Having a portfolio that can protect during the down times and soar in rising markets is the ultimate goal for most investors, but achieving it is by no means straightforward.

One option is to diversify, putting together a collection of funds, trusts and shares that complement each other. One way to know if you have achieved this is to look at correlation.

If two funds are highly correlated to each other (that is, their performance often moves in parallel), the combination of the two is best avoided in a diversified portfolio, with the goal being to avoid losing all your money simultaneously should they both collapse.

In this series, Trustnet is looking at which funds within the IA UK All Companies sector are most correlated to each other over five years.

The £5bn Liontrust Special Situations fund, which we used as a benchmark for our analysis, is among the largest in the sector – competing for the top position with Lindsell Train UK Equity, which we recently looked into.

One of the hallmarks of the portfolio is that it has lower volatility than the sector average thanks to its quality bias – the team uses its economic advantage approach to identify stocks that have been around for a long time and can continue to thrive in all markets.

However, the fund will lag the index when investors are buying lower quality cyclical stocks, such as we have seen so far in 2022.

Headed by FE fundinfo Alpha Managers Anthony Cross and Julian Fosh, and the portfolio tends to be tilted towards capital-light industries such as software, engineering, healthcare and technology while shying away from traditional ‘value’ sectors such as banks, miners and housebuilders.

Paul Green, investment manager in the multi-manager team at Columbia Threadneedle Investments, noted similarities between Liontrust Special Situations and the other behemoth in the IA UK All Companies sector – Lindsell Train UK Equity.

“An overarching observation would be that the Liontrust fund would be quite highly correlated to Lindsell Train UK, given they both have a focus on quality growth businesses,” he said.

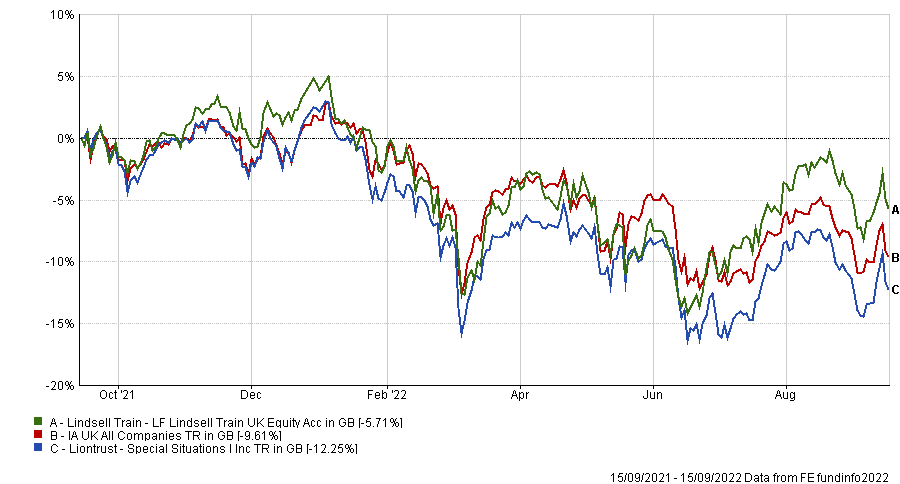

In fact, the two funds are 84% correlated, but distanced themselves recently at the two opposite sides of the peer group performance line, as shown in the graph below.

