Passive funds have been eating the lunch of their actively managed counterparts for a long time but recent volatility has inspired a resurgence of sorts.

Tariff-inspired volatility brought about by US president Donald Trump’s ‘Liberation Day’ has benefited active managers who have been able to nimbly move in and out of stocks and protect investors during the market falls, while capturing more upside when it rebounds.

From 2 April to Wednesday’s close, some 95% of IA UK All Companies sector funds beat the FTSE 100, while 86% were ahead of the FTSE All Share. What’s more, many of the funds with poorer returns were passive, suggesting active funds had done even better than the initial headline numbers.

It is worth noting, however, that the market upswing on Thursday may impact the data again, as most active funds have only beaten the market during the down days.

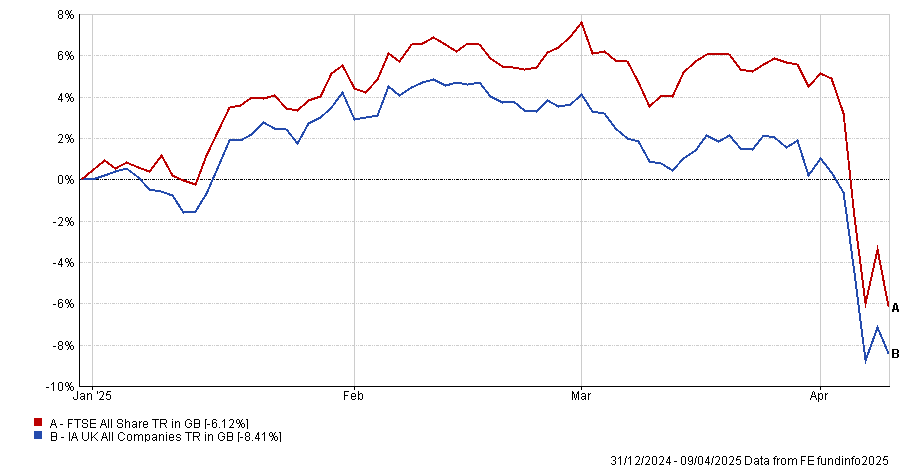

Even with a better week, active funds are still in the mire. Despite the FTSE All Share dropping 6.1% year to date (to Wednesday’s close), just 63 or 29% of funds in the IA UK All Companies sector have beaten the market. Of those 63 funds, several were passive or smart beta products, meaning active managers struggled even more than the data initially suggests. Things are even worse when comparing the sector to the FTSE 100, where just 18% of portfolios beat the large-cap index.

Performance of sector and index YTD

Source: FE Analytics

This is far from a new phenomenon. Only a fifth of the sector has beaten the FTSE 100 over the past one and three years, with this rising to 23% and 25% over five and 10 years respectively. The data is kinder versus the FTSE All Share index, but not by much, with 37% beating the index over three years. This then drops to 35% and 31% over five and 10 years, respectively.

Overall, the average fund in the IA UK All Companies sector has failed to beat either index in a calendar year since 2020 and has only done so four times in the past 10 years (not including 2025, when the average is behind the indices again).

This persistent performance problem has been noticed by investors – who have reacted in a big way. Laith Khalaf, head of investment research at AJ Bell, said money “is still gushing out of actively managed funds”, despite years of consistent net selling.

So what needs to change to get investors back into actives? Below, Trustnet asked experts what will encourage investors to put their faith in active funds once again.

Behavioural change

UK active managers' continued struggles are partly due to investors' unwillingness to part from passive strategies, Khalaf explained. Many investors have “got out of the habit of selecting active funds” because passives are comparatively effective and cheap, he argued, as well as being more consistent performers.

“Lower passive fees, risk aversion compared to the index, and increasingly less engaged investors” means that some have little desire to pay up in the hope of beating the market.

Alex Paget, fund manager of the VT Downing Fox multi-asset fund range, added that, while the market this year has been “definitely more conducive for active manager outperformance", they have yet to prove themselves.

“I do not know why, but I think it is because people allocate passively these days. All recent volatility has done is make people move their money from an S&P 500 or global tracker to a FTSE 100 tracker,” he added.

Rob Morgan, chief analyst at Charles Stanley Direct, said: “Old habits die hard, and momentum takes a long time to revert.” While this was an “unhealthy approach” to markets, investors' tendency to base buying decisions on past performance means it will be “hard to turn this passive narrative around” until active managers consistently improve.

A move to mid-caps

The other factor that would exponentially help active managers is investors looking further down the market capitalisation spectrum. Many UK active equity managers find opportunities in the small and mid-cap space but this has been a struggle in recent years as large-caps have dominated.

Paget said, “I think for active managers to enter a new golden era, you need to see money filter down into small-caps.”

“Particularly good active managers” will have been increasing their allocations towards small- and mid-caps over recent years as valuations have fallen, he said, but noted this has been an “extreme headwind”, particularly in 2025, as this area of the market has “experienced one of the worst quarters compared to large-caps since the global financial crisis”.

Morgan agreed that better performance of smaller companies was the next step for an active manager resurgence.

The “aura of invincibility for big stocks has been inevitably tarnished” in recent weeks following the tariff debacle, he said, so UK active managers with overweights to small and mid-caps will “be rubbing their hands together at the opportunities”.

If a rotation were to take place, passive vehicles would need to struggle for some time for active managers to experience a true resurgence, Khalaf argued.

“Short bursts of underperformance are not enough to turn around the long-standing outflows from active managers. Passive vehicles would have to underperform for some considerable time to overturn the tide but, even then, it is a slow grind back,” he said.