accounting for 65.1% of all holdings.

Rising inflation has significantly impacted these companies, but Train said that these sectors are showing signs of improvement.

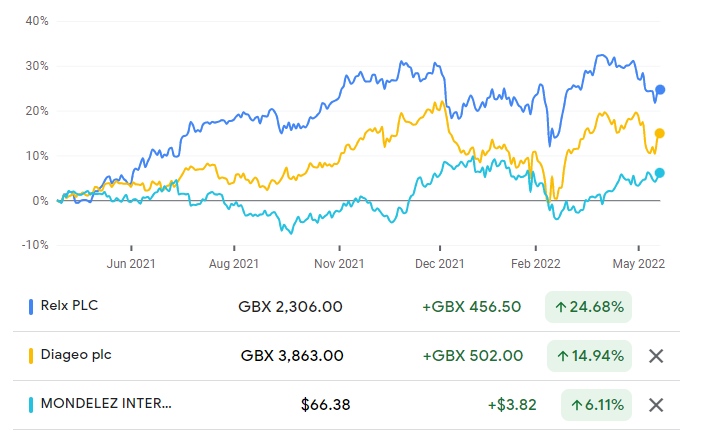

In fact, the shares of the trust’s top holdings in consumer staples/discretionary businesses RELX (12.7% of assets), Diageo (12.6%) and Mondelez (9.3%) all increased in over the past year.

Share price of trust’s top consumer staples/discretionary assets over the past year

Source: Google Finance

Meanwhile, the share price of one of its top financial holdings, the London Stock Exchange (10.2% of assets), broke even over the past year and Schroders declined by 18.6%.

Train pointed out that all holdings in the portfolio made a positive Return on Capital (RoC) over the past year, which is a company’s net income compared to its operating costs.

Hargreaves Lansdown had the highest RoC in the portfolio, but its share price was down 48.7% over the past 12 months.

Share price of Manchester United and Hargreaves Lansdown over the past year

Source: Google Finance

Likewise, Manchester United was the only holding in the trust that had a negative RoC, meaning it was spending more money than it was making. This was reflected in the share price, which was down 17.5% over the past year.