Performance of funds against sector over 1yr

Source: FE Analytics

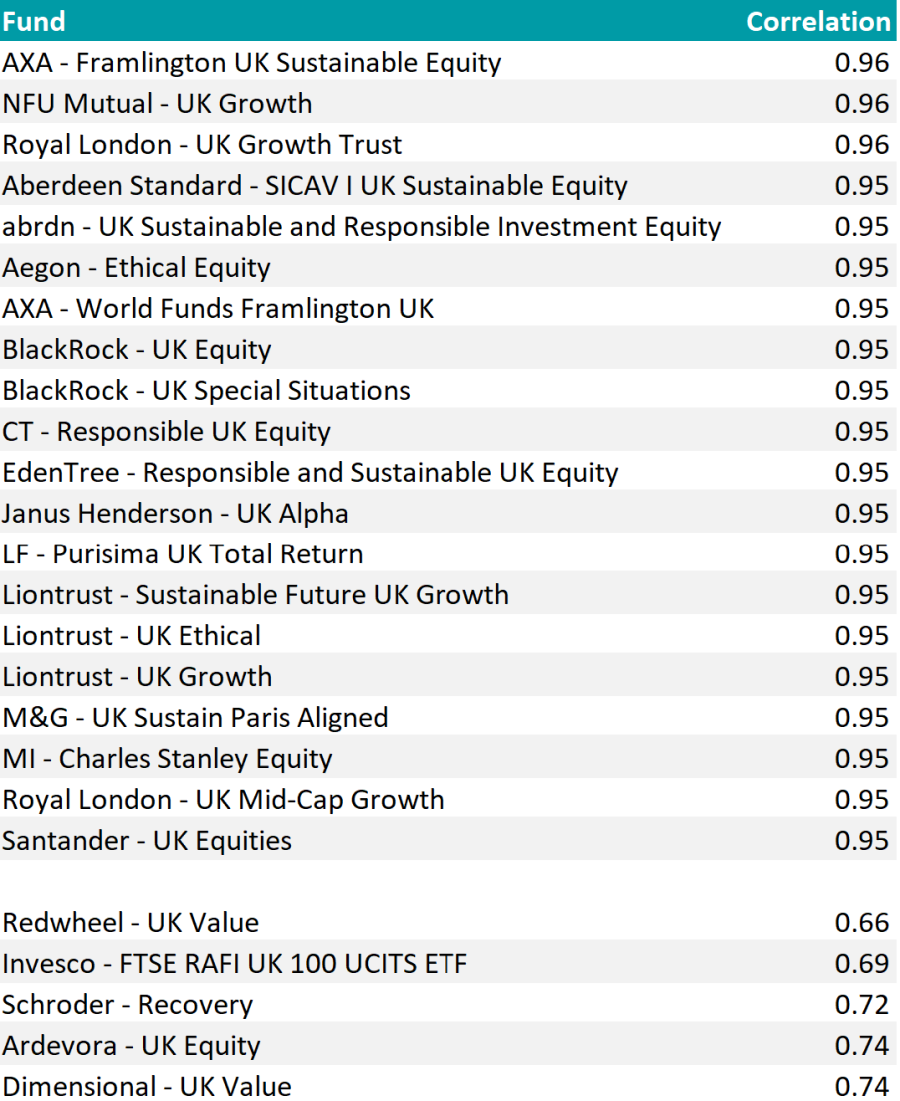

Other funds have much higher correlation to Liontrust Special Situations, however. In fact, the majority of IA UK All Companies funds are highly correlated to it.

Of the total 234 funds we considered, almost half have a correlation of 90% or higher while a further third have a correlation of between 80% and 90%.

At 96%, AXA Framlington UK Sustainable Equity, NFU Mutual UK Growth and Royal London UK Growth Trust are at the top of the list.

The list continues with as many as 38 funds with 95% or 94% correlation, including many sustainable strategies such as Aberdeen UK Sustainable Equity, abrdn UK Sustainable and Responsible Investment Equity and Aegon Ethical Equity, to name a few.

With a 95% correlation are also other three Liontrust solutions: Sustainable Future UK Growth, UK Ethical and UK Growth.

The least correlated funds were Redwheel UK Value (66%) and the Invesco FTSE RAFI UK 100 ETF (69%).

Funds with the highest and lowest correlation with the Liontrust fund over 5yrs

Source: FE Analytics

Green suggested that Artemis UK Select, which was picked to hold against Lindsell Train UK Equity, would also pair well with Liontrust Special Situations. The two have an 84% correlation.