Rogue US trade policies have made markets jittery. Tariffs, announced by US president Donald Trump earlier this month, have already caused two sell-offs and subsequent rallies, but despite the volatility, investors aren’t necessarily in panic mode, with many still showing signs of greed.

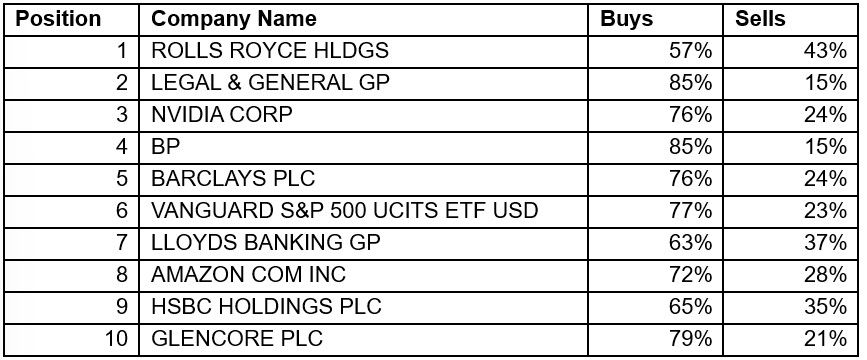

Net buys have surpassed net sell orders on interactive investor by 61% to 39% last week, with many still committing to the stocks that drove the market before Trump’s ‘Liberation Day’, according to investment platform interactive investor (ii).

The third most-traded stock on the platform between 3 April and 7 April was semiconductor darling Nvidia, with 76% of trades being buys. This was despite it losing 29% and being 35% lower than its record high.

Most traded investments on interactive investor 3 April – 7 April

Source: interactive investor

According to Richard Hunter, head of markets at ii, this is “evidence that investors are attempting to take advantage of market volatility by buying quality companies during the dip”.

Other areas of net buys included defence, such as Rolls Royce, and blue-chip companies, such as Legal and General.

Whether this greed is misplaced is up for debate, but there could be dangers waiting around the corner. As such, experts suggested places investors may wish to avoid when reallocating to markets.

US mega-caps, private equity and high-yield bonds

While Nvidia, Tesla and other technology companies had many net buyers among the market turmoil, these are exactly the type of stocks that Simon Evan-Cook, manager of the Downing funds-of-funds range, would avoid. He was already wary of the asset class at the start of the year.

“I’m avoiding tech mega-caps if for no other reason than they were at the heart of the previous decade-long megatrend and, when the tides turn, megatrend winners tend to end up out of favour for a long period of time,” he said.

Private equity also made him nervous, as at some point, “their private prices will have to reflect public anxiety”. He added: “High-yield bonds also look vulnerable, particularly if you’re expecting them to act as a defensive foil to equities.”

China and European equities

From purely an uncertainty standpoint, China is a particularly challenging place to invest right now, as Darius McDermott, managing director at Chelsea Financial Services, noted. It remains the only country not granted exemptions on Trump’s tariffs and tensions between the two major global powers continue to escalate.

“As a minority foreign investor from the West, you risk ending up as collateral damage if the situation escalates further,” he said.

Another risk investors need to factor in is the potential for the country to go to war with its neighbours. “In a worst-case scenario, if China were to invade Taiwan, your investments could become worthless overnight,” he said, as has been the case with those who invested in Russian assets prior to the country’s invasion of Ukraine.

Another area that could be hit hard by tariffs is Europe. Despite looking more stable than the US, the region faces tariff headwinds as it is home to many export-driven economies. The 25% auto tariff is particularly damaging for large car-producing countries, such as Germany.

“China’s ongoing devaluation of the yuan makes it harder for Europe to compete on exports and increases the risk that Chinese goods, redirected from the US, are dumped cheaply into European markets,” McDermott continued.

“Pharmaceutical tariffs would also be very bad news for the continent. Also, European equities have outperformed the US year-to-date, making them potentially more vulnerable – even if, on a relative basis, valuations are still lower.”

No particular areas

There isn’t anywhere Ben Yearsley, director of Fairview Investing, wouldn’t invest right now, provided that one is clear on why they are investing.

“I am looking to top up long-term positions I have at cheap prices,” he said. “What I’m not doing is looking to trade and make a quick buck out of fallen angels. It’s clear things have changed in the investment landscape, but the question is ‘What?’.

“At this stage, it isn’t an easy question to answer as the outcome of the tariff question is still unknown. One thing is clear – president Trump wants to build more stuff in the US and costs will be higher in the short term. In the long term, it’s probably good news for US companies. I still wouldn’t bet against the US.